[contextly_auto_sidebar]

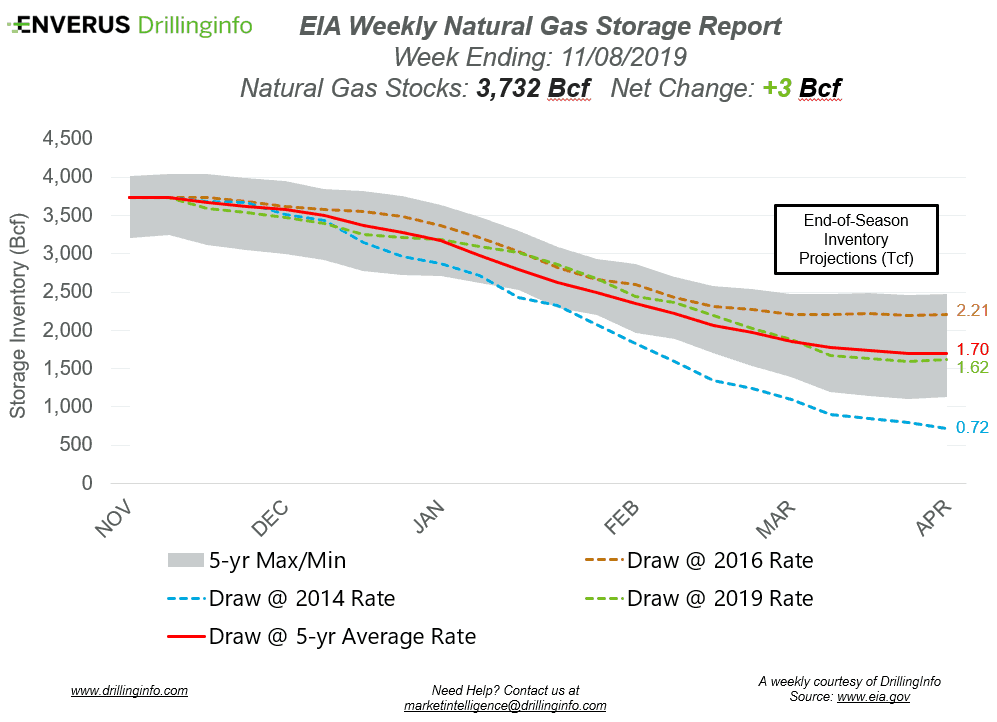

Natural gas storage inventories increased 3 Bcf for the week ending November 8, according to the EIA’s weekly report. This is slightly higher than the market expectation, which was a flat storage report.

Working gas storage inventories now sit at 3.732 Tcf, which is 491 Bcf above inventories from the same time last year and 2 Bcf above the five-year average.

Prior to the storage report release, the December 2019 contract was trading at $2.670/MMBtu, roughly $0.070 higher than yesterday’s close. At the time of writing, after the report, the December 2019 contract was trading at $2.636/MMBtu.

Cold temperatures across the US last week, except on the West Coast and in Florida, caused increased Res/Com demand, resulting in a lower storage injection reported this week. Cold temperatures have continued into this week with below-average, and some record-low, temperatures across the US. Current weather forecasts show the near-term to be colder than normal but return to a normal range in the back third of November. However, even at normal temperatures, the last two weeks of November are historically net draws. Since 2010, the last two storage reports in November have yielded a net injection only one time, in 2011. Weather forecast changes are a key aspect of the market to keep an eye on, as they will continue to play a significant role in storage inventories and price volatility.

See the chart below for projections of the end-of-season storage inventories as of April 1, the end of the withdrawal season.

This Week in Fundamentals

The summary below is based on Bloomberg’s flow data and DI analysis for the week ending November 14, 2019.

Supply:

- Dry production increased 0.12 Bcf/d on the week. Most of the increase came from the South Central (+0.32 Bcf/d) and the Mountain Region (+0.29 Bcf/d), with an offset coming from the East (-0.49 Bcf/d). The East region production decline is mainly due to NEXUS having maintenance on the pipeline.

- Canadian imports increased 0.70 Bcf/d as colder weather has hit the US.

Demand:

- Domestic natural gas demand increased 12.99 Bcf/d week over week. Res/Com demand accounted for most of the increase, rising 10.77 Bcf/d. Industrial demand also increased 1.20 Bcf/d, while Power demand increased 1.02 Bcf/d.

- LNG exports increased 0.06 Bcf/d, while Mexican exports increased 0.14 Bcf/d.

Total supply increased 0.81 Bcf/d, while total demand increased 13.60 Bcf/d week over week. With the increase in demand outpacing the increase in supply, expect the EIA to report the first draw of the season next week. The ICE Financial Weekly Index report is currently expecting a draw of 91 Bcf. Last year, the same week saw a draw of 134 Bcf; the five-year average is a draw of 67 Bcf.