Total ESG score

Environmental score | 44.2

Social score | 15.8

Governance score | 19.6

E | GHG Intensity | 2.7 kg CO2e/boe Intensity

S | Social investment Rate | $0.13/boe

G | Female Board Member Representation: | 50%

Total ESG score

Environmental score | 46.6

Social score | 14.0

Governance score | 14.9

E | Planned GHG Emissions Intensity Drop from 2019-2025 |100%

S | Female Representation in Workforce | 37%

G | Modified Payout Due to Negative Total Shareholder Return | Yes

Total ESG score

Environmental score | 36.5

Social score | 14.4

Governance score | 20.0

E | Flaring Intensity | 0.8% of gas produced

S | Total Recordable Incident Rate | 0.26 incidents per 200,000 work hours

G | Long-Term Management Incentive Based on Performance Vesting | 55%

ABS →

Total ESG score

E | GHG emissions | 5 CO2e intensity

S | Social investment rate | 33%

G | Female board member representation | 50%

DEF →

Total ESG score

E | GHG emissions | 5 CO2e intensity

S | Social investment rate | 33%

G | Female board member representation | 50%

HIJ →

Total ESG score

E | GHG emissions | 5 CO2e intensity

S | Social investment rate | 33%

G | Female board member representation | 50%

KLM →

Total ESG score

E | GHG emissions | 5 CO2e intensity

S | Social investment rate | 33%

G | Female board member representation | 50%

NOP →

Total ESG score

E | GHG emissions | 5 CO2e intensity

S | Social investment rate | 33%

G | Female board member representation | 50%

QRS →

Total ESG score

E | GHG emissions | 5 CO2e intensity

S | Social investment rate | 33%

G | Female board member representation | 50%

TUV →

Total ESG score

E | GHG emissions | 5 CO2e intensity

S | Social investment rate | 33%

G | Female board member representation | 50%

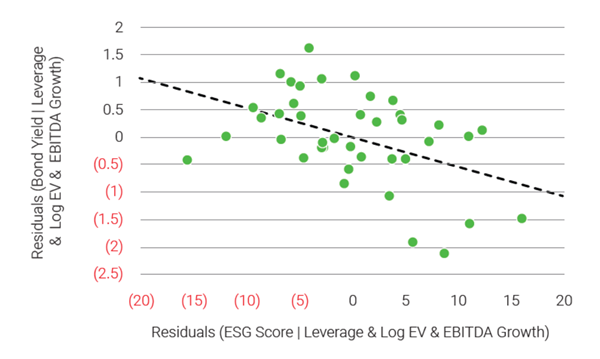

Our data science team answered this by analyzing the impact of ESG scores on bond yields after normalizing for other variables such as company size and leverage. We found a statistically significant relationship indicating that a 10-point improvement in ESG score leads to a 0.54 percentage point drop in bond yields, all else equal (Figure 1). Understanding risks of all kinds remains critical in the investment world.

Enverus ESG™ Analytics is the energy industry reference for ESG metrics, providing full visibility into companies’ rankings, how they compare among their peers, and who and what are the most environmentally responsible and investible opportunities in the space. The scope of the data set includes:

GHG emissions, methane leakage, corporate ESG targets, flaring rates, land use, water consumption, spill rates, energy usage and more.

Corporate diversity, social investments, safety records, training rates and more.

Corporate alignment with shareholders, board independence and diversity, employee pay rates, management incentives and more.

Learn more about Enverus ESG™ Analytics.

Enverus ESG™ Analytics and Enverus Intelligence™ clients can access full rankings.

Not all energy companies are created equal. ESG goes beyond financials to highlight proper company stewardship.

The higher the better. Anything at or over 63 is considered top quartile in our ranking.

Improving performance in any of our 35 ESG factors will lead to a better score. For example, reducing scope 1 greenhouse gas emissions.

Everyone. Companies can have better relationships with their stakeholders, while investors can lower risk.

We think so. Data transparency will continue to improve, providing investors with the appropriate tools.

We are energy specialists. This allows us to spend time on harder-to-acquire datasets that provide a unique edge.

Discover

About Enverus

Resources

Follow Us

© Copyright 2025 All data and information are provided “as is”.