Whipsawed Into Reading Tea Leaves—Is This What It’s Come Down To?

Equity markets go down 10% in a day, then stage the biggest rally ever seen. Then they go down again. Then they rally, only to lose ground in the next trading session. And oil prices? Same story. From March 5-18, prices dropped by nearly 60%. From March 18-20, prices rose by 35%—no doubt due to […]

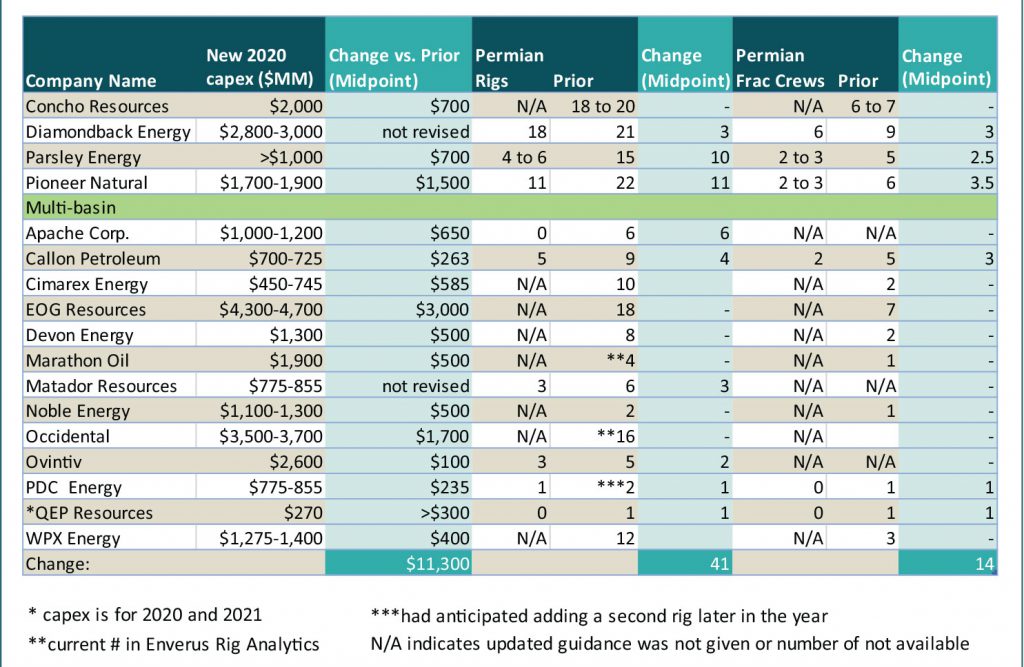

Permian Operators Slash 2020 Plans as Oil Market Craters

The economic implications of the novel coronavirus and the oil price war initiated between Saudi Arabia and Russia have sent oil markets on a downward spiral. WTI settled at $20.37/bbl on March 18, dropping 24% on the day and 56% in the last two weeks. Shale operators across the U.S. have acted swiftly to adjust […]

Pinpointing the Well Spacing Sweet Spot in the Karnes Trough

Well spacing in the Eagle Ford Basin is tighter today than ever, with some wells in the Karnes Trough being drilled less than a football field apart. How did we get here? More importantly, what are the best options available to maximize production as spacing decreases? After a decade of downspacing across Eagle Ford, historical […]

Local Economic Volatility in Oil Patch Boom and Bust Cycles

Boom and bust cycles come with the territory in the oil patch. We’ve all seen variations on the theme, like the bumper stickers that pleaded, “Lord, give me another oil boom and I promise I won’t piss it away!” And we’re all schooled in the idea that when a boom moves through an area, everything […]

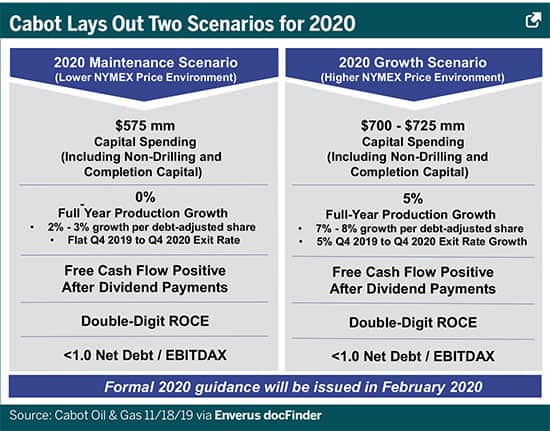

Austerity Coming to Appalachia in 2020 as Price Outlook Worsens

The price outlook for natural gas is currently worse than it was a year ago, thanks to rapidly growing U.S. output driven by associated gas from oil production. As of Dec. 9, the 12-month strip price for Henry Hub is $2.27/MMbtu compared to $3.29/MMbtu a year ago. The Energy Information Administration (EIA) estimates that U.S. […]

An Industry Always in Transition—Part 2

Financial Headwinds, AI, and Black Swans Many financial analysts are pointing out that more than $120 billion in oil patch debt, with possible attendant bankruptcies, comes due between 2020 and 2022. Again and again, news articles mention the belief that mergers and acquisitions will inevitably consolidate the industry. What word summarizes where we are? Uncertainty. […]

An Industry Always in Transition—Part 1

Foundational Transformations I recently participated in the 10th anniversary of the formation of the Berg-Hughes Center at Texas A&M. The theme of the celebration was geoscientists and petroleum engineers in a time of energy transition. From my perspective, our industry has always been in transition—from Azerbaijan to Titusville; the Spindletop salt domes to the East […]

From IP to Peak Rates—Navigating Uncertainty

I became very familiar with the vagaries of initial potential (IP) test data reporting when I set a number of horizontal wells during the first wave of horizontal drilling in the Austin Chalk in the Dilley, Texas-area in the early ’90s. We’d be drilling a hole and off in the distance I’d see a large […]

Pacific Northwest Refiners Face Crude Sourcing Setback in 2020

IMO 2020 rules restricting sulfur content in marine fuels will force refiners to find new sources of crude With the International Maritime Organization’s (IMO) restrictions on marine fuels with sulfur content greater than 0.5% coming into effect in January, refiners around the world should be well on their way toward adjusting their operations to mitigate […]

All in the Family

With public and private upstream operators looking at alt funding to continue growth of operations, private equity-backed companies are also taking alternative approaches to their business. After the downturn of 2016, private equity jumped into the oil patch to the tune of more than $100 billion and counting. Some of the most active quarters over […]