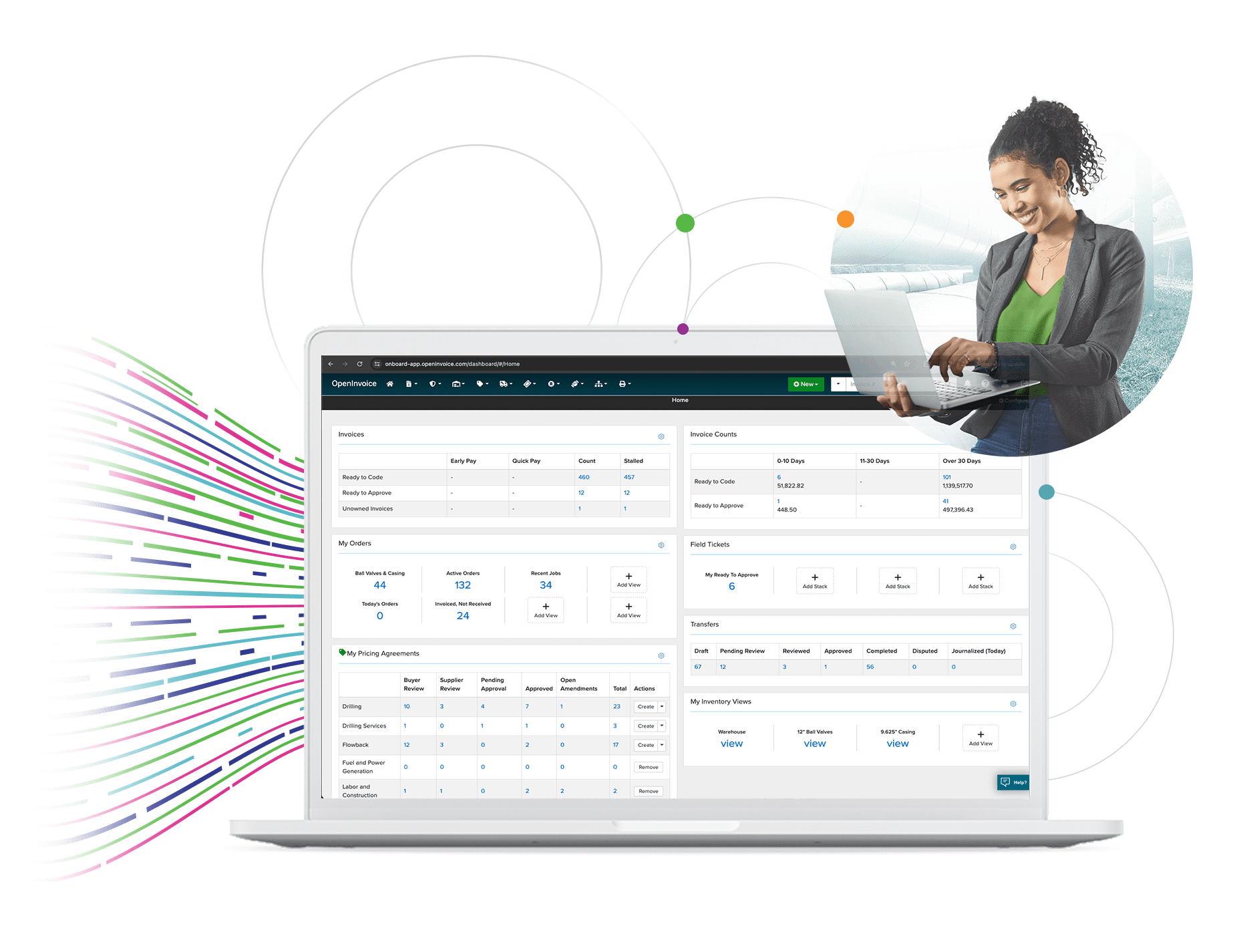

Streamline oil and gas invoice processing, optimize spend control through automated compliance and reconciliation, and access the industry’s largest network of suppliers. With integrations into 25+ ERP systems and additional Enverus solutions that further increase back-office automation and spend control on one source-to-pay platform, OpenInvoice is your fit-for-purpose AP solution that can scale to meet your business needs.

Use back office automation to accelerate your oil and gas invoicing using automatic approvals and coding, workflow routing and reconciliation that cuts down on errors and removes manual touchpoints.

With instant access to 40k+ suppliers across North America, 25+ ERP integrations and the ability to further automate your source-to-pay process as you grow, onboarding is minimal and scaling business processes is easy.

Explore our free click-through demo to discover how OpenInvoice streamlines coding changes, verifications, and approvals. Learn about adding attachments, configuring workflows (including routing and auto-approvals according to price threshold), and customizing roles and permissions. Experience all these features and more!

Create, save and schedule robust ad-hoc reports and easily re-run and download them on a regular basis.

Configure automatic coding and auto-approvals for invoices that match your specific threshold criteria.

Approve invoices right from your mobile phone or device to keep your projects on track.

Reduce call volumes by providing your vendors with self-service payment statuses of their invoices.

Reduce invoice dispute volumes and shorten dispute resolution times by validating required data before an invoice is submitted to you.

Capture line-item detail allows you to analyze spend on a specific vendor or product/service basis.

Run reports at a summary or line-item level to help you analyze your payables from a vendor, product/service, coding, AFE/WBS, cost center basis and more.

OpenInvoice is the gateway to the Enverus source-to-pay platform of solutions. These add-ons give you the capability for pricing agreement validation (OpenContract PriceBook), purchasing and receiving (OpenOrder), field ticket processing (OpenTicket), and inventory and material transfers (OpenMaterials).

Save time with automated price validation workflows and optimize spend with price compliance reporting and spend analytics.

Read More About OpenContract® PriceBook

Gain complete inventory oversight. Track the quantity and value of inventory by location and accurately log material transfers in your accounting system.

Read More About OpenMaterials

OpenOrder, a purchase order software made for oil and gas, increases spend visibility and controls without burdening operations, with flexibility to issue, approve and track procurement of services and materials with a purchase order.

Learn more about OpenOrder.

Accelerate invoice approvals and payment with cloud-based digital field ticket management.

Read More About OpenTicket®

Insights on WCSB Oil Production Pipeline Expansions, and AECO Hub Gas Pricing The Canadian oil and gas industry is at a pivotal moment, with significant potential on the horizon that could reshape the landscape. Enverus Intelligence® Research (EIR), a subsidiary...

In a landmark move within the Canadian energy sector, Whitecap Resources Inc. (WCP) and Veren Inc. (VRN) have announced a near merger of equals. This strategic combination, with a purchase price of C$8.6 billion (US$5.9 billion) for Veren inclusive of...

The following blog is distilled from Intelligence® Research (EIR) publications and EIR’s very own Andrew Dittmar’s media statements on the Diamondback acquisition. With U.S. upstream M&A reaching $105 billion in 2024—the third highest as recorded by Enverus—the market shows no...

British Petroleum Backs Away From Renewables The following blog is distilled from an interview on CBC’s “The Eyeopener,” hosted by Loren McGinnis who interviewed Enverus Intelligence® Research’s (EIR) very own Al Salazar. Click here to listen to the full radio...

Explore key OFS pricing trends for 2025 and learn how you can manage spend and improve efficiency. Stay ahead in the oil and gas industry.

Energy Stakeholders Meet in New Mexico to Address Key Permian Basin Issues Last month, stakeholders from across the energy sector gathered in New Mexico to tackle the pressing issues facing the Permian Basin. Among the wide-ranging discussions, three key themes...

Discover

About Enverus

Resources

Follow Us

© Copyright 2025 All data and information are provided “as is”.