Texas landowners have long benefited from the mineral and hydrocarbon reserves sitting beneath their properties. Mineral owners can trace their ownership back through time, linking previous owners through legal documents and courthouse records back to Texas sovereignty (the chain of title process). Privately held mineral rights were officially written into the Texas state constitution of 1866, 34 years before the first oil well was drilled at Spindletop, near Beaumont.

The first owners of land across Texas passed on their mineral rights to their descendants, sold portions off or otherwise split their interest. The long legacy of mineral rights ownership in Texas allowed interests to be divided and divided time again leading to a specialty asset class that is bought and sold with ownership calculated up to eight decimal places.

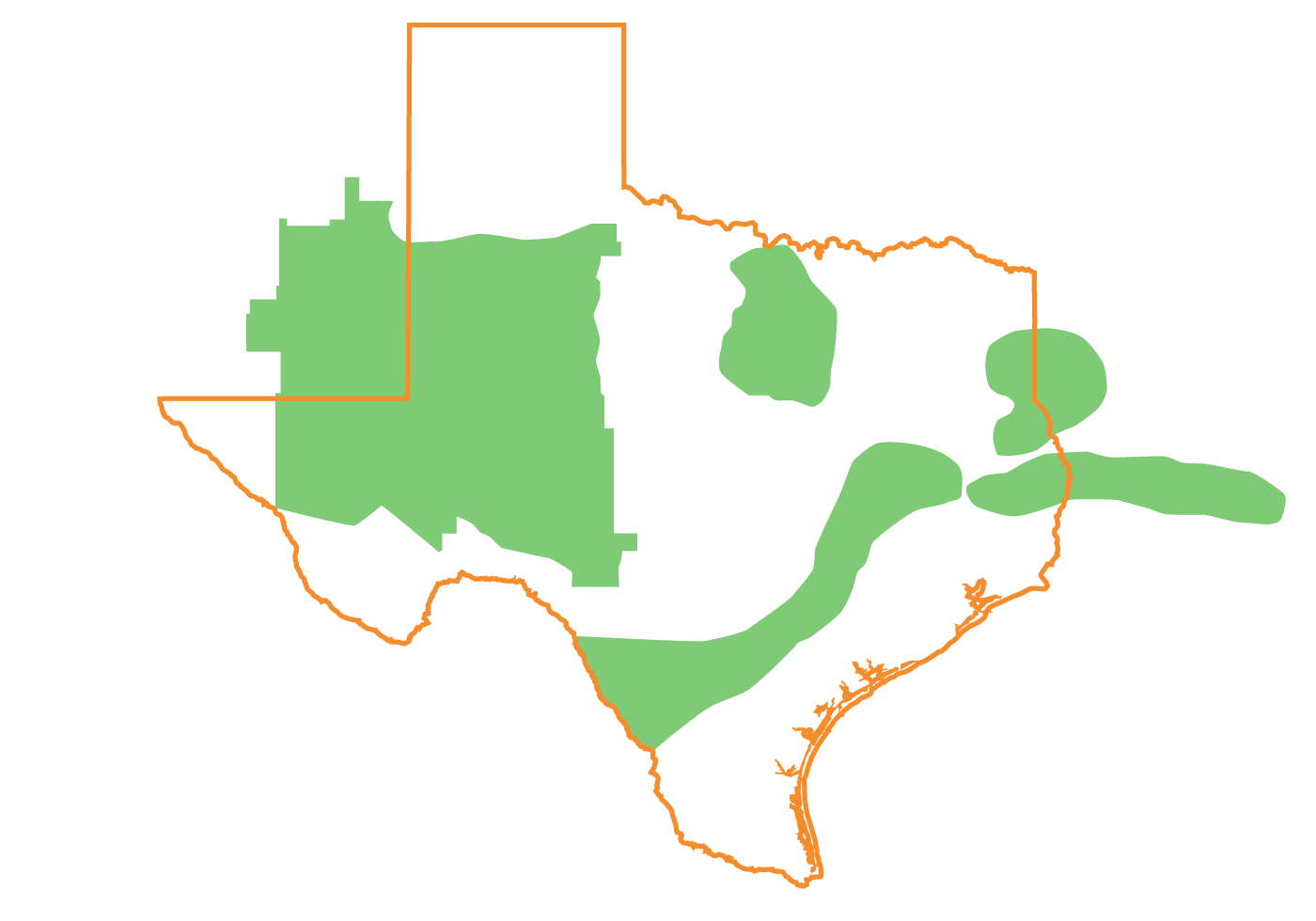

Texas is home to the country’s most abundant hydrocarbon reserves, from the Permian in the west and Haynesville in the east to the Barnett Shale of north Texas and the Eagle Ford in the south. Yet for most of Texas history, unlocking these vast oil and gas reserves was limited to vertical wells drilled in conventional reservoirs. Today’s booming Permian Basin was not always booming with much of its shale oil written off for decades as unrecoverable. However, the Shale Revolution of the past decade has unleashed oil and gas production across Texas with the advent of horizontal drilling and hydraulic fracturing.

Faced with diminishing returns from legacy fields and stripper wells, Texas mineral owners have been propelled suddenly into a burgeoning market for mineral buyers and sellers. Today, two-thirds of 254 Texas counties produce oil and gas. The impressive unconventional basins of Texas have given unprecedented opportunities to large institutional mineral rights buyers and investors large and small looking to sell.

Mineral rights across the Permian’s Midland and Delaware Basins fetch a premium for their stacked pay zones (or benches) while Eagle Ford offers investors many opportunities to lease, buy and sell.

Stable and improving natural gas prices have led many operators to increase drilling in the Haynesville Shale even during recent downturns, making Texas dry gas plays an increasing focus for buyers and sellers.

Natural gas liquids (NGL) are an increasingly important part of Texas energy production with the Eagle Ford especially benefiting from close proximity to export terminals at Corpus Christi.

Discover

About Enverus

Resources

Follow Us

© Copyright 2024 All data and information are provided “as is”.