Research written by:

Matt Smith, Head Analyst, Kpler

Wendi Orlando, VP of Product Management, Enverus

Enverus and Kpler have announced a partnership to directly confront global transparency and data challenges in the energy and commodity markets. Addressing issues including data opacity, trend awareness and inventory dynamics, our collaboration aims to sharpen strategic decision-making and market response capabilities.

Revolutionizing the approach to energy commodity trading, our first joint suite of tools is designed to deliver both macro insights for long-term strategy and real-time data for daily trading decisions:

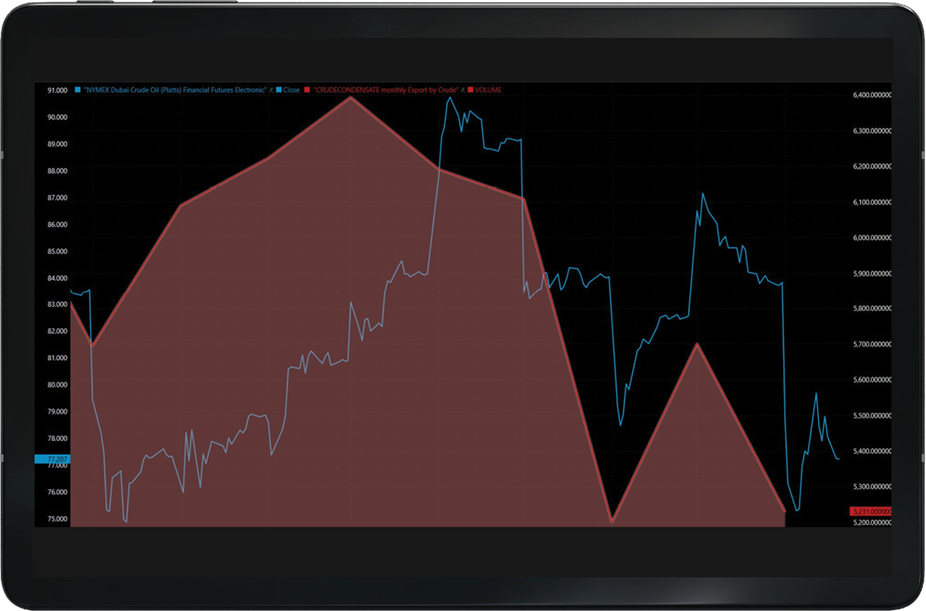

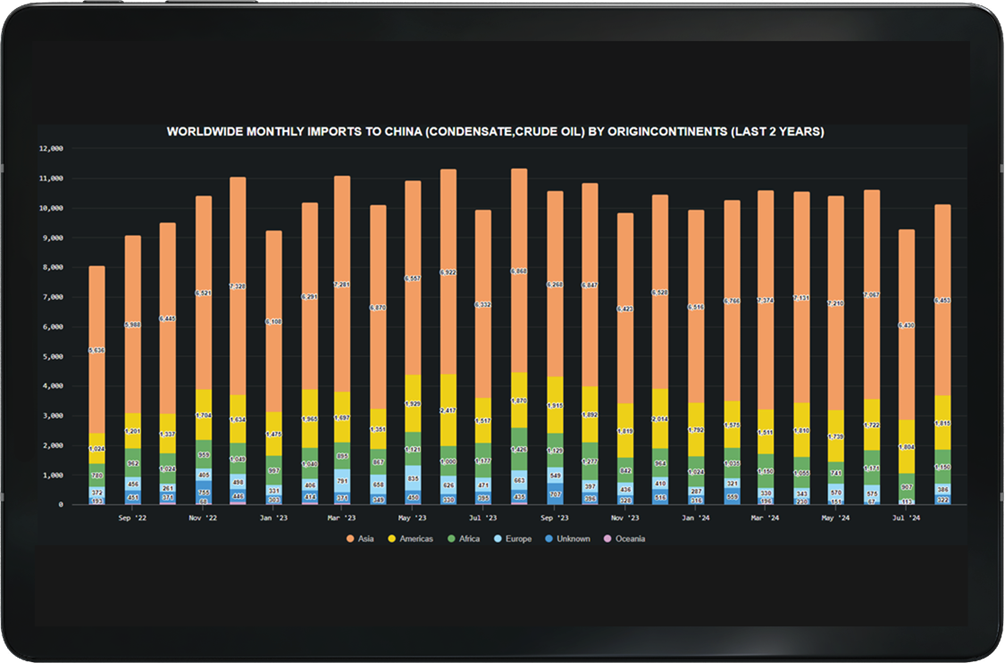

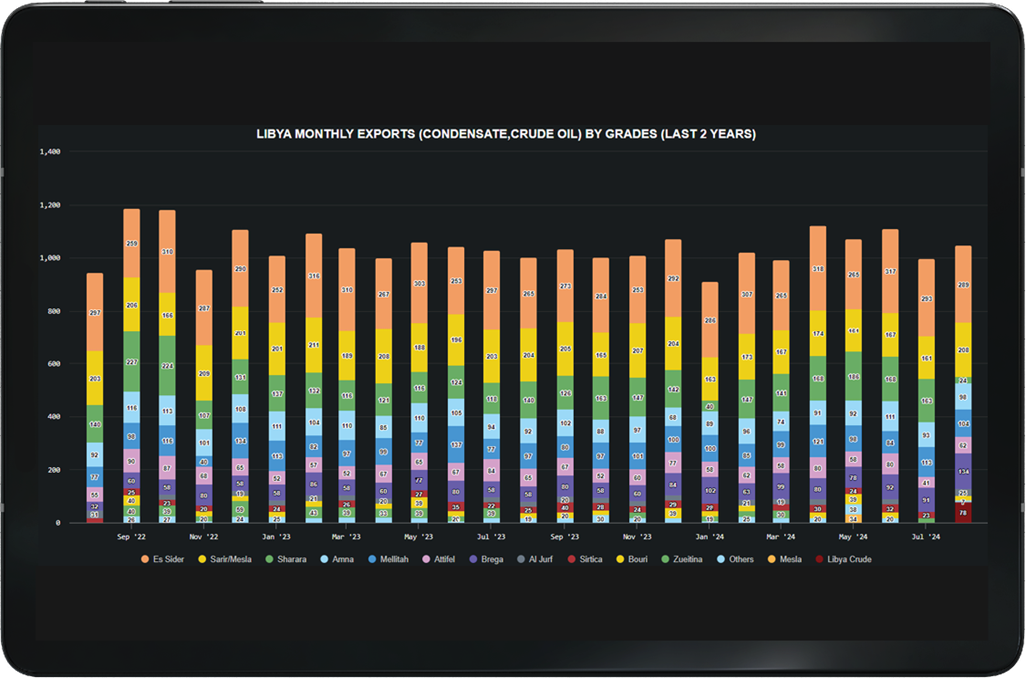

Source | Webinar: Aligning supply and demand with the current market outlook for pricing: opportunities and challenges

Discover

About Enverus

Resources

Follow Us

© Copyright 2024 All data and information are provided “as is”.