Our “Trader’s State of the Market” e-book offers an in-depth look at the evolving U.S. power markets, highlighting key trends, market volatility and the transition to renewable energy. With expert analysis and insights, it equips traders with the knowledge to manage risks and capitalize on opportunities. Explore the dynamics of various ISOs, regulatory shifts and cutting-edge technologies reshaping the energy landscape.

In the ever-evolving landscape of energy markets, power trading has emerged as a critical component. This e-book is designed to provide a comprehensive overview of the unique aspects of trading in different power markets across the United States.

Power markets are complex systems, with numerous factors contributing to their volatility. From the supply-demand balance to regulatory changes, weather patterns to technological advancements, each aspect plays a significant role in shaping the market dynamics. This volatility, while posing risks, also presents opportunities for those who can accurately predict and navigate these shifts.

Drawing inspiration from the State of the Markets reports released by deregulated independent system operators (ISOs), this e-book will dive into the intricacies of power trading. You’ll learn about the challenges and opportunities created by the transition from traditional power sources like coal to renewable energy sources like wind and solar. As coal units retire and the saturation of renewables increases, markets are expected to experience increased volatility. As variability increases, the change brings opportunity for new technologies like batteries and quick-start thermal units to take advantage of this volatility.

Through detailed analysis, real-world examples and expert insights, we hope to provide you with the knowledge and tools to navigate the volatile energy markets.

Welcome to the exciting world of power trading!

Power markets are complex systems that are influenced by a number of factors. Let’s get into a comprehensive explanation of these markets, focusing on factors like price volatility, demand growth, market efficiencies and the impact of natural gas on power markets.

Heat rates are a key metric in power trading, often reflecting the efficiency of a specific natural gas unit or the marginal unit—the one setting the price in deregulated ISO markets. By stripping out natural gas prices from the power price, heat rates allow traders to zero in on core power market fundamentals. Traders can use heat rates as an index, trading synthetic positions or hedging trades in both physical gas and power markets. The heat rate shows the market’s implied efficiency, and when multiplied by the gas price, it gives the forecasted power price. Mastering these dynamics is essential for capturing value in volatile markets.

Power prices reflect the on-peak wholesale trends over the past decade across deregulated ISOs, where traditional power plants and renewable sources have learned to coexist, resulting in generally stable pricing. However, significant periods of volatility still arise, driven by extreme weather events and unexpected demand surges. Winter Storm Uri in 2021, for example, caused unprecedented price spikes in the Electric Reliability Council of Texas (ERCOT) as natural gas supply froze and demand skyrocketed. Similarly, the global natural gas volatility stemming from the Russia-Ukraine war in 2022 sent power prices soaring across U.S. markets, affecting both long-term contracts and spot trades. These moments remind traders to stay vigilant, as events like these can disrupt normal market conditions and create both risks and opportunities.

Over the past decade, demand across various ISOs has been shaped significantly by strong renewable portfolio standards (RPS), encouraging the integration of renewables like wind and solar. This has led to distinct demand patterns, as seen in the recent upward trend in regions like ERCOT and Southwest Power Pool (SPP) which have low requirements for RPS but have natural resources amenable to renewable development, and where both population growth and commercial and industrial activity have fueled increasing grid demand. On the other hand, ISOs like California Independent System Operator (CAISO) and ISO New England (ISO-NE) have experienced stable or slightly declining demand, due to high energy efficiency, increased distributed generation, and the growing impact of behind-the-meter renewable energy.

Understanding these demand trends is crucial for traders, as they offer insights into regional dynamics, the impact of renewable integration, and potential volatility triggers such as seasonal shifts or extreme weather events. These patterns help traders forecast price movements, identify market opportunities and hedge against risk more effectively.

The development of power assets remains critical for ensuring stability in power markets, particularly as ISOs transition away from traditional coal-fired generation. Regions like ERCOT and SPP have made substantial strides in integrating renewable energy into their generation mix, with wind and solar playing an increasingly significant role. This shift, coupled with robust natural gas infrastructure, has allowed these ISOs to manage demand fluctuations while enhancing grid reliability. In contrast, PJM Interconnection (PJM) and Midcontinent Independent System Operator (MISO), while gradually adopting renewables, have been slower to incorporate them on a large scale. As shown in the charts, both regions still rely heavily on coal and natural gas, though many coal plants are slated for retirement over the next decade.

This looming capacity gap in PJM and MISO, created by the planned phase-out of coal, will likely be filled by renewable energy sources, making the issue of market volatility more pressing. The intermittent nature of wind and solar introduces challenges for grid stability, particularly during peak demand periods. This unpredictability in generation can lead to price spikes and scarcity events, requiring innovative market designs and enhanced grid flexibility.

For traders operating in PJM and MISO, this evolving energy landscape demands careful attention. As more renewable capacity comes online, these markets may experience heightened volatility, similar to what we’ve seen in ERCOT during periods of extreme weather. To navigate this environment, market participants must employ strategies that anticipate shifts in generation patterns and leverage opportunities in ancillary services, energy storage and demand response programs.

Regions that have already integrated high levels of renewables, like ERCOT, CAISO and SPP, offer insights into how market participants can manage these fluctuations. Innovation in energy storage technologies and improved grid flexibility will be key to mitigating the impact of renewable intermittency. Furthermore, regulatory bodies in PJM and MISO are expected to enhance market designs to better manage these changes, but traders must remain vigilant. By staying ahead of these developments, traders can optimize their portfolios and capitalize on market movements driven by the ongoing energy transition.

Market volatility in power markets happens due a complex interplay of factors, primarily driven by the variability in supply and demand. Sudden changes in power demand – things like weather events, economic shifts and consumer behavior – can cause significant price fluctuations. For instance, extreme weather conditions such as heatwaves or cold snaps often lead to sharp increases in electricity demand, straining the grid and pushing prices up. On the supply side, the integration of intermittent renewable energy sources like wind and solar exacerbates this volatility. Unlike traditional power plants, renewable energy generation is inconsistent, creating imbalances between supply and demand that contribute to price swings.

Natural gas prices further influence market volatility due to their role as a major fuel source for power generation. Fluctuations in natural gas prices directly impact electricity prices. Rising gas prices increase generation costs, leading to higher power prices, while falling gas prices can have the opposite effect. Additionally, supply chain disruptions and geopolitical events affecting natural gas availability can cause sudden price spikes. Regulatory changes and technological advancements also play roles in market volatility. New environmental regulations or shifts in policy, such as carbon pricing, can alter market dynamics, while advancements in data analytics and automated trading introduce both opportunities and new sources of volatility. To navigate these challenges, market participants must employ effective risk management strategies, including hedging and adaptable trading approaches, while staying informed about market trends and underlying volatility factors.

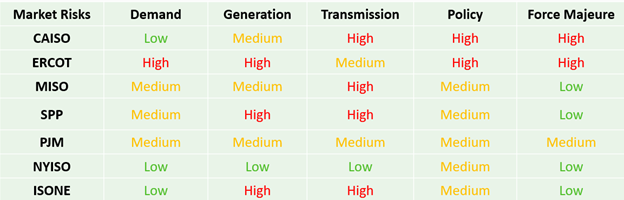

This section will provide a detailed look at the unique characteristics, risks and opportunities of different power markets, organized by ISOs.

ERCOT operates the electric grid and manages the deregulated market for 75% of Texas. In recent years, the state has seen an unprecedented increase in electricity demand, driven by economic growth, population expansion, and the rapid development of power-hungry industries like data centers, Bitcoin mining, and LNG terminals. Texas has positioned itself as a haven for these energy-intensive operations, offering a business-friendly regulatory environment, ample space, and access to relatively cheap renewable power.

The Bitcoin mining industry alone added nearly 3 GW of demand, particularly in West Texas, where stranded natural gas is being used to power these facilities. By 2030, the power demand from data centers and crypto mining is expected to be a major contributor to ERCOT’s forecasted near-doubling of electricity demand, reaching up to 150 GW. These industries, while adding strain to the grid, have also found ways to participate in demand response programs, sometimes being paid to curtail operations during peak load events.

Moreover, the state’s aggressive approach to attracting new businesses extends beyond just data centers and miners. Texas is also home to a growing number of LNG terminals, which require substantial amounts of electricity for liquefaction and processing. These factors, combined with ongoing electrification in sectors like oil and gas, mean that ERCOT’s grid will face continuous pressure to expand and modernize.

Meanwhile, the fuel mix within ERCOT has shifted significantly towards renewables. Wind power has been a cornerstone of Texas’ renewable portfolio for years, and 2023 saw a surge in solar farms, highlighting the state’s commitment to sustainable energy. However, this transition presents its own challenges. Renewable resources, while reducing carbon emissions, introduce volatility due to their intermittent nature, particularly during periods of high demand or extreme weather events. The Competitive Renewable Energy Zones (CREZ) initiative from 2008-2013 helped enhance transmission capacity, but issues like congestion in West Texas remain a concern.

The Texas Legislature and Public Utility Commission have responded to these growing demands and risks by proposing significant reforms to enhance grid reliability, especially after the catastrophic failures during Winter Storm Uri. As ERCOT continues to evolve as an energy-only market, these reforms will play a critical role in balancing the state’s explosive demand growth with the need for grid stability.

CAISO oversees the operation of California’s bulk electric power system, transmission lines, and electricity market. Over the past decade, peak load and demand within CAISO have gradually declined, largely due to population decreases and the rise of behind-the-meter solar installations, which have significantly reduced on-peak demand.

While CAISO’s wind energy sector has matured, solar energy development continues, though much of it is happening outside California, with direct transmission links feeding into CAISO’s grid. Meanwhile, the energy storage landscape is rapidly evolving, with battery storage projects dominating the queue.

However, CAISO faces significant risks from extreme natural events, such as wildfires droughts and floods, which have disrupted grid operations in recent years. Limited natural gas transport from West Texas and other regions continues to pose a critical supply issue However, as of 2023 the expansion of Aliso Canyon has relieved some of these concerns during peak demand periods. Moreover, the forward congestion market remains underfunded, with most hedging activities occurring in the day-ahead and real-time markets.

In addition to these operational challenges, CAISO’s Extended Day-Ahead Market (EDAM) is now competing with SPP Markets+ program for dominance in the Western U.S. Both markets aim to expand their influence and attract utilities, creating a competitive environment. CAISO’s Western Energy Imbalance Market (WEIM) has grown significantly, generating nearly $3 billion in benefits since its inception. However, SPP’s Markets+ is gaining traction, particularly as some WEIM participants are also involved in Markets+ development.

The competition between these two markets extends beyond operational benefits. Market participants are weighing their options, as transmission constraints and governance issues create complexities in both systems. Entities like NV Energy chose CAISO’s EDAM due to its expansive market footprint but concerns over transmission seams between the two markets persist, potentially limiting the efficiency of cross-market power flows.

Looking forward, CAISO must navigate not only its operational risks but also the shifting competitive landscape as the West looks to harmonize energy markets while maintaining reliability, sustainability and cost-effectiveness.

Over the past decade, ISO-NE has seen a steady decline in overall energy demand—down 8%—due to strong energy efficiency policies and population changes. However, the demand is expected to shift from summer to winter peaks as heating electrification and transportation electrification ramp up.

Looking forward, offshore wind is expected to play a pivotal role in the region’s clean energy transition. Major projects, such as the offshore Vineyard Wind project, which is already supplying power to the grid, with more capacity slated for the future. Offshore wind is expected to account for a large portion of new capacity scheduled for 2024, alongside battery storage and solar. However, this progress faces hurdles—offshore wind financing has been affected by rising costs and inflation, leading to contract cancellations and delayed projects. Recent, notable failures of the turbine blades at this particular farm may also empower more opposition.

ISO-NE’s transition to renewables is complicated by ongoing natural gas constraints. The region depends heavily on liquefied natural gas (LNG) imports, especially during the winter months when pipeline constraints limit natural gas flow. The continued reliance on LNG, particularly through the Everett terminal, remains a critical issue for maintaining winter grid reliability. Moreover, renewable energy goals often clash with local opposition (NIMBYism) and environmental concerns, delaying both renewable projects and necessary transmission upgrades.

Despite these challenges, ISO-NE is adjusting its markets to better compensate for the resources needed for balancing supply and demand. The current interconnection queue reflects a massive shift toward renewables. As ISO-NE pivots towards a greener grid, its ability to maintain reliability during extreme winter conditions remains a key concern. Winter demand variability is expected to continue to increase, necessitating significant investment in firm, dispatchable resources like long-duration storage or zero-carbon fuel.

MISO manages one of the largest wholesale energy markets globally, with more than $40 billion in annual gross market charges. While MISO has historically prioritized low volatility and stable pricing, recent developments in renewable integration and grid congestion are presenting new challenges.

MISO continues to leverage abundant wind resources, especially in its northern western region. However, this wind energy influx has created significant congestion issues on key transmission lines, which hinders the efficient distribution of power. The challenge is further compounded by MISO’s current infrastructure limitations, as large-scale renewable projects frequently face delays due to grid capacity constraints.

The interconnection queue in MISO has grown rapidly, with more than 160 GW of new generation and storage capacity awaiting approval as of 2023, predominantly from solar and wind projects. MISO has initiated reforms to streamline the interconnection process, including increasing milestone payments and penalties to reduce withdrawals and bottlenecks. Despite these changes, the backlog remains a critical barrier to expanding renewable energy in the region.

MISO also continues to maintain relatively low retail electricity rates. However, as more coal plants retire and renewables take a larger share of the grid, MISO’s ability to keep rates stable will depend on resolving transmission congestion, clearing the backlog of interconnection requests and managing the more variable intermittent resources.

In the New York Independent System Operator (NYISO) region, energy demand has remained flat to slightly down over the past decade, reflecting strong energy efficiency measures and shifts in population. Power flows primarily move counterclockwise toward the load centers in downstate New York, particularly New York City, which has shaped recent grid upgrades.

NYISO has made significant strides in building new transmission infrastructure. Recent projects, like the Public Policy Transmission Projects, are addressing congestion in key regions, enabling better power flow from upstate renewables to the densely populated downstate areas. These transmission projects are critical to integrate renewable generation into the grid as the state works towards its 2040 zero-emissions goal. However, congestion continues to be a challenge, especially as more renewable generation comes online.

The region’s aggressive offshore wind policy took a major step forward with the first project coming online in Zone K (Long Island), with future projects aiming to deliver up to 9 GW of offshore wind by 2035. However, the high costs and funding uncertainties surrounding these projects pose potential risks to achieving these targets. Solar energy, while largely behind-the-meter, plays a growing role, though grid-scale solar faces challenges due to limited transmission capacity and high curtailment during times of low demand. Battery storage is also being integrated into the grid, but existing policies offer limited arbitrage potential, making it harder for storage to play a significant role in balancing renewable variability. To meet its ambitious renewable targets, NYISO is also advancing heat pump adoption and energy efficiency measures, though the pace of renewable integration remains a challenge due to the costs and complexities involved in expanding transmission.

PJM coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. PJM operates the largest and most liquid bilateral market in the U.S., with the West Hub often serving as a proxy for more exotic contract structures. The region has experienced flat to moderate demand growth, driven primarily by the rapid expansion of data centers in Virginia and Maryland.

As PJM targets substantial increases in renewable resources to achieve a more decarbonized grid, the region faces heightened risks of market volatility. This volatility is compounded by the retirement of more than 26 GW of traditional generation capacity, including coal and gas plants, which have been deemed unreliable under PJM’s new capacity accreditation process. This reduction in available capacity has led to a significant increase in capacity prices, with the 2025/2026 auction clearing at a record high price.

Maintaining resource adequacy is a growing challenge for PJM, as the slow pace of new generation—especially renewable projects—coming online exacerbates the capacity crunch. PJM’s interconnection queue has become increasingly clogged, with delays in processing new renewable and storage projects. These delays, along with transmission bottlenecks, present long-term risks to PJM’s ability to integrate new intermittent resources effectively.

These capacity price spikes send a strong signal to the market, incentivizing new investments in generation resources. However, to maintain grid reliability while transitioning to a cleaner energy mix, PJM must focus on addressing its interconnection and transmission challenges. Without strategic planning and investment in infrastructure, the region may continue to face high-capacity prices and increased market volatility in the coming years.

SPP manages the electric grid across 17 central and western U.S. states. SPP has seen significant wind power development, particularly concentrated in its western regions, with power flows moving eastward. However, the transmission infrastructure has not kept pace with this build-out, leading to increased congestion near the eastern border with MISO. Over the past decade, SPP has experienced steady growth, driven by the electrification of natural gas operations and the expansion of data centers, similar to trends observed in West Texas.

SPP’s new Markets+ initiative is set to have a transformative impact on the western U.S. grid. Markets+ builds on SPP’s Western Energy Imbalance Service by adding a day-ahead market, which allows for more optimized and cost-effective dispatch across a larger geographic footprint. This expansion aims to improve coordination between balancing authorities and expand market participation in the West. The potential for reduced transmission bottlenecks and increased access to renewable energy sources could drive further efficiency gains in SPP’s market.

However, despite these advancements, SPP continues to face challenges with its financial transmission rights (FTR) market, which remains notably underfunded. Additionally, traders have reduced their engagement in virtual trading due to increasing fees. While Markets+ could improve operational efficiencies and help manage congestion in the long term, immediate concerns about market volatility and reliability persist as demand grows and infrastructure constraints remain.

The transition from traditional power sources like coal to renewable energy sources such as wind and solar is a significant trend reshaping the energy markets. Over the past decade, regions like ERCOT and CAISO have seen substantial increases in renewable energy capacity, particularly in wind and solar farms. This shift is driven by both environmental policies and economic incentives aimed at reducing carbon emissions and promoting sustainable energy. However, the integration of these variable renewable energy sources introduces new challenges, particularly in terms of grid stability and market volatility. As coal units retire, the reliance on intermittent resources like wind and solar can lead to fluctuations in energy supply, necessitating advanced grid management and storage solutions to maintain reliability.

The implications of this shift are profound. Traditional power plants, which provided consistent and controllable energy output, are being replaced by renewable sources that depend on weather conditions. This variability can cause significant price swings and operational challenges. For instance, in ERCOT, the rapid increase in solar capacity has led to periods where solar generation drops sharply, requiring quick ramp-up from other sources or battery storage to fill the gap. As more coal units retire and renewable penetration increases, traders must navigate a landscape marked by higher volatility and the need for sophisticated risk management strategies.

Regulatory changes are a major source of uncertainty in the energy markets, influencing everything from market operations to investment decisions. In recent years, several key regulatory shifts have been proposed or implemented, each with significant implications for power trading. For example, after Winter Storm Uri, the Texas Legislature and the Public Utility Commission introduced sweeping reforms aimed at enhancing grid reliability and resilience. These reforms include changes to market price caps, capacity requirements and incentives for new generation development.

In California, the introduction of a carbon market by the Western Electricity Coordinating Council has increased the cost of hydro imports, impacting the state’s energy mix and market dynamics. Similarly, the expansion of the SPP into a new market structure, SPP+, poses potential changes in market operations and resource allocation. These regulatory developments require traders to stay informed and adaptable, as policy shifts can significantly alter market conditions and trading strategies.

Technology is revolutionizing the energy markets, driving efficiency and enabling new capabilities. The rise of smart grids, which use digital technology to monitor and manage electricity flows, is enhancing grid reliability and facilitating the integration of renewable energy sources. Advanced metering infrastructure and real-time data analytics allow for more precise demand forecasting and load management, reducing the risk of outages and improving operational efficiency.

Artificial intelligence (AI) and machine learning are also playing a crucial role in energy forecasting and trading. These technologies can analyze vast amounts of data to predict market trends, optimize trading strategies and identify opportunities for arbitrage. For instance, AI-driven models can forecast solar and wind generation with greater accuracy, helping traders make informed decisions in a market characterized by variability and uncertainty. As technology continues to evolve, its impact on power trading will likely grow, offering new tools and strategies for managing risk and maximizing returns.

Despite the uncertainties and challenges, energy markets are finding ways to adapt and evolve. One notable response is the development of new financial products and trading strategies designed to manage risk and capitalize on market opportunities. For example, the increased use of FTRs and other hedging instruments helps traders mitigate the impact of congestion and price volatility. In regions like ERCOT, where market volatility is high, these financial tools are essential for managing exposure and ensuring profitability.

Innovative market responses also include the deployment of battery storage systems, which provide critical support for grid stability and enable more effective integration of renewable energy. In Texas, battery storage is being used to smooth out the fluctuations in solar generation, providing a buffer during periods of rapid decline in solar output. Additionally, the rise of virtual power plants, which aggregate distributed energy resources to provide grid services, represents a new frontier in energy management and trading. These market innovations demonstrate the resilience and adaptability of the energy sector in the face of ongoing transitions.

As the energy markets continue to evolve, the ability to anticipate future trends and adapt accordingly is more important than ever. Looking ahead, several key trends are likely to shape the future of power trading. The continued growth of renewable energy, driven by both policy mandates and technological advancements, will remain a central theme. This growth will necessitate further investments in grid infrastructure, storage solutions and advanced forecasting tools to manage the variability and ensure reliability.

Regulatory developments will also play a critical role, with ongoing reforms and new policies influencing market dynamics and investment decisions. Traders will need to stay agile and informed, leveraging technology and innovative strategies to navigate the complexities of the evolving landscape. The integration of AI and machine learning in trading and forecasting, the expansion of smart grid technologies and the development of new financial products will all contribute to a more dynamic and resilient energy market. By staying ahead of these trends and embracing change, traders can position themselves for success in the future of power trading.

Power trading is a complex and dynamic field, characterized by volatility, transition and uncertainty. However, as we have seen throughout this e-book, these challenges also present numerous opportunities for those who are willing to understand and navigate these complexities.

The transition from traditional power sources to renewables is creating new opportunities for traders, even as it introduces new risks and uncertainties. Regulatory changes, while potentially disruptive, can also open new markets and trading possibilities. And the rapid pace of technological innovation is constantly reshaping the trading landscape, offering new tools and strategies for those who are willing to adapt.

In the face of these changes, the key to success in power trading is knowledge. By understanding the unique characteristics of different power markets, staying informed about regulatory changes and market trends, and developing effective risk management strategies, traders can navigate the volatility of the energy markets and seize the opportunities that arise.

As we look to the future, one thing is clear: the energy markets will continue to evolve.

People, process and technology for E&P innovators looking to disrupt the old and usher in the future of energy.

Read More About our E&P Solutions

Respond faster to rig and activity trends with real-time GPS and satellite telemetry data analytics.

Read More About Activity Analytics

An essential set of O&G data analytics. Redeploy your team’s bandwidth to higher value analysis and strategy with clean analytics-ready data sets.

Read More About Foundations

Track activity in near-real time to get the most recent and actionable insights on operators, leases, rigs, permits and more across the industry.

Read More About Oilfield Services

Technical research, publications and direct access to industry experts that leverage today’s most advanced analytics and technology to deliver independent, third-party insight into oil and gas, power, liquefied natural gas and renewables.

Read More About Intelligence

Discover

About Enverus

Resources

Follow Us

© Copyright 2025 All data and information are provided “as is”.