Overlooked for much of the Permian Basin’s oil producing history because of its remote location, arid conditions, and tight rock formations, the Delaware Basin’s vast oil reserves have recently been unlocked with the introduction of hydraulic fracturing techniques. The following sections provide details about the basin’s production capacity, major geological structures, market activity, and regional population.

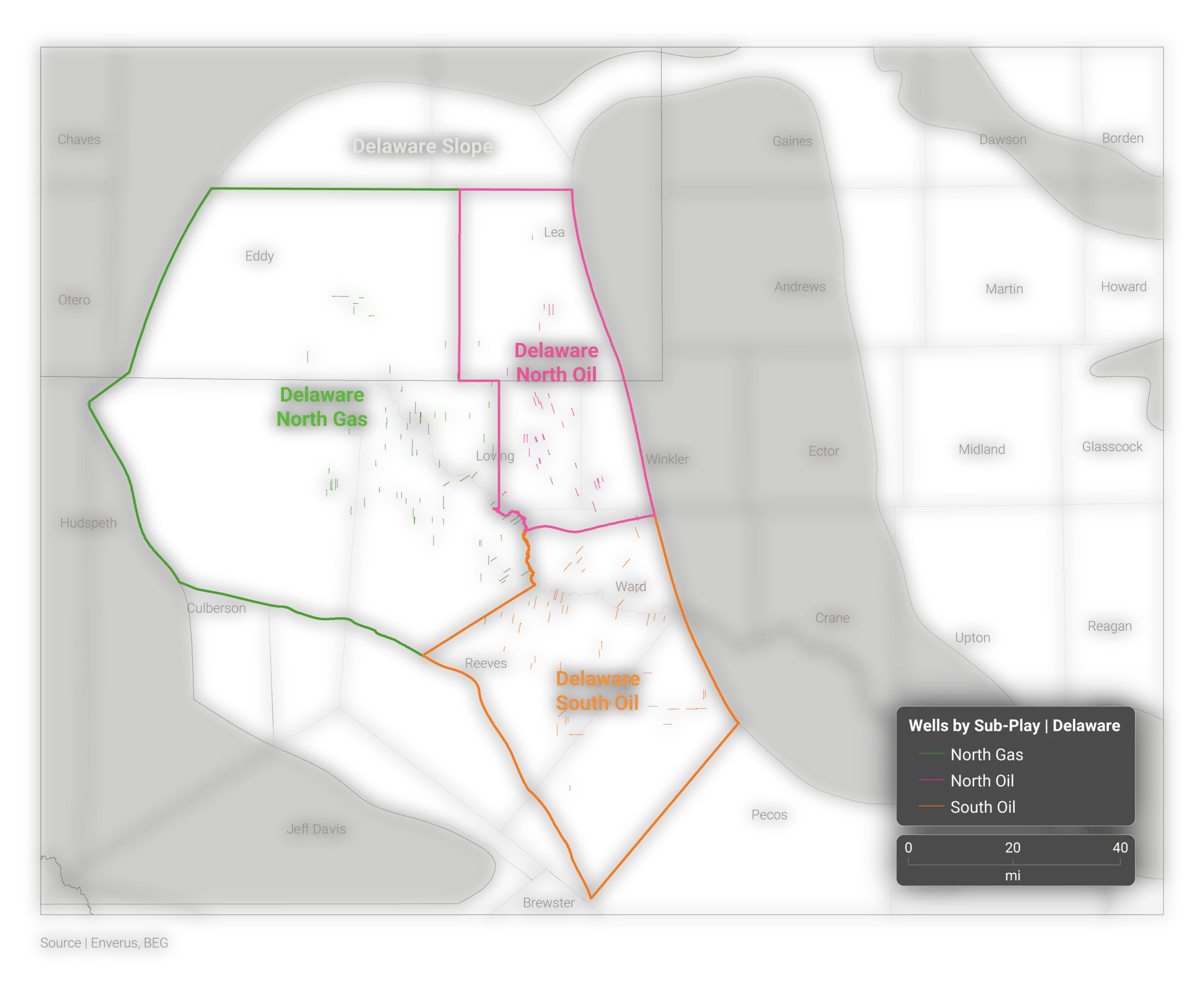

Located on the western section of the Permian Basin, the Delaware Basin covers a 6.4M acre area. It is the deepest of the Permian subbasins with the thickest deposits of rock. It is heavily faulted compared to the Central Basin Platform and Midland Basin with overpressured reservoirs on the eastern side. Primary targets in the basin are the organic-rich units within the Wolfcamp and Bone Spring groups, with the latter having more localized, turbidity-driven deposition.

The Delaware Basin region is also well known for Guadalupe Mountains National Park, a fossilized reef exposed at the surface, and Carlsbad Caverns

In addition to its vast oil and gas reservoirs, there are a wide variety of subsurface natural resources in the region, including major sylvite formations that yield a steady supply of potassium salts (potash), a byproduct of which is rock salt. The arid conditions of the New Mexico and Texas state line provide a source of sand, which operators use as proppant for hydraulic fracturing. As much as 10 barrels of water are produced for every barrel of oil in the Delaware Basin, however, the high salt content makes produced water unsuitable for fracturing, requiring operators to dispose of saltwater through injection wells.

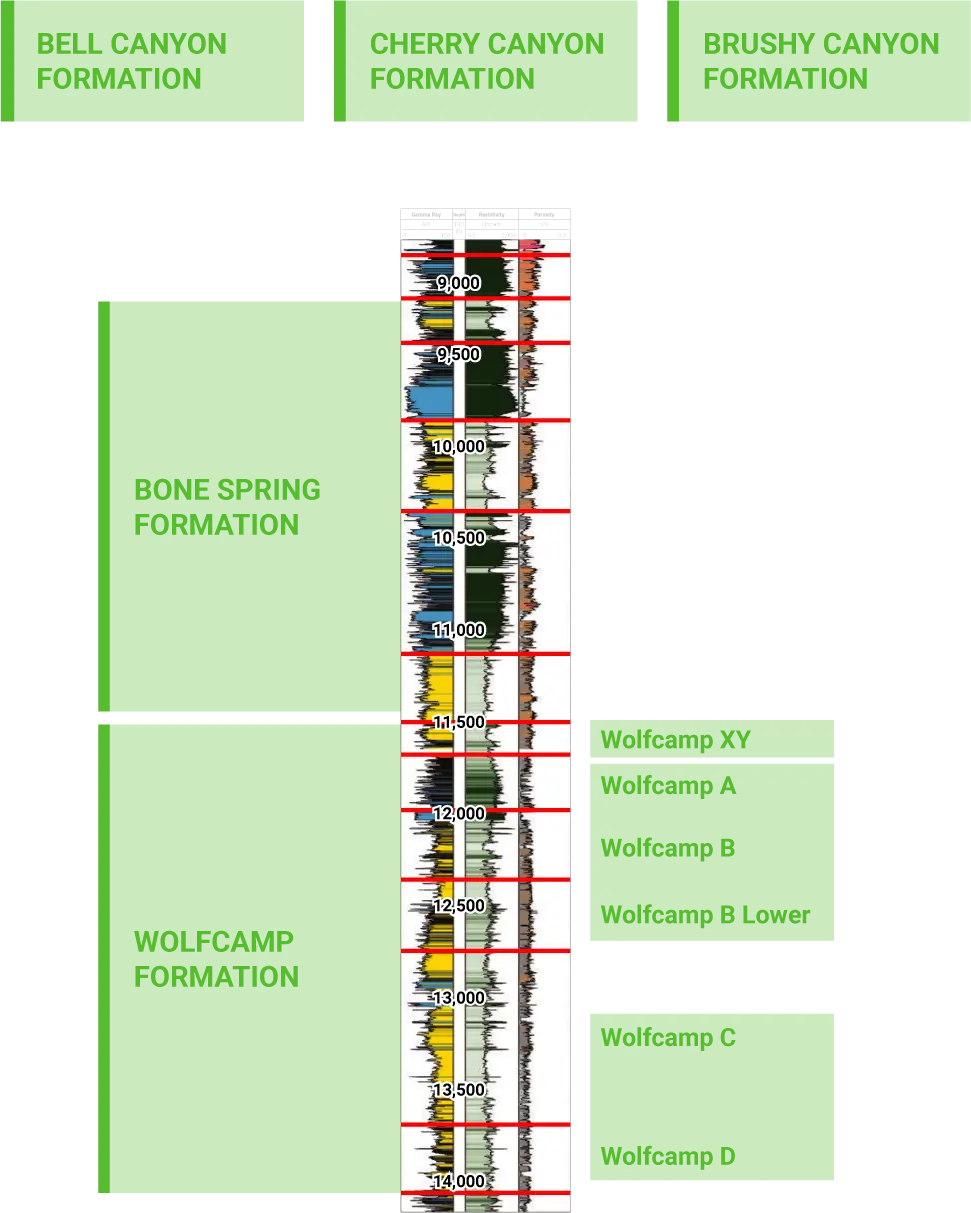

The introduction of horizontal drilling has revitalized interest in the Wolfcamp and introduced the Bone Spring as the money-making formation of the Delaware Basin. It is a thick package of alternating sands, shales, and carbonate intervals.

Horizontal development unleashed an enormous amount of production from the basin, growing it from about 80 Mbbl/d at the beginning of 2010 to over 2.1 MMbbl/d a decade later. While the basin has shown great potential in terms of resource and economics, the basin’s structural varied lithological complexities have led to a wide disparity in results across the play, much of which is driven by parent-child well interactions both within and across landing zones.

Decreasing horizontal and vertical spacing between parent and child wells coupled with cemented carbonates in the subsurface are leading companies to investigate interwell pressure communication across zones in order to mitigate the economic impact of hydraulic fracturing on producing wells (frac hits).

The oil rich deposits of the Bone Spring Formation are primarily targeted in New Mexico’s Eddy and Lea Counties. Because this region is comprised of Federal lands, the 2021 ban on new drilling will enable producers to continue drilling for wells permitted before the ban. The ban is not expected to impact overall drilling activity in the Delaware Basin.

The Delaware Basin’s surface area covers 13,000 square miles, most of which is sparsely populated. The northern end of the basin lies in New Mexico, giving it exposure to federal land which typically carries a lower royalty rate compared the private leases in Texas and some regions of New Mexico. Flanked by the Northwest Shelf, it dips towards the Central Basin Platform (CBP) which serves as its eastern boundary.

Historically, production focused on vertical development and targeted the conventional carbonate formations in the Northwest Shelf. Legacy vertical wells also tapped into the unconventional stacked pay zones of the basin by completing zones within both the Bone Spring and Wolfcamp formation, resulting in a comingling of production once referred to as the Wolfbone.

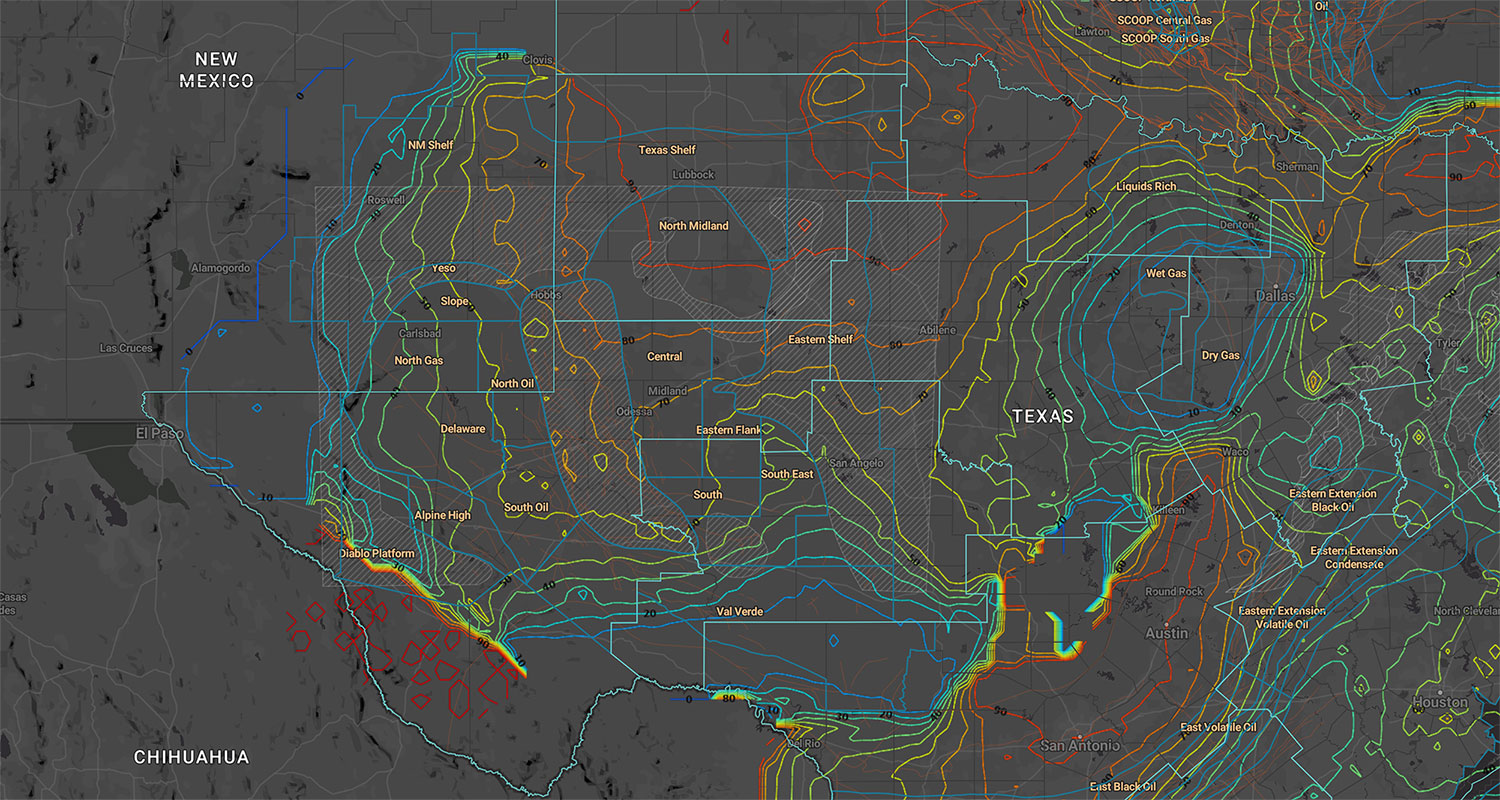

Today, most operators target the Bone Spring and Wolfcamp Formations with horizontal drilling and hydraulic fracturing. There are multiple emerging opportunities, such as proving out legacy vertical targets, including the Avalon and 2nd Bone Spring as viable horizontal targets. Additional emerging targets in the Delaware Basin area include the Yeso Trend, with sits just north of the basin along the Northwest Shelf.

The formations of the Delaware Basin are mainly comprised of carbonate reef deposits and shallow marine clastic sediments. From youngest to oldest (or shallowest to deepest), formations include Bell Canyon, Cherry Canyon, Brushy Canyon, Bone Spring (including Avalon Shale), and Wolfcamp.

In addition to its core formations, the Delaware Basin features a number of nearby adjoining geologic features or basins.

The Northwest Shelf is a northwest extension of the Delaware Basin (also known as the Yeso Play) featuring older conventional development. As with much of the Permian, modern drilling and horizontal wellbores are revitalizing the activity in the Yeso and Abo formations of the Northwest Shelf.

A little brother to the Delaware, the Marfa Basin is a deep and tectonically complex structure primarily comprised of Tertiary volcanic sediments that is located on the Texas side of the Delaware. Since the 1940s, wildcatters have attempted to unlock the Marfa Basin’s untapped oil and gas reserves, however, success has been elusive given the basin’s depth and reservoir characteristics.

Given the extensive target depths for the Wolfcamp and Bone Spring Formations, Delaware Basin rigs represent some of the highest performing land drilling rigs with rotary and directional capabilities that demand high day rates.

In response to the takeaway capacity needs of the Delaware’s emergence as a dominant oil play following the advent of unconventional drilling in the last decade, the pipelines of the Delaware Basin include a network of newer oil, gas, and produced water transportation pipelines. Midstream infrastructure is continuously being built out ahead of production growth. Given the extremely high water cut in the basin, moving produced salt water from the wellhead to disposal wells underscores the importance of water pipelines in the region.

The prolific oil reserves of the Delaware Basin have attracted the supermajors and leading publicly traded firms. Delaware Basin oil companies also include many smaller independent exploration and production companies. The following table lists top oil companies of the Delaware Basin by barrel of oil equivalent (BOE).

|

Operator |

Oil (Mbbl) |

Gas (Mmcf) |

BOE (Mboe) |

|

362 |

1,900 |

545 |

|

|

404 |

1,595 |

512 |

|

|

213 |

1,193 |

406 |

|

|

249 |

1,000 |

274 |

|

|

109 |

850 |

249 |

|

|

143 |

1,800 |

229 |

|

|

106 |

638 |

212 |

|

|

152 |

895 |

203 |

|

|

198 |

1,400 |

175 |

|

|

83 |

423 |

99 |

|

|

84 |

794 |

75 |

|

|

40 |

200 |

71 |

|

|

56 |

219 |

65 |

|

|

190 |

1,100 |

56 |

|

|

32 |

89 |

47 |

The counties of the Delaware Basin stretch from Eddy county, New Mexico in the north to Pecos county, Texas in the south. Population sizes range from less than 200,000 in Lea, Eddy, and Chaves Counties in New Mexico to the sparsely populated Loving County of Texas with just over 100 residents.

|

County |

State |

Population |

Land Area |

Land Area |

Surface |

|

Texas |

9,340 |

6,184 |

16,020 |

0.13% |

|

|

New Mexico |

64,600 |

6,060 |

15,700 |

0.16% |

|

|

Texas |

2,230 |

3,810 |

9,870 |

0.01% |

|

|

New Mexico |

52,706 |

4,198 |

6,756 |

0.50% |

|

|

Texas |

15,000 |

2,265 |

5,866 |

0.03% |

|

|

New Mexico |

60,232 |

4,394 |

7,071 |

0.07% |

|

|

Texas |

113 |

677 |

1,090 |

1.10% |

|

|

Texas |

16,248 |

4,765 |

7,669 |

0.02% |

|

|

Texas |

11,046 |

2,642 |

4,252 |

0.30% |

|

|

Texas |

10,528 |

836 |

1,345 |

0.03% |

|

|

Texas |

6,772 |

841 |

1,353 |

0.02% |

The cities of the Delaware Basin are spread out along its vast 6.4M acre area and include Mentone, a remote town in Loving County, Texas with a population of 29. The largest city in the basin area is Odessa, Texas.

|

City |

State |

County |

Population |

Land Area |

Land Area |

|

Texas |

Ector County |

117,000 |

51.4 |

133 |

|

|

New Mexico |

Chaves County |

47,800 |

29.8 |

77 |

|

|

New Mexico |

Lea County |

37,800 |

26.4 |

68 |

|

|

Texas |

Andrews County |

17,700 |

6.96 |

18 |

|

|

New Mexico |

Roosevelt County |

11,900 |

7.95 |

20.95 |

|

|

Texas |

Reeves County |

9,920 |

22 |

56 |

|

|

Texas |

Gaines County |

7,560 |

3.8 |

9.84 |

|

|

Texas |

Brewster County |

6,070 |

4.8 |

12.43 |

|

|

Texas |

Culberson County |

1,920 |

2.84 |

7.35 |

|

|

Texas |

Jeff Davis County |

1,110 |

10.1 |

26.16 |

|

|

Texas |

Loving County |

29 |

0.17 |

.44 |

Discover

About Enverus

Resources

Follow Us

© Copyright 2025 All data and information are provided “as is”.