Battling Blackouts with Accurate Renewable Power Forecasting

As a professional power market forecaster, you better believe that I hate to see instances of rolling power blackouts. Americans from California to New York are experiencing power interruptions this summer, which brings on loads of new market risks to individual consumers and businesses alike. Thankfully, the latest scare in California was manageable for utilities […]

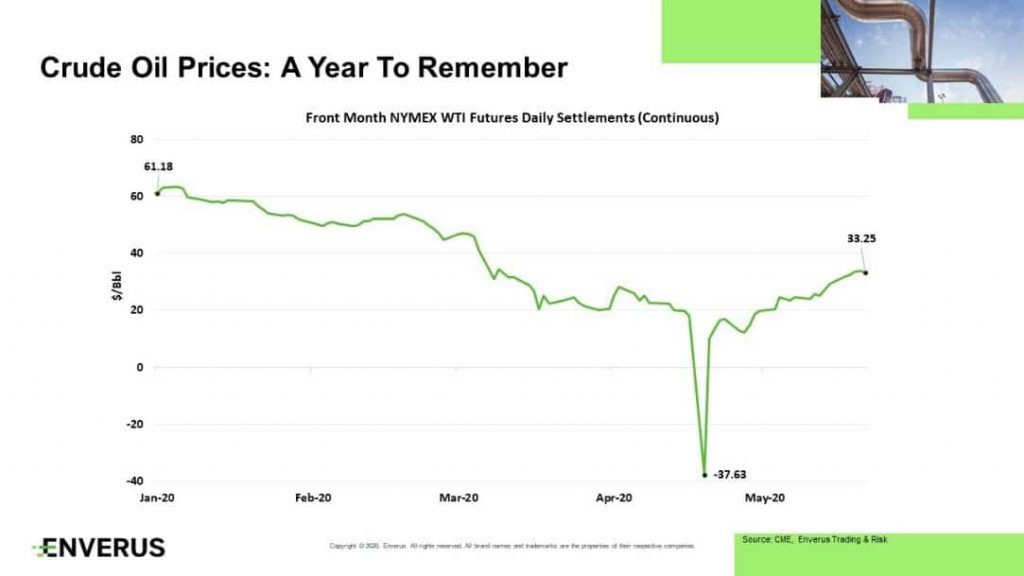

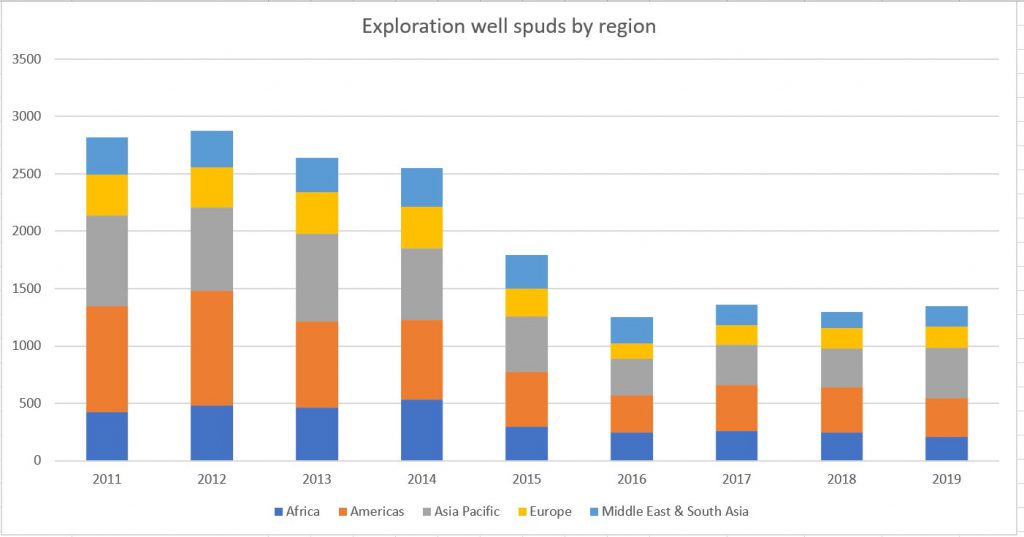

Delivering Oil Price Transparency When It’s Most Needed

U.S. oil markets are rounding off one of the most volatile and dramatic decades in recent memory. Just since the end of 2014, we’ve experienced two major price downturns as well as a massive shift in global crude trade flows. The U.S. yielded so much oil output that it became the biggest producer globally and […]

Revived Market Volatility Changes Everything for Risk Analysts

The world is transforming before our eyes. New market realities at play for energy risk managers were unthinkable before the emergence of COVID-19 and risk management has never been more important to energy and commodity traders. From 2020 onward, the people who analyze price risk will throw away their old playbooks. Risk analysts must push […]

How Social Unrest Showed Up in NY Power Loads This Summer

Government-mandated closures aren’t the only thing cutting into power demand in New York this summer. Once the epicenter of the COVID-19 outbreak in the U.S., New York maintained strict closures and travel restrictions throughout April and May. Its shutdowns were swift compared with the rest of the country. As early as March 24, my team […]

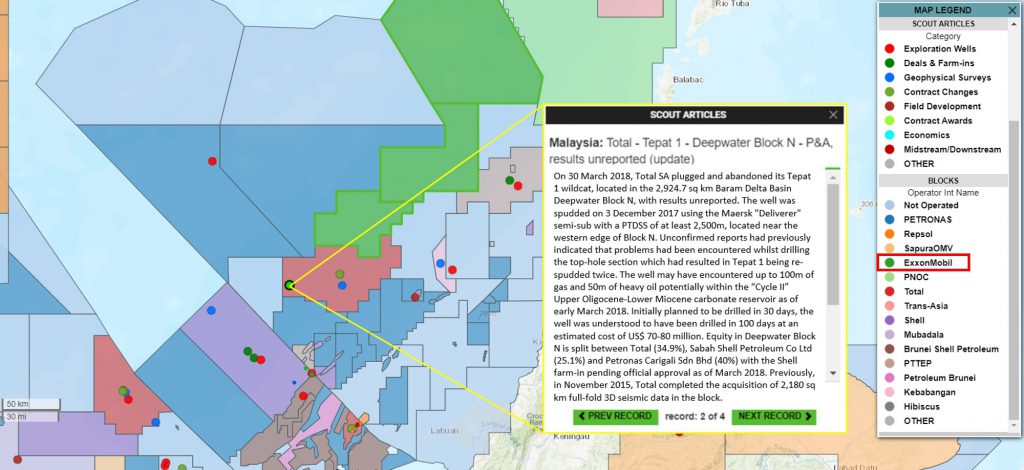

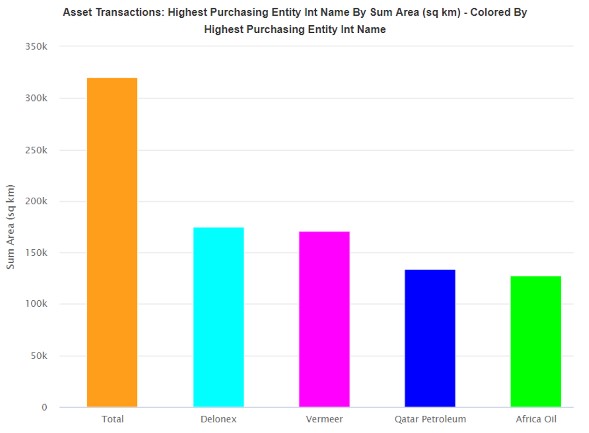

Sharks in the Water—Part 3

“Dice are rolling, the knives are out …” In this week’s blog, we’re highlighting two more “sharks in the water”—companies with solid balance sheets, long-term growth strategies, and cash to spend on acquisitions from stressed rivals during these stressful times. In Part 2 of this series, we highlighted Total, which we see as an […]

Risk Analysts Take Note—High Oil Market Volatility is Here to Stay

2020 has been quite a roller coaster ride—and it’s not even halfway over yet. To be sure, in recent weeks WTI crude reached a little bit of oil price stability compared to what we have been experiencing. But by no means is market volatility in the rearview mirror. In fact, the kind of volatility WTI […]

How COVID-19 Will Impact Power Loads During Summer Peaks

U.S. power markets have endured a transformative two and a half months as school, business, and some manufacturing closures have swept across the nation due to COVID-19. A little more than two months ago, the PRT team was analyzing the first results of our COVID-19 power load demand destruction models. (I wrote about the challenges […]

MarketView Anywhere Links Remote Energy Traders to Markets

2020 brought on brand new challenges for everybody in the energy industry. Working from home set-ups were particularly challenging for traders and analysts who normally work in close proximity in trade floors. Our director of product management for MarketView, Sven Schoerner, sat down with ComTech Advisory to talk about the benefits MarketView as a data […]

Sharks in the Water—Part 2

“Dice are rolling, the knives are out … ” In this week’s blog, we will highlight a new “shark in the water”—a company with solid balance sheets, long-term growth strategies, and cash to spend on acquisitions from stressed rivals during these stressful times. Last week we discussed Shell, which we believe has both the […]

Sharks in the Water

“Dice are rolling, the knives are out … ” Oil’s recent price implosion, resulting from the double whammy of OPEC’s early March failure to agree on further production cuts with Russia and demand destruction in the wake of the global coronavirus pandemic, has left the global oil & gas exploration business reeling. Subsequent OPEC++ cuts […]