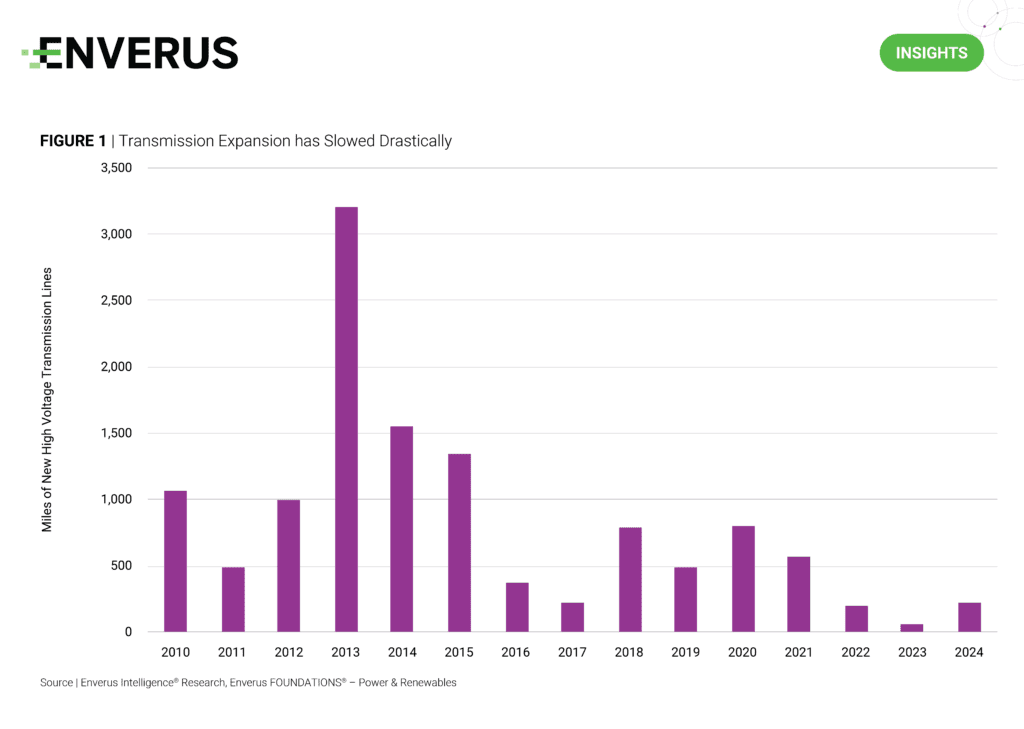

Enverus Intelligence® Research (EIR) and many others have published at length on the coming wave of load growth that starkly contrasts more than a decade of stagnation. What is discussed less is how challenging system upgrades and expansions have become in recent years (Figure 1). To identify two markets that stand out, we expect transmission systems will need to grow 14% and 10% in ERCOT and WECC respectively, representing hundreds of miles of system expansions each year over the next five years. What happens if these infrastructure projects fail to materialize? One vein of solutions gaining more attention is temporary quick-install power systems like those developed by VoltaGrid, Life Cycle Power, Solaris Electric and others. Data center developers, the largest force behind load growth are turning to quick-fix solutions for essential projects, like xAI with its Memphis Colossus artificial intelligence supercomputer facility.

While many large loads face multiyear wait times and development hurdles in the queue, well-capitalized firms that are willing to push the envelope may be able to find a haven in regulated markets where conditions are ideal. At its Memphis site, xAI utilized the infrastructure from an old electronics manufacturing facility with existing grid connections and proximity to both power and natural gas. Working with a utility and midstream partner, it was able to set up a facility with nearly 100 MW of power in less than three months. EIR thinks more opportunities like this are available and regulated markets could provide a refuge from lengthy interconnection queues.

- Renewables on Contract – Who’s Buying PPAs and What’s Changing? – As a substantial amount of renewable capacity rolls off power purchase agreements (PPAs), we analyze how developers can remain competitive amid shifting trends in contract volumes, technology types, offtake demand, contract durations and PPA prices.

- Carbon-Led Exploration – Commercializing CCUS in Southeast Asia – This report explores how companies in Southeast Asia are adopting a carbon-led exploration and production approach to commercialize the region’s CCUS projects.

- Big Emissions, Bad Rocks – Sequestration Struggles in Data Center Alley – This report evaluates the Tri-State CCS project in West Virginia and its potential to sequester CO2 from nearby emitters. With a growing demand for decarbonization in Appalachia, Enverus Intelligence® Research analyzes the CO2 sequestration options and capacities for current emitters, blue hydrogen projects and data centers.

Enverus Intelligence® Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.