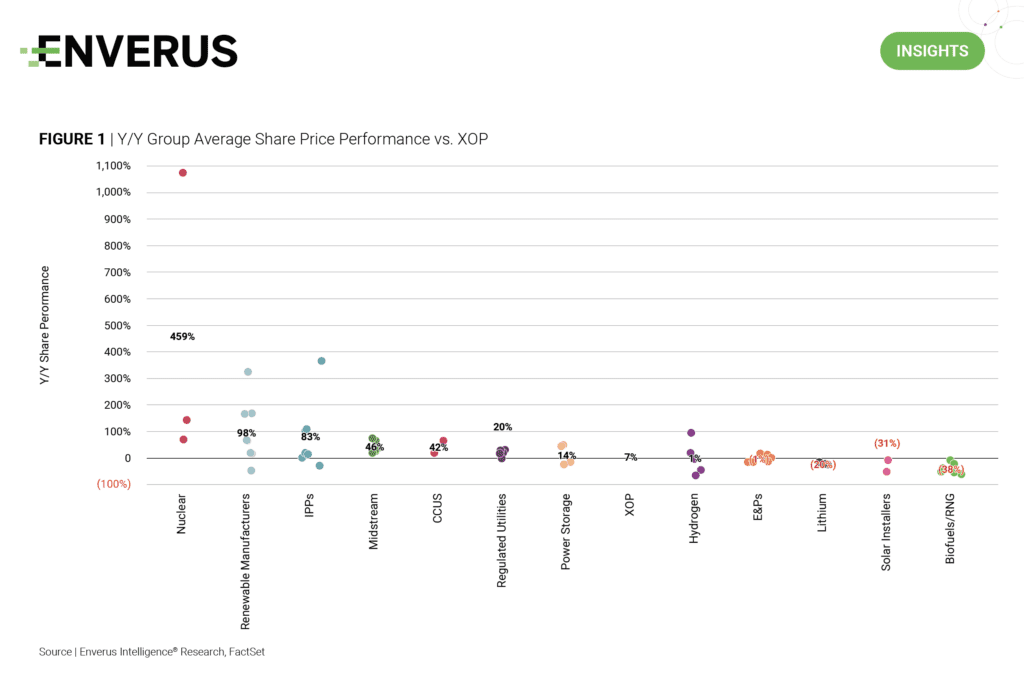

An Enverus Intelligence® Research (EIR) analysis of the energy transition 3Q24 earnings season found nuclear companies rose 459% year-over-year, reflecting a bullish trend driven by confidence in a supportive incoming administration. Favorable policies and global decarbonization goals underscore the potential importance of small modular reactors to supply reliable, low-carbon baseload power.

Independent power producers (IPPs) experienced an 83% increase, also reflecting a bullish trend for ratable generation. Exceptional quarterly results were driven by rising demand for reliable power from AI hyperscale data center expansions and broader electrification trends. Long-term contracts enhance revenue certainty and exposure to AI infrastructure demand ensures sustained growth. IPPs are well-positioned to benefit from the early stages of a major technological revolution.

In contrast, solar installers witnessed a 31% year-over-year decline. Challenges include highly leveraged balance sheets and the threat of rolled-back investment tax credits under the new Trump administration. Proposed tariffs on Chinese imports further pressure cash flow margins. EIR remains bearish on the sector, recognizing the only positive factor is a more favorable interest rate environment for debt refinancing efforts.

Highlights:

- Tracking the Energy Transition Market – Nuclear, IPPs Surge; Solar Installers Struggle Amid Policy Shifts – The 3Q24 edition of the ETR team’s equity tracking report provides coverage across various energy transition sectors as well as integrated traditional energy businesses.

- Efficient Data Center Siting – From Overwhelming Options to Optimal Locations – The surge in AI technology is driving rapid growth in data center development. Successful siting of a data center depends on energy availability, site quality and energy cost. In this report, Enverus Intelligence Research provides a workflow based on critical factors affecting these key pillars, leveraging Enverus PRISM® P&R suite data and analytics.

- Nuclear in Its AI Era – Enabling the Next Generation of Reactors – Demand for computing power coupled with the surge of AI is prompting technology giants to pursue reliable, low-carbon power sources for data centers, fueling a resurgence in interest in nuclear power. EIR evaluates various IPP’s existing nuclear energy portfolios and their opportunities for large-scale deployments.

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.