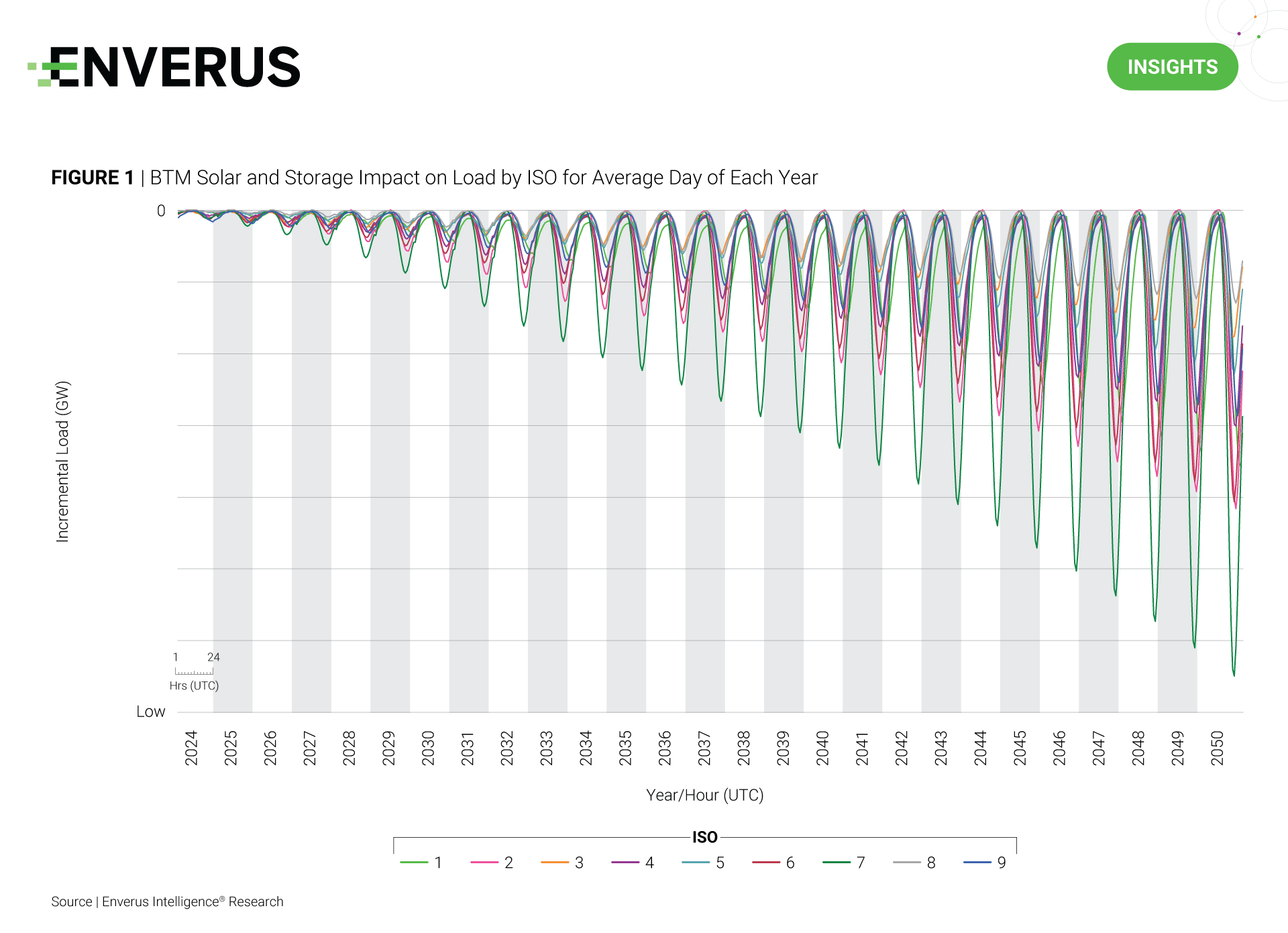

U.S. federal and state governments are incentivizing distributed energy generation technologies like residential solar and storage to speed up decarbonization. We find that the combination of these incentives, decreasing rooftop solar costs and rising retail power prices strengthens the economic rationale for installing household solar and storage. The duck curve in California demonstrates the significant effects this can have on load (Figure 1).

Enverus Intelligence® Research’s long-term load forecast anticipates that behind-the-meter (BTM) solar and storage solutions will be economically driven. However, non-financial factors such as energy security and environmental concerns also contribute to demand. Our BTM solar and storage forecast quantifies annual cost savings from rooftop solar and estimates residential solar demand based on the historical correlation between cost savings and annual installations. Additional factors considered are the impact of interest rates and the implementation of avoided-cost tariffs similar to California’s NEM 3.0.

Research Highlights:

- ERCOT Fundamentals – Lighting the Lone Star – Gain valuable insights into the future of the ERCOT power market with Enverus Intelligence Research’s comprehensive report, covering generation mix projections, load forecasts, power price impacts, market restructuring, interconnection queues, asset benchmarking and project siting analysis.

- Data Center Alley – Capacity Running Out – This Fusion Insights analyzes load interconnect opportunities remaining in PJM and identifies prime locations to locate new data centers. Subscribers can download the nodal withdrawal capacity data file attachment and use Fusion to join it with our ATC or substation tables in Enverus PRISM® to recreate this dashboard.

- Long-Term Load Forecast – Returning to Growth – Our long-term power demand forecast model considers historical drivers of power demand across the Lower 48 and models variables that we think will impact future load, including data centers, electric vehicles, residential solar and storage, cryptocurrency mines, green hydrogen, CCUS and electrification trends. This report analyzes the effects that these new exponential load drivers will have on our power demand forecasts from 2024-2050.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. Click here to learn more.