Since 2020, the demand for power purchase agreements (PPAs) has surged, driven by tax incentives, corporate clean energy goals, and increasing power needs. Data centers and the push for 24/7 clean energy matching are further accelerating this trend. The rapid development of U.S. renewables has shifted the market dynamics, creating a buyers’ market where PPA durations have shortened to 10-15 years, which is less than the lifespan of most assets, due to off-taker preferences.

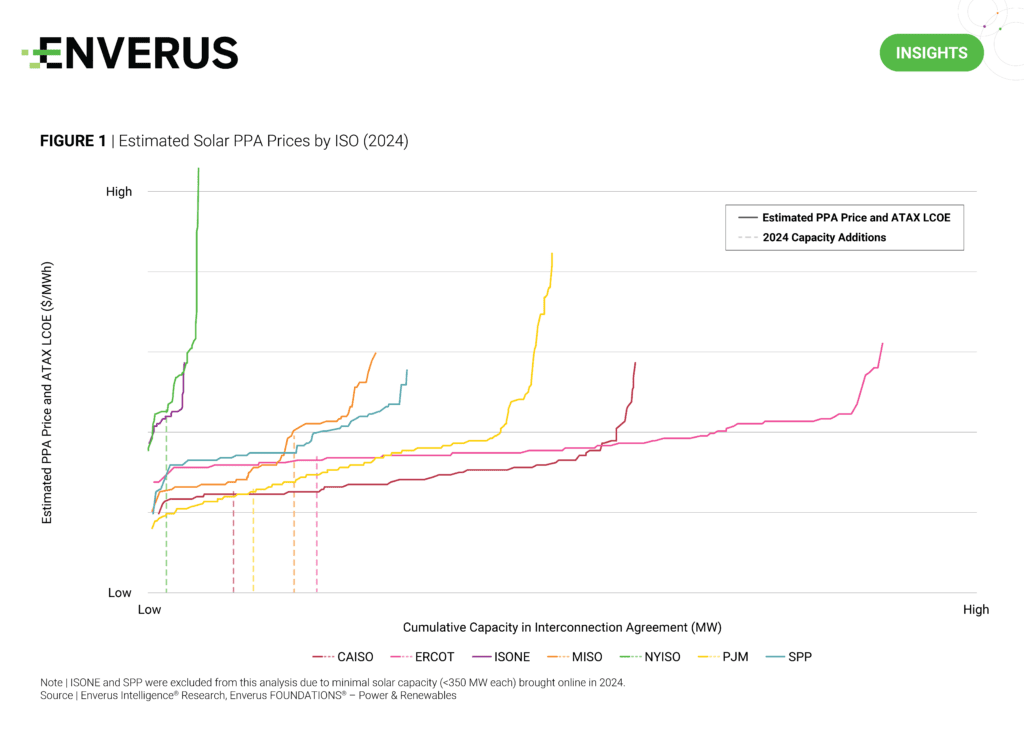

Given this shift, it is crucial for developers on both sides to understand PPA price trends. By comparing the after-tax levelized cost of energy (LCOE) for solar projects in the interconnection queue with the operational capacity for 2024, optimal PPA prices for 2025 can be determined (see Figure 1). Most markets show solar projects meeting PPA demand at $20-$30/MWh, whereas NYISO’s LCOEs are closer to $50/MWh due to weaker solar resources and higher costs. With solar growth outpacing wind, Wright’s Law suggests that solar costs will decrease more rapidly post-2025, making a low LCOE essential for developers to secure PPAs in an increasingly competitive market.

Research Highlights

- Renewables on Contract – Who’s Buying PPAs and What’s Changing? – As a substantial amount of renewable capacity rolls off, we analyze how developers can remain competitive amid shifting trends in contract volumes, technology types, offtake demand, contract durations and PPA prices.

- Carbon-Led Exploration – Commercializing CCUS in Southeast Asia – This report explores how companies in Southeast Asia are adopting a carbon-led exploration and production approach to commercialize the region’s CCUS projects.

- Big Emissions, Bad Rocks – Sequestration Struggles in Data Center Alley – This report evaluates the Tri-State CCS project in West Virginia and its potential to sequester CO2 from nearby emitters. With a growing demand for decarbonization in Appalachia, EIR analyzes the CO2 sequestration options and capacities for current emitters, blue hydrogen projects and data centers.

About Enverus Intelligence® | Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts, and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.