The world of energy transition M&A is buzzing with change and possibilities. Energy companies across the globe are undertaking unique journeys in the energy transition landscape, venturing into new territories and reshaping the future of the energy industry as we know it. A clear-cut example is the divergent strategies observed in the supermajor space, where U.S majors have shown a skew towards molecule-based energy transition technologies like carbon capture, while European firms leaned into predominantly power strategies.

A major force in the U.S market – policy. Despite the lack of guidance, firms are discovering innovative ways to progress and finalize energy transition deals.

As we navigate this change, let’s take a moment to distill it down to three pivotal reasons why capitalizing on this shift in the energy landscape is a must.

- Big Investment Opportunities

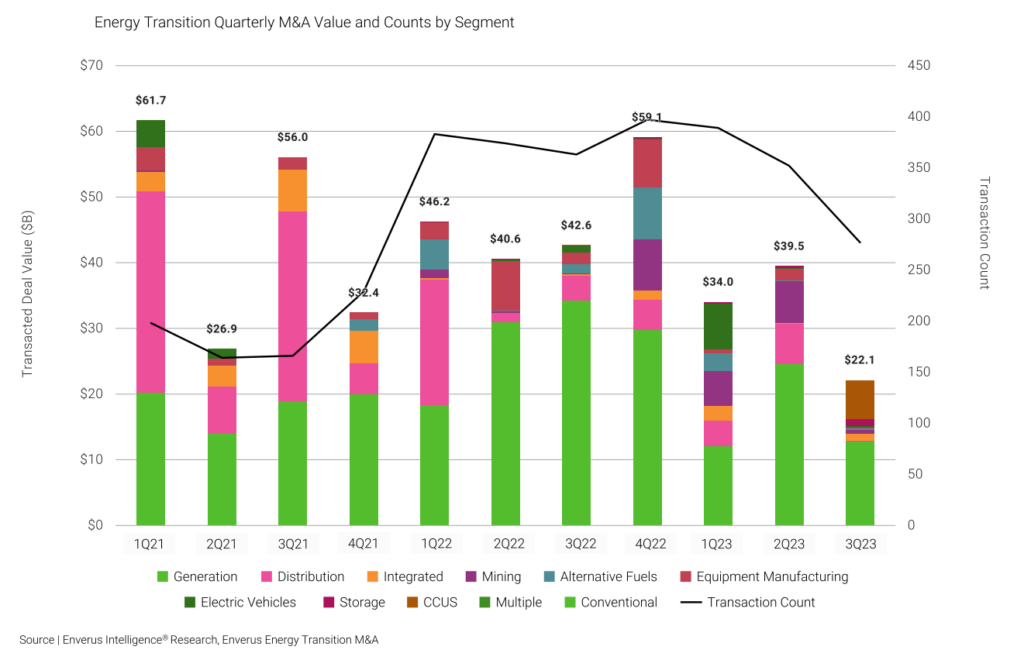

Think of the energy transition sector as a hotspot for investments. In 2022, investments exceeded a staggering $1.11 trillion, signaling high investor confidence in energy transition-related projects. It’s no longer a shift but a game-changing seismic shakeup that’s creating attractive opportunities for businesses to tap into. The door is wide open, but entry requires a smart strategy and deep appreciation of evolving market dynamics.

- Strategic Navigation Is Vital

Understanding the ‘why’ is fundamental, but the million-dollar question stands, – How do businesses successfully chart their course in this exciting yet complex territory? Enverus hails an answer. Our innovative Energy Transition M&A solution presents the ability to demystify emerging trends through careful examination of press releases, acquisition presentations and deal insights to empower customers with informed decision-making. Our team includes hundreds of energy and finance experts who evaluate trends and write research contributing to a rich tapestry of insights and analytics, covering a spectrum of technologies – from your bread-and-butter energy assets down to the trendsetters – solar, wind, hydrogen, batteries, carbon capture usage and storage, biofuels and more.

- Information Is Power, Sustainability Is the Future

Let’s face it – the energy transition frontier can be a whirlwind. That’s why we’re creating a space where complexities are transformed into understandable insights. We stand committed to sifting through the noise to deliver invaluable insights that not only dive deep into deal specifics but shed light on the wider context, giving you the power to make smart decisions and contribute actively to shaping a more sustainable, energy-forward future.

At Enverus, we believe that every complexity is a puzzle waiting to be solved, and every challenge a hidden opportunity. Our knowledge curation, clear-cut insights and innovative strategies are not only tailored to address these unique complexities, but provide guidance in this high-stakes energy transition journey.

Watch our Webinar ” Capitalizing on Change – The Energy Transition M&A Landscape “

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. EIR is registered with the U.S. Securities and Exchange Commission as a foreign investment adviser. See additional disclosures here.