The global energy landscape is undergoing a significant transformation, driven by the imperative to mitigate climate change and transition to a more sustainable future. As the world shifts towards cleaner and renewable energy sources, private equity companies are presented with a unique opportunity to invest in the energy transition. However, evaluating the success of such investments requires a careful assessment of various factors and data sets. In this blog post, we will explore effective strategies for private equity firms to assess energy transition investments and identify the key data sets to focus on for determining investment success.

Regulatory environment and policy landscape

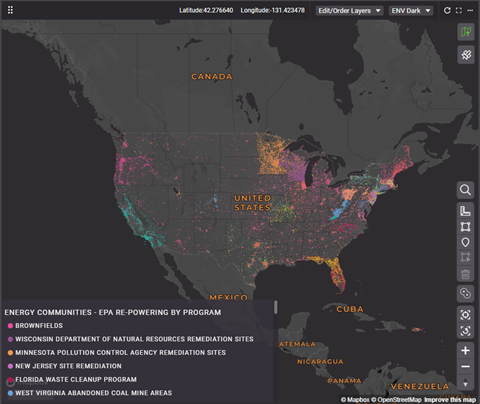

One crucial aspect of assessing energy transition investments is understanding the regulatory environment and policy landscape. Policies like 2022’s Inflation Reduction Act (IRA) introduced positive incentives for investors willing to deploy capital in renewable energy projects. For private equity companies to maximize their return on investment (ROI), key data sets are necessary when assessing long-term commitment of governments to supporting the energy transition. For example, the Energy Community Tax Credit Bonus increases the investment tax credit an extra 10% for projects that began operating after Dec. 31, 2022, and are within one of four qualifying energy communities. Power and Renewables data sets like the energy community layers in PRISM can have a great impact on assessing the success of an investment as it relates to the political landscape.

Market trends and project economics

A comprehensive analysis of market trends and demand outlook is essential for assessing the viability of energy transition investments. For renewable power investments, market data related to installed capacity, energy prices, demand projections and project economics will help investors optimize their capital allocation decisions. Investors will also need to be aware of emerging opportunities in the hydrogen, CCUS and clean fuels space, which are becoming more lucrative thanks to recent policies like the IRA. With a stable cash flow from power offtake agreements and quick deployment, renewables are a known and reliable entity. On the other hand, hydrogen represents a high-risk investment due to its early-stage technology, limited potential offtakers and uncertain cash flows. Scaling up hydrogen’s economic viability depends heavily on government policy incentives, making it vulnerable to changes with each new government. Our team of intelligence professionals provides regular commentary and insights on the most impactful energy transition trends. The Enverus Intelligence®| Research team provides weekly updates on through the Enverus Energy Transition Weekly Wrap. Sign up here.

Technological innovation and scalability

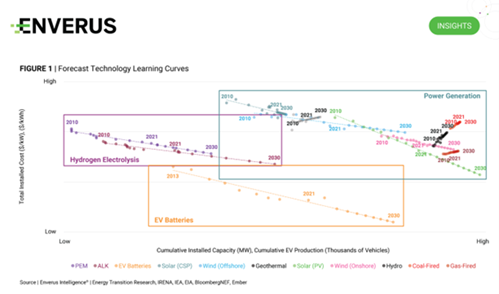

The energy transition features a myriad of technologies at vastly different stages of maturity. Innovation will occur at different rates as technologies scale up over time. Understanding the scalability and commercial potential of emerging technologies is crucial for identifying promising investment opportunities. Key data sets to consider include research and development activities, patents, industry partnerships and pilot projects showcasing technological advancements.

Capital cost trends for key technologies can be estimated using Wright’s Law, a framework for forecasting cost declines as a function of cumulative production.

Environmental, social and governance factors

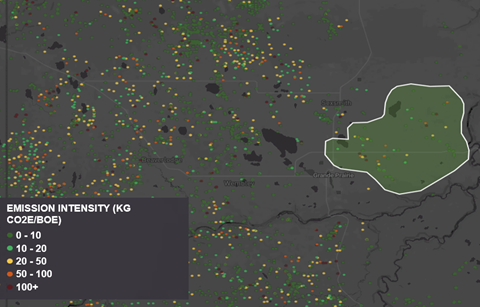

Considering environmental, social and governance (ESG) factors is becoming increasingly important for private equity firms. ESG considerations can impact the long-term success and reputation of investments. Private equities who prioritize ESG principles are more likely to attract companies who might be better positioned to adapt to changing regulatory landscapes and consumer preferences, contributing to a more resilient and prosperous investment portfolio. Assessing the environmental impact of projects, such as GHG emissions, flaring rates, land and water usage is crucial. Evaluating the social and community aspects, including job creation, local economic development and stakeholder engagement, is also essential. Private equity firms can benefit from leveraging data sets like ESG Analytics, which offer a comprehensive overview of ESG metrics within a unified platform, complemented by industry-leading operational and economic analytics.

Conclusion

Assessing energy transition investments is a complex task, but private equity companies can make informed decisions by focusing on the right data sets. By considering the regulatory environment, market trends, project economics, technological innovation and ESG factors, firms can optimize their energy transition investments. It is important for private equity companies to adopt a holistic approach, combining quantitative and qualitative analysis, to effectively evaluate energy transition opportunities and contribute to a sustainable future.

Interested in learning more about how Enverus can help you identify high-potential energy partners and provide strategic research to maximize ROI? Fill out the form below and one of our experts will reach out to you to discuss your investment strategies.

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. See additional disclosures here.