Natural gas power plants have become increasingly attractive to investors, due to rising load growth expectations and the need for reliable grid balance. With coal plant retirements and a surge in intermittent generation, natural gas is critical for ensuring adequate supply. To guide this interest, Enverus Intelligence® Research (EIR) has created a market screening analysis that ranks U.S. regions based on factors such as forward power prices, gas feedstocks and power demand growth, helping investors identify top areas for natural gas development.

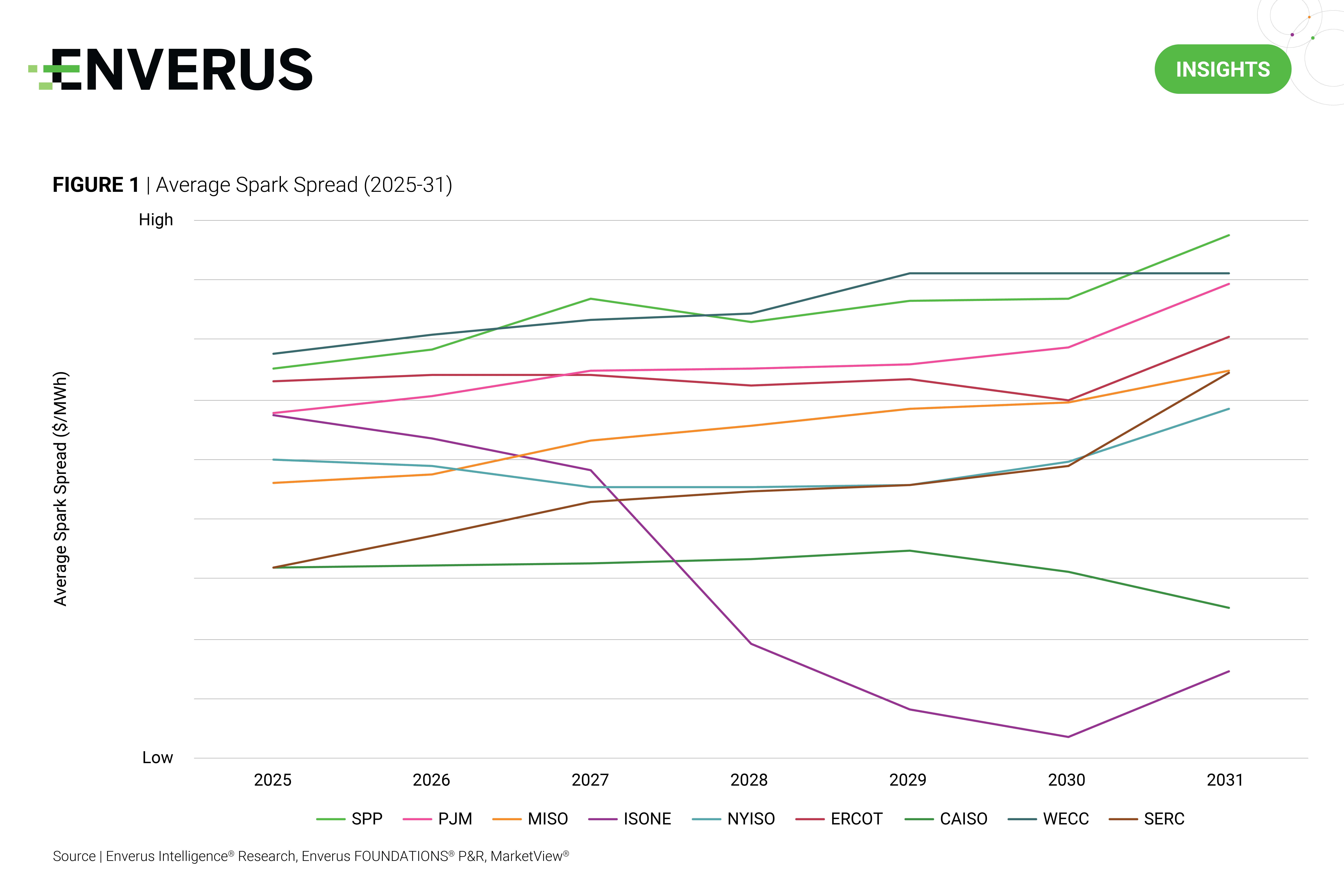

As part of the market screening analysis, EIR uses spark spreads—a measure of the difference between electricity market prices and the cost of natural gas in generation—as a key indicator of profitability for natural gas plants across ISOs. Spark spreads reflect the gross margin between fuel costs and electricity revenue. The market-implied spark spreads through 2031 shows the lowest average spark spreads in ISONE and CAISO, at $15/MWh and $16/MWh, respectively, while SPP and WECC record the highest, at $37-$38/MWh. These insights help evaluate market profitability and guide natural gas investment decisions across regions.

- Nuclear in Its AI Era – Three Mile Island Restart – Analysis of the deal struck between Constellation Energy and Microsoft to restart the Three Mile Island Unit 1 nuclear reactor.

- Power Plant Emissions – Navigating Carbon Costs – Enverus Intelligence Research investigates which U.S. power generators are most exposed to carbon pricing based on greenhouse gas emissions.

- Natural Gas-Fired Screening – Benchmarking Prime Development Regions – We build on EIR’s solar, battery storage and onshore wind market analyses to identify top locations for natural gas-fired projects in the U.S. Our screening considers factors like power prices, gas feedstock costs, spark spreads, capacity market prices, changes in the generation mix, load growth, cost of entry via acquisition and carbon prices.