For decades, ISO interconnection queues have managed the process of evaluating and approving power generation projects before they can connect to the power grid. In recent years, maintaining grid stability has become increasingly challenging due to various factors, including long queue times, congestion, costly interconnection studies and the replacement of deactivated coal and natural gas generation with renewable sources (Deactivated Generation Article). It is important for developers to be as well-informed as possible when planning the construction and operation of a power generation project. Enverus PRISM® Congestion Analytics add-on includes Available Transfer Capability (ATC) (available for ERCOT, SPP, PJM and MISO), which can help you identify which points in the grid can handle your next project.

Project Development Challenges in PJM

Historically, there was no immediate cost for applying for new queue positions. Now, PJM requires a readiness deposit of $4,000 per MW which has increased the financial burden for PJM developers at the time of applying for a PJM queue project. Additionally, developers must make decisions three years in advance for project details such as the location, the size of project, fuel sources and more.

PJM is forecasting a significant amount of gas and coal generation to become decommissioned in the coming years and decades. This decommissioned capacity is primarily being replaced by renewable projects in the queue, which are considered less reliable energy sources than gas and coal. As seen in the following Enverus PRISM® charts, coal and natural gas projects are the primary fuels being deactivated in the coming years, while renewable energy accounts for most planned projects in the PJM region. With the increasing number of queue applications from renewable projects, PJM has begun offering an expedited queue process for projects replacing retiring power plants (decommissioned generation) to address the lack of coal and gas power supply.

Problem: It is challenging for project developers to quickly understand which locations in the grid can support a new power generation project. There are long wait times in ISO queues and upfront costs at the start of the queue process (especially in PJM) which places an even greater emphasis on finding the optimal location for a power generation project.

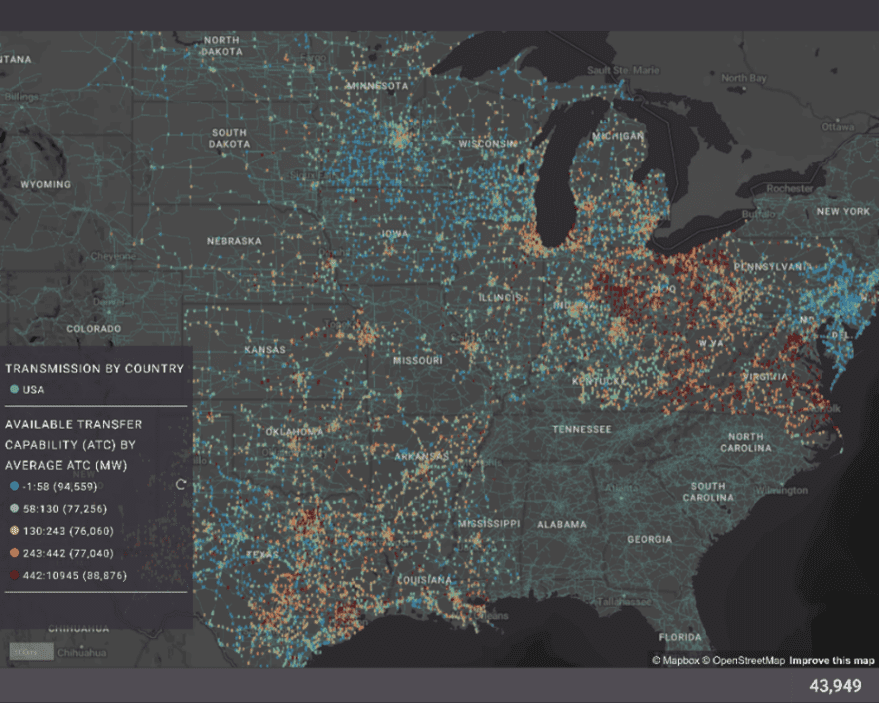

Solution: PRISM’s ATC feature displays the injectable capacity (measured in megawatts) that the grid can handle at a particular point of interconnection (POI). The Congestion Analytics add-on in PRISM, which includes ATC, can help developers earlier on in their project siting process to find points of interconnection with the capacity to support their project, reducing risks later. PRISM displays ATC at the bus level which can then be rolled up to their related substations. Data aggregations include minimum, maximum and average ATC values.

Visualizing ATC in PRISM

Locational Marginal Pricing

To begin the process of finding an optimal project POI, PRISM users can start by looking at the LMP dataset and targeting the PJM zones that have high average pricing, which include Baltimore Gas & Electric (BGE), Southern Maryland Electric Cooperative (SMECO), Delmarva Power & Light (DPL), Dayton Power & Light (DPL), AEP, etc (see Figure 4).

Next, filter the ATC dataset to substations with an average ATC of 5,000 in order to only display substations with many megawatts available for injection. Refine the ATC dataset further by filtering to only high-ATC substations that are owned by a company associated with high LMP pricing (10 highest-priced PJM zones in Figure 4).

Planned Transmission Lines

Next, overlay the high-ATC substations (blue dots in Figure 5) with planned transmission lines (pink lines in Figure 5) to get a high-level understanding for which regions within the PJM territory are scheduled to have net-new transmission lines in the future. This can help identify a region that has network upgrades already planned and further pinpoint an area that is optimal for a new generation project. While there are high-ATC substations across the PJM territory, many of the PJM planned transmission lines are in the Ohio region, which can be leveraged in the search for an optimal POI.

with high ATC values along with planned transmission lines.

Land Parcels – Daily global horizontal irradiance (GHI) (kWh/m2)

To assess locations for future solar projects, seek out high-ATC substations that are in areas with high GHI values (areas shaded dark and light red in Figure 6).

One example (Figure 7):

- Don Marquis Substation (765 KV)

- Pike County, Ohio

- Average ATC: 4,388 MW

- Daily GHI: 4.04 kWh/m2

Land Parcels – Average wind speed at 100m (m/s)

Overlay windspeed with high-ATC substations to see locations with average wind speed that is greater than 7.36 m/s (shaded light red in Figure 8). One example (Figure 9):

- Hanna Substation (345 KV)

- Portage County, Ohio

- Average ATC (MW) for the 4 busbars: 4,835 MW

- Average Wind Speed: 7.5 m/s

These two substations boast high ATC values and could be possible starting points for a new project depending on the type of project, the land available and the buildability of that land around those substations. PRISM has a variety of tools to pinpoint this specific land location further- Parcels, Exclusion Layers, Customizable Buildable Acreage and more.

Decommissioned Power Plants

High-ATC substations that overlap with retiring coal and natural gas generation offer a unique opportunity to potentially expedite the PJM queue process (2023 PJM State of the Market). Overlapping high-ATC substations (blue dots in Figure 10) with coal/natural gas plants (orange dots in Figure 10) that are set to be decommissioned soon, results in two notable examples:

- Miami Fort has a decommissioning date of 2027 and its collector substation (Miami Fort substation) on the project site has an average ATC of 4,378 MW

- 558 MW coal plant in Hamilton County, Ohio and owned by Luminant

- Big Sandy has a decommissioning date of 2030 and a nearby substation called Baker (Riverside) that has an average ATC of 5,664 MW

- 280.50 MW natural gas plant in Lawrence County, KY owned by Kentucky Power

The retirement of such plants presents a significant opportunity to replace deactivated generation with renewable sources like solar or wind. This transition can potentially qualify the project for an expedited queue process in PJM. If the right land parcels near Miami Fort exist, it could be ideal for such a renewable energy project. This site could leverage the existing high-ATC substation, aligning with PJM’s requirements and expediting the approval process. By identifying and utilizing these opportunities, developers can navigate the regulatory landscape more efficiently and contribute to the transition toward sustainable energy.

Customizable Buildable Acreage

Once an opportunity has been identified, like Fort Miami, further land analysis can be done. Analyzing 1,000 land parcels surrounding the Miami Fort project/substation results in more than 3,000 acres that are suitable for project development. Thousands of acres are needed for a planned renewable energy project to adequately replace the decommissioned generation.With Customizable Buildable Acreage (CBA), users can adjust the parameters to suit specific conditions. The average daily GHI for these parcels (4.10 kWh/m2) indicates that this area may be suitable for a future solar project. These 1,000 land parcels near the Miami Fort area have an average buildable acreage of 72.06%, which is one possibility for a high-performing solar farm.

roughly 1,000 parcels surrounding the Miami Fort project, which is scheduled to

be decommissioned in 2027.

Conclusion

Developers face significant challenges, including long wait times, grid congestion and high study costs, especially in PJM due to recent policy changes. Historically, obtaining available capacity information required expensive system impact studies, creating a barrier for many developers. However, PRISM’s ATC feature revolutionizes this process by providing accessible and timely data, significantly reducing the time it takes for developers to gain this crucial information to support their development efforts that contribute to a more stable, sustainable grid.

By leveraging PRISM, developers can efficiently identify optimal POIs for their projects, assess the potential impact of retiring traditional plants, and strategically plan for future generation projects. This feature helps developers with project development and enhances the understanding of congestion patterns within the power grid. PRISM empowers developers to navigate the complexities of the energy market more effectively, fostering the transition towards a more sustainable and resilient energy infrastructure.

Interested in learning more about grid connections and identifying optimal points of interconnection? Check out our solution’s page for more information.