With $28 billion in clean fuels M&A since 2021, the sector has outpaced all other carbon innovation categories combined. However, the industry sits at a crossroad as an increasing supply of low-carbon fuels exerts downward pressure on U.S. credit prices, fundamentally reshaping market dynamics. In our inaugural Clean Fuels Fundamentals, Enverus Intelligence® Research (EIR) examined how industry participants can adapt to these shifts, building more resilient business models to sustain long-term value creation amid evolving market forces.

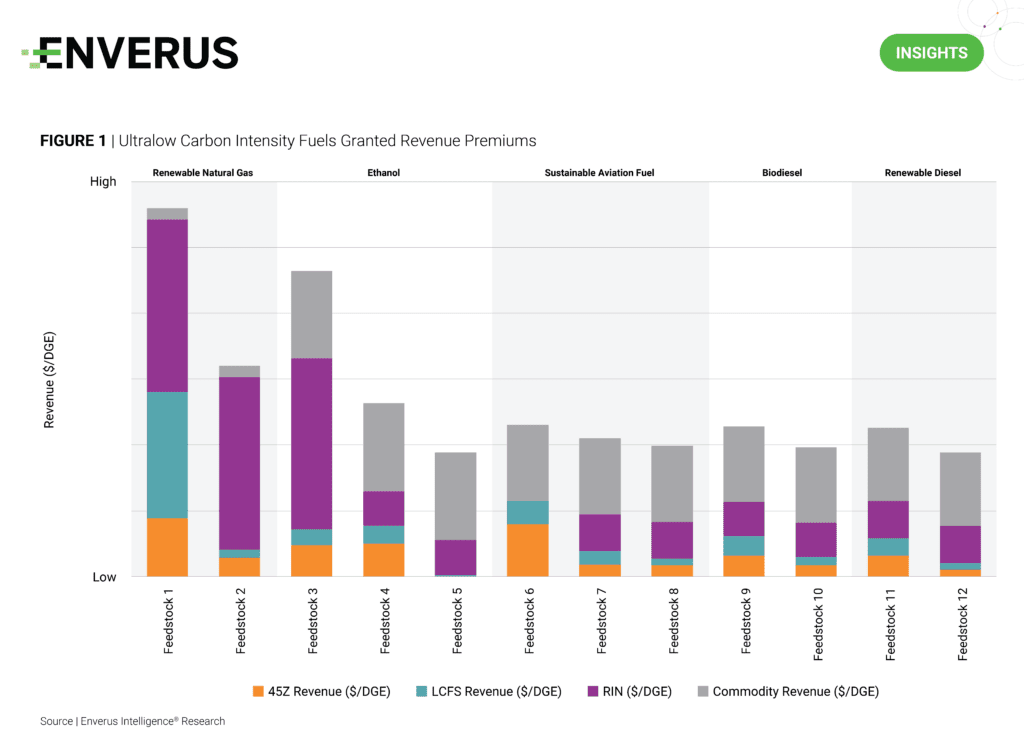

Figure 1 highlights various fuel types and their production pathways to triangulate corresponding revenue impacts. Utilizing low-carbon intensity (CI) feedstocks such as animal waste can significantly enhance revenue streams from 45Z and Low Carbon Fuel Standard credits, as these incentives are directly tied to CI scores. We also analyzed emerging trends in M&A activity, benchmarking transaction valuations against EIR’s bottom-up assessments to provide deeper insights into market pricing and strategic positioning.

Other key findings include:

- Renewable natural gas (RNG) dominated North American transactions, comprising half of all deals and commanding valuation multiples more than five times higher than biodiesel, renewable diesel (RD) and ethanol.

- Technology stacking has become a critical lever, allowing developers to layer credit mechanisms and boost revenues by up to 15 times baseline market prices.

- When used as a feedstock for blue hydrogen, landfill RNG delivers an 86% net incremental uplift to RD returns – implying that fully committing this fuel would require 144% of projected 2030 landfill gas volumes to meet RD demand.

- Clean Fuels – Strategies for a Resilient Future – The clean fuels industry is at a critical juncture. An influx of low-carbon fuels has put downward pressure on U.S. credit prices, reshaping the economic landscape of the sector. This presentation explores how stakeholders can navigate these dynamics and develop more resilient business models to create sustainable value in the face of changing market conditions.

- The Trump Effect – Power & Renewables Outlook – As the Donald Trump Administration advances its energy agenda, the power and renewables sector faces shifting trade policies, executive orders and varying levels of federal support for renewable energy. The declaration of an energy emergency, pause on offshore wind projects and promises to “drill, baby, drill” will reshape domestic and global markets. This presentation examines recent market changes and White House announcements affecting power generation and investment, including new tariffs, canceled DOE disbursements and halted offshore wind leasing.

- Class VI Update 4Q24 – The Wave Is Coming – In this new quarterly report series, Enverus Intelligence® Research provides an overview of recent changes and additions to the growing list of Class VI wells associated with CCS project in the U.S. Leveraging the Enverus FOUNDATIONS® – Carbon Innovation Wells database, this report series covers new Class VI applications, changes to permit status, permit approvals and newly disclosed project details. In this inaugural report, we cover updates in 4Q24 as well as highlights from 2024.

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.