Enverus Intelligence® Research (EIR) has updated its long-term load forecast model, predicting a 30% increase in total U.S. power demand by 2050, down from the previous projection of 39%. This revision incorporates factors such as reshoring manufacturing and updates to data center and residential solar outlooks.

The increased adoption of behind-the-meter residential solar and storage is expected to reduce the average daily variability in load while also delaying peak load later into the evening as we approach 2050. The reshoring trend to grow domestic manufacturing capacity is projected to contribute less than 3% to average load growth by 2050. EIR is more bullish in our short-term outlook for data centers, as we forecast a total average load increase of 41 GW through 2035, compared to 27 GW in our previous estimate.

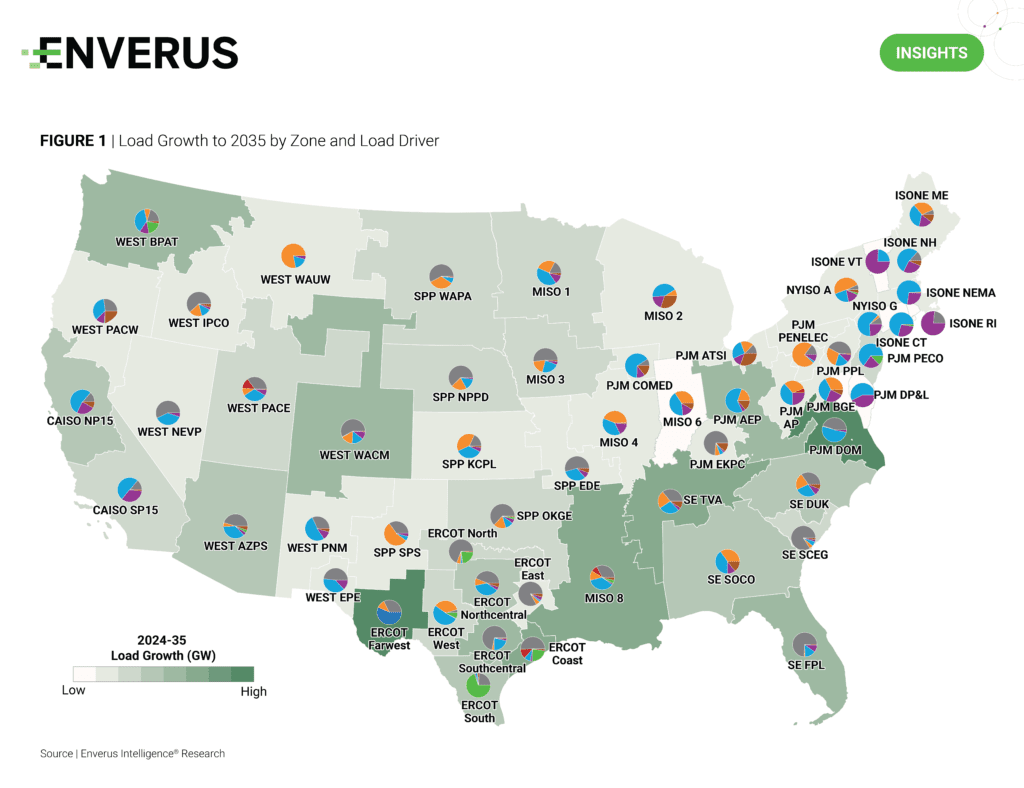

ERCOT Far West and PJM Dominion zones are expected to experience the highest increase in load growth through 2035, driven by oil field electrification and data center expansion, respectively. Baseload growth in ERCOT is particularly noteworthy, reflecting rapid population growth and a strong industrial base. PJM and SE continue to exhibit the highest average daily load and intraday variability. Data center expansion cryptocurrency mining and electric vehicle adoption are key drivers of increased load across PJM and MISO. Strong EV penetration is observed in CAISO and ISONE.

Research Highlights

- Big Emissions, Bad Rocks – Sequestration Struggles in Data Center Alley : This report evaluates the Tri-State CCS project in West Virginia and its potential to sequester CO2 from nearby emitters. With a growing demand for decarbonization in Appalachia, Enverus Intelligence® Research analyzes the CO2 sequestration options and capacities for current emitters, blue hydrogen projects and data centers.

- Carbon-Led Growth With BECCS – Would You Believe It? – Enverus Intelligence® Research analyzes the economics and regional opportunities for the deployment of bioenergy with carbon capture and storage, highlighting different incentives including the growing role of carbon removal credits.

- OPEC+ Unwinds, Trump Tariffs – Leading to Oil Price Downgrade : We revised our 2025 and 2026 oil price forecasts following OPEC+’s decision to unwind production cuts and American tariffs ramping up.

About Enverus Intelligence® | Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts, and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.