With the recent surge of renewable fuel adoption in California, we have analyzed and updated our long-term price forecast for low carbon fuel standard (LCFS) credits using the latest two quarters of the California Air Resources Board (CARB) data. Our inaugural report in March was able to derive the quarterly credit bank surplus to within 0.41% and 0.87% error respectively for 4Q23 and 1Q24 data. Additionally, we have offered insights into our view on supply and demand fundamentals through the program’s lifetime.

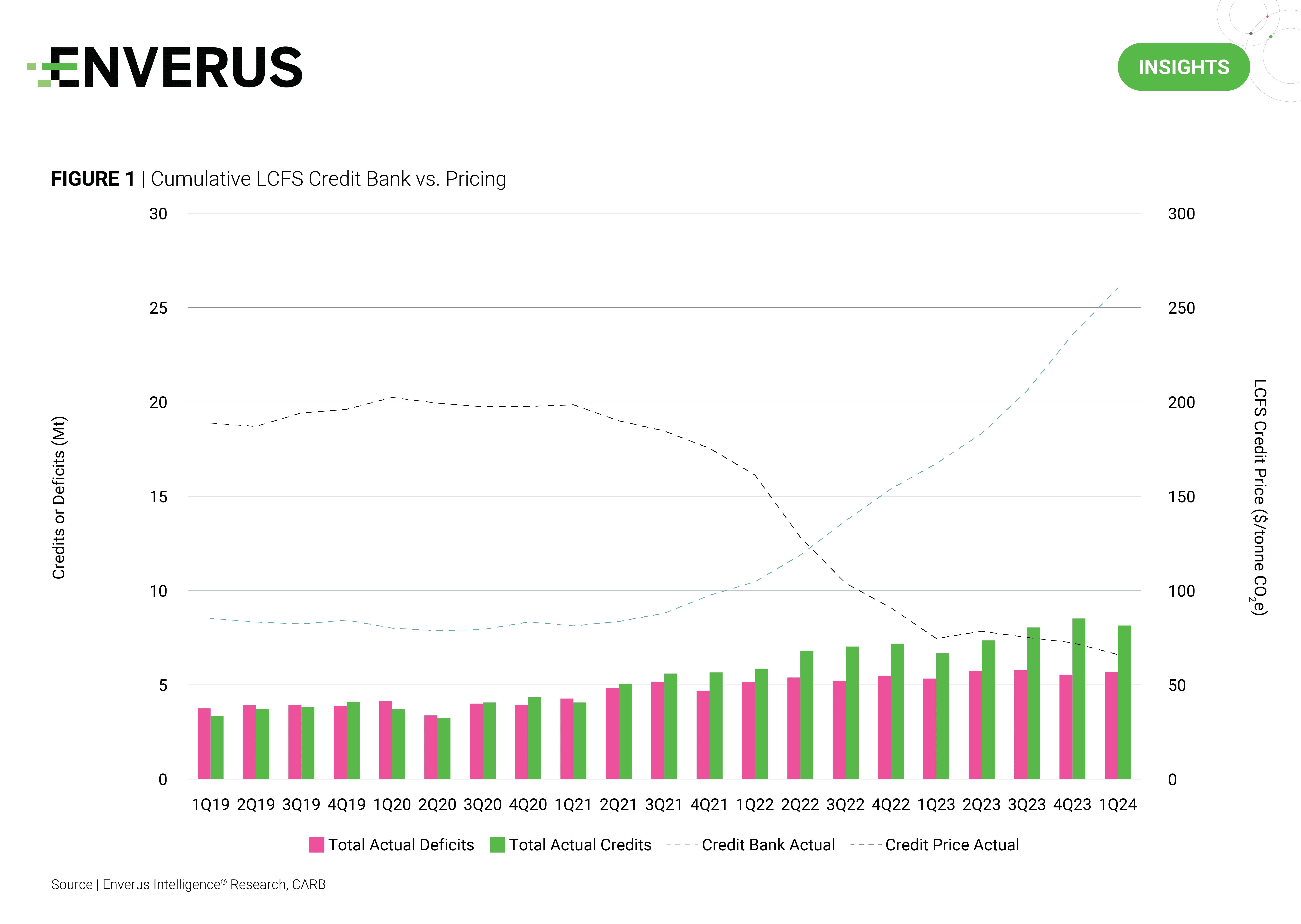

The growing production of renewable diesel and biomethane/renewable natural gas are primarily responsible for the LCFS credit bank surplus and consequently the decline in credit prices from ~$185/tonne in 1Q19 to $51/tonne in 1Q24.

CARB is set to meet Nov. 8 to discuss various amendments to the LCFS program, including a carbon intensity reduction target of 30% rather than 20% with respect to the 2010 baseline. CARB will also discuss replacing the original 5% immediate reduction for 2025 with a more aggressive 9% reduction. Despite these changes, we anticipate continuous growth in the credit surplus, peaking at 41.4 million in 4Q27. The activation of the auto-acceleration mechanism in 2Q27 is expected to decrease the surplus throughout 2029-30, leaving the LCFS market bullishly undersupplied. We predict that a steeper 2025 reduction would more effectively curb the short-term credit bank escalation, rather than deferring action until the AAM takes effect in 2028-29.

Highlights:

- LCFS Price Forecast – Credit Bank Rises Like Half Dome – We refresh our long-term price forecast for California’s LCFS credits, assess how our model has trended against two quarters of realized credit bank growth, and provide our view on supply and demand fundamentals through the life of the program.

- Natural Gas-Fired Screening – Benchmarking Prime Development Regions – We build on EIR’s solar, battery storage and onshore wind market analyses to identify top locations for natural gas-fired projects in the U.S. Our screening considers factors like power prices, gas feedstock costs, spark spreads, capacity market prices, changes in the generation mix, load growth, cost of entry via acquisition and carbon prices.

- Long-Term Capacity Expansion – Market Makeover – This report encompasses Enverus Intelligence Research’s capacity expansion model for the Lower 48, based on forecast load, risked interconnection queues and technology cost curves.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. See additional disclosures here.