Long-lead international upstream projects still offer returns that remain competitive with North American oil plays and the fast-growing renewable energy sector despite growing economic, investor and regulatory headwinds. As a result, long-term production declines from the international project slate will continue to be offset by world-class projects such as the Guyana/Suriname developments that offer strong economics and production growth.

International offshore project IRRs have come into question in recent years as major new development projects have thinned. The push for greater portfolio diversification among operators raised the bar for new investments in long-cycle hydrocarbons projects. While it’s impossible to establish with full certainty just how resilient and investable the global oil and gas space is, understanding the returns from long-cycle projects gives a strong steer.

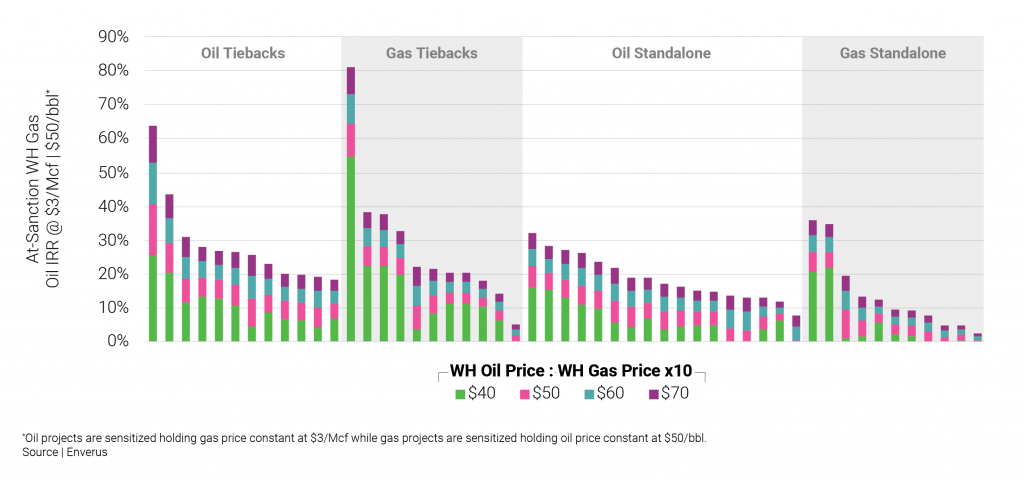

Amid a broad industry expectation that the days of long-cycle oil and gas projects and, by association, international supply are numbered, this is not the case, in our view. Taking into account full-cycle returns, resource scale and asset performance, we assess that hydrocarbon projects in this sector still offer competitive double-digit returns, particularly for oil and gas tiebacks compared to standalone projects (Figure 1).

Renewable energy returns are also relevant to this discussion as international oil companies allocate increased capital to onshore and offshore wind projects. When compared side-by-side in a $50 Brent world, international hydrocarbon projects IRRs are competitive with those of offshore and onshore wind projects, supporting our view that offshore oil and gas will retain its place in operators’ portfolios.

Unlike oil and gas projects, renewable investments help companies reduce their emissions profile, offer stable cash flow through power purchase agreements, access to lower cost of capital and boost corporate green credentials. But renewables also face their own headwinds despite strong IRRs: the lack of land availability and distance to population centers often challenge onshore wind projects.

FIGURE 1 | IRR of Supermajor Offshore Project Slate

Let’s get started!

We’ll follow up right away to show you a quick product tour.