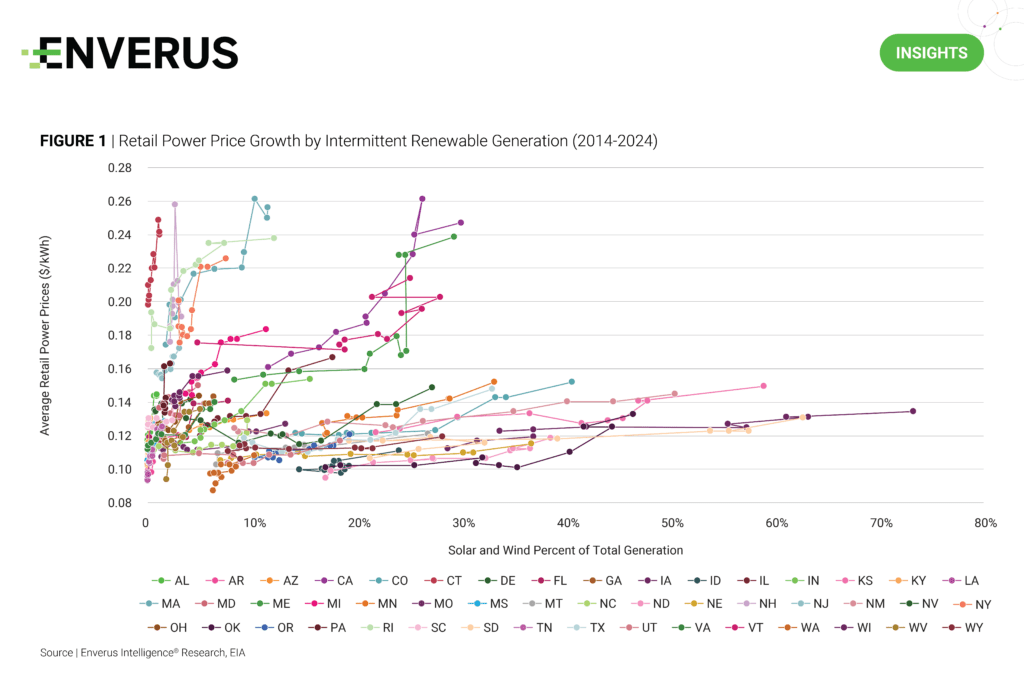

The increasing integration of intermittent generation sources like solar and wind across the U.S. has contributed to rising retail power prices. The variable nature of these renewable energies requires significant investments in grid stability and reliability measures, such as backup generation and energy storage, to ensure a consistent power supply when renewable output fluctuates. The external costs created by new renewable energy projects are paid for by retail consumers and do not impact the project-level economics.

Northeast states exhibit a steady upward slope, while Texas and North Carolina show more gradual increases, with California falling somewhere in between (Figure 1). These trends align with regional patterns in interconnection costs and the challenges faced by states with lower capacity factors. These aspects, along with policy initiatives aimed at rapidly expanding renewable generation, are driving higher retail electricity prices as the grid evolves to manage a more complex and variable energy landscape.

Highlights From Energy Transition Research:

- RE+ 2024 | Impact on Total U.S. Grid: Residential Solar and Storage: Presented at RE+ 2024, this slide deck highlights the latest insights from our updated U.S. Residential Solar and Storage Forecast, as well as the impact on power demand until 2050. By forecasting solar savings and hourly impacts on load, we can assess the key regions that are poised for significant grid offset through behind the meter solar generation.

- Power and ET M&A Review | Load Growth Sparks Demand for Power Deals: This energy transition quarterly M&A review utilizes our Energy Transition M&A platform, which has captured more than 7,000 deals across 100 countries spanning power (generation, distribution, storage and integrated assets) plus alternative fuels, CCUS, equipment manufacturing, electric vehicles and mining of energy transition metals.

- Seeing the Ceiling | Maximizing for Output of Today’s Gas-Fired Grid: This analysis looks at the maximum potential for incremental gas-fired generation from now until 2035, given load growth projections from data centers and other large loads in the U.S. It discloses which gas hubs will see outsized growth opportunities and which gas producers are exposed.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Click here to learn more.