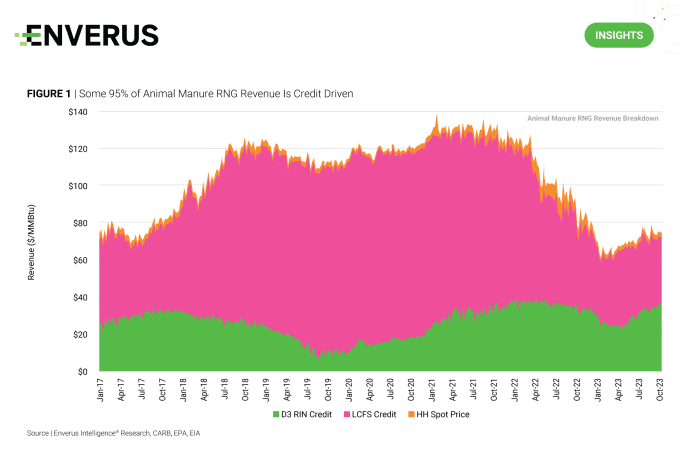

In a world where energy value can make up a small portion of the revenue stream from emerging business models, what else is at play? Enverus Intelligence Research views effective energy transition business practices as taking advantage of two key additive revenue streams. The first is reliability, which is most prominently found today in ancillary services and energy storage markets on the power and renewables side. The second is environmental revenues associated with an underlying energy supply such as a tax credit, a green premium or a voluntary carbon credit. In businesses like the utilization of animal manure, these revenues can be exponentially greater than the value of the underlying molecule. D3 RIN credits and LCFS credits drive ~95% of the value of methane captured from manure (Figure 1).

Other revenue models like those associated with direct air capture benefit from observed voluntary credit market prices of greater than $1,000/tonne of CO2 removed. Winners in the energy transition will be the organizations that can creatively capture revenue from two or even all three of these key sources, ideally on top of strong underlying energy business models.

Highlights from Research (Client Access Only)

- Hydrogen Fundamentals – Hype Meets Reality – Mounting hype for hydrogen technology has yet to translate to meaningful commercial liftoff. In this report, we apply a robust investment framework to identify defensible business models and projects across the hydrogen production space.

- Geothermal Anywhere – Prioritizing Non-Conventional Project Locations – New drilling technologies are enabling geothermal projects to be sited outside of traditional areas in the Western U.S., expanding the market for this renewable energy source. This report provides an overview of key drivers of project economics and identifies which locations might be optimal for future expansion.

- U.S. Emissions Stocktake – Methane Mitigation Drives Decline – This report serves as an U.S. emissions stocktake for the oil and gas sector, evaluating industry progress based on the latest EPA-reported data. We analyze trends in the upstream and gathering sectors from 2020 to 2022, highlighting where operator efforts are paying off and which sources are harder to mitigate.