The pace of electric vehicle (EV) sales growth has slowed down based on the most recent North American EV sales data. Tesla, which owns more than 50% of U.S. EV market share, saw lower profit margins in 2023 because of meaningful price cuts to the Model 3 and Model Y. The broader slowdown can be attributed to many factors like the lack of charging infrastructure, higher interest rates and market saturation among enthusiasts.

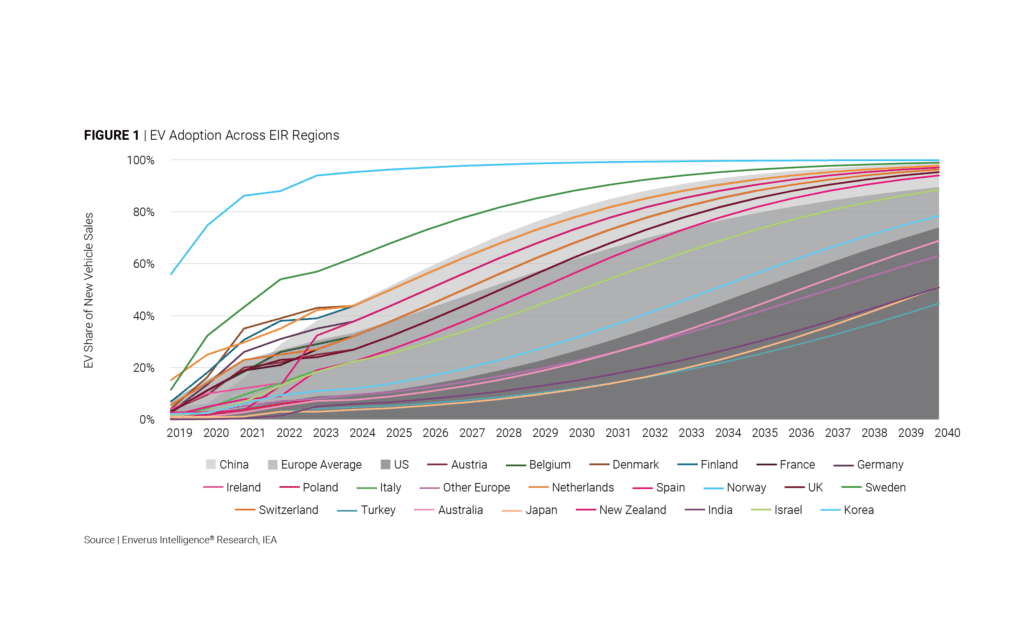

Does this mean EV hype has run out of gas? Unlikely. Although the EV adoption rate has slowed in the near term, the inevitability of price and range parity will supercharge EV sales near the end of the decade. EPA regulation to reduce tailpipe emissions would create further tailwinds for the increase of EV share in new car sales; we forecast this could increase from 9% in 2023 to 50% by 2035. Any meaningful progression in full-self-driving or vehicle autonomy would positively impact our adoption view.

Highlights from Energy Transition Research

Cummins | Big Engines for Bigger Data – We take a dive into the growth prospects for Cummins’ data center-adjacent business lines, which we believe is supportive for the equity.

Data Center Demand | Load Impact Imminent – This publication offers a Lower 48-level view on expected growth in data center capacity and associated power demand.

Tracking the ET Market | Improving Multiples in a Lower Cost of Capital Environment – The 4Q23 edition of the Energy Transition Research team’s equity tracking report provides coverage across various energy transition sectors as well as integrated traditional energy businesses.