Renewable integration has experienced a remarkable surge in Texas, with the installation of more than 9 GW of renewable capacity in 2023 alone. This additional renewable capacity has led to increased price volatility, which is advantageous for energy storage assets. As a result, there has been a significant increase in energy storage capacity with 2.7 GW of new installations. The profitability of assets within the energy storage fleet can be attributed to three key factors: battery size, operating strategy and location.

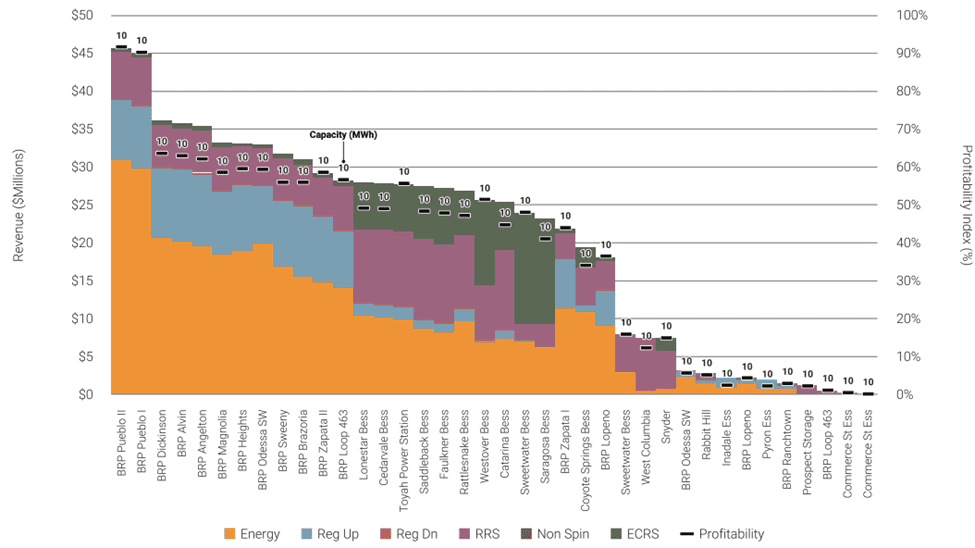

Enverus Intelligence Research (EIR) defines the profitability index as the total annual revenue divided by our estimate of the total capital cost of each asset for batteries operating throughout the entire year of 2023. Contrary to what one might expect, battery size does not play as pivotal a role in profitability as other factors. This is evident from the wide range of profitability observed among 10 MWh batteries (Figure 1). Energy arbitrage and regulation up were the dominant operating strategies for the top-performing assets. Profitability generally decreased with more capacity dedicated to Responsive Reserve Service and ERCOT Contingency Reserve Service, and with fewer services that the asset provides. EIR anticipates that the continued integration of renewables will lead to increased price volatility, which in turn will strengthen the business case for energy storage assets that focus on arbitrage opportunities.

Highlights From Energy Transition Research

(You must be an Enverus Intelligence® Research subscriber to access links below)

Electric Vehicles | Building for the Bull Run – EIR has moderated its near-term view on EV adoption, downgrading our call on oil demand reduction.This downward revision to our demand destruction findings, now 0.5 MMbbl/d by 2030 and 2.8 MMbbl/d by 2035. Displacement was also revised downward from 4 MMbbl/d and 14.5 MMbbl/d in 2030 and 2040 to 3.6 MMbbl/d and 13.2 MMbbl/d.

Texas Grid Storage Gold Rush | Keys to Unlocking Profitability – We explore what battery size, operating strategy and location for storage assets in ERCOT are the most profitable.

Geothermal Anywhere | Prioritizing Non-Conventional Project Locations – New drilling technologies are enabling geothermal projects to be sited outside of traditional areas in the Western U.S., expanding the market for this renewable energy source. This report provides an overview of key drivers of project economics and identifies which locations might be optimal for future expansion.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. Click here to learn more.