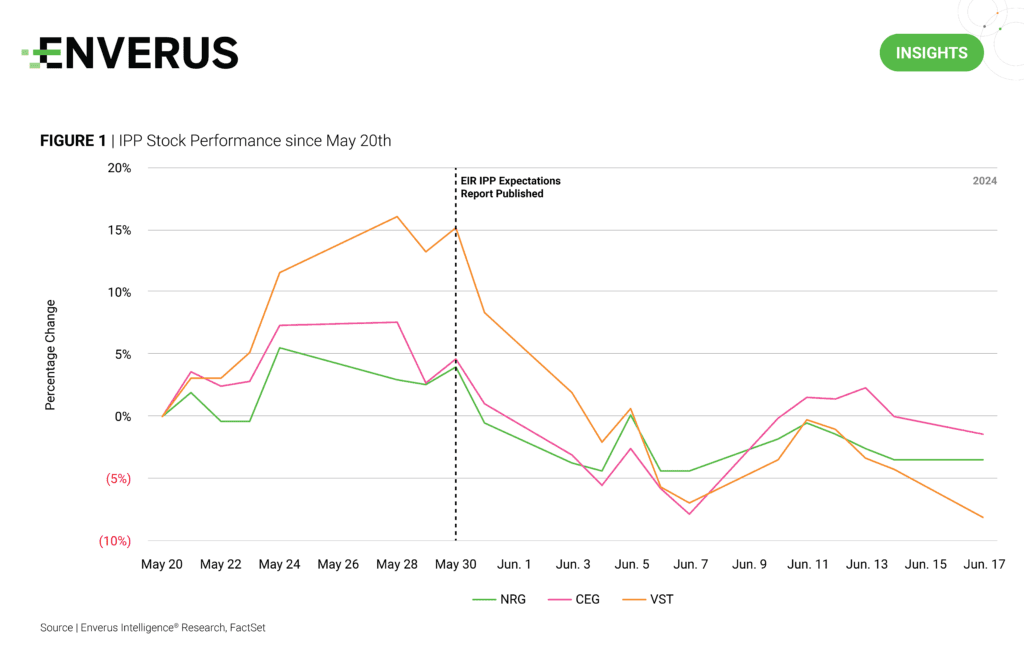

The hype around data center growth and associated power demand is high and wide-ranging. Enverus Intelligence® Research (EIR) has developed a proprietary data center load forecast that has been helping power project developers identify business expansion opportunities, as well as potential equity trades, based on our forecast load growth. Our recent report, AI-Driven IPP Expectations: VST Not the Data Center Darling, identified lower exposure to data center-led growth for VST relative to NRG and CEG, and our expectation for relative underperformance.

Our proprietary data center load forecast, which is highly conservative relative to sell- and gas supply-side viewpoints, enabled the unique analysis. We analyzed each IPP’s portfolio to calculate a load growth-weighted available capacity metric, identifying power plants likely to be called upon more often in the regions with the most growth. To learn more about our data center view, click here or sign up for the weekly newsletter.

Note: The research report discussed is an example of the type of analysis and advice offered by EIR. Results from one report does not represent the entirety of investment outcomes associated with EIR’s research, and results can vary significantly.

Highlights from Energy Transition Research:

- ET Market Tracker – Multiple Rerating for Data Center-Adjacent Power Producers – The 1Q24 edition of the ETR team’s equity tracking report provides coverage across various energy transition sectors, as well as integrated traditional energy businesses.

- Surfing the Green Wave – Hydrogen in Europe – This report delves into the impact of policy frameworks propelling Europe’s clean hydrogen evolution, while scrutinizing the ramifications of potential shortfalls in meeting 2030 green hydrogen targets. We assess the production dynamics and demand drivers of green hydrogen, alongside an evaluation of transmission networks and import strategies, and juxtapose costs to unveil the economic viability of green hydrogen against conventional fuels.

- Battery Storage – Best Practices for Investment, Siting and Development – This presentation ranks the most attractive regions for battery storage developers looking to enter or expand in the U.S. market.