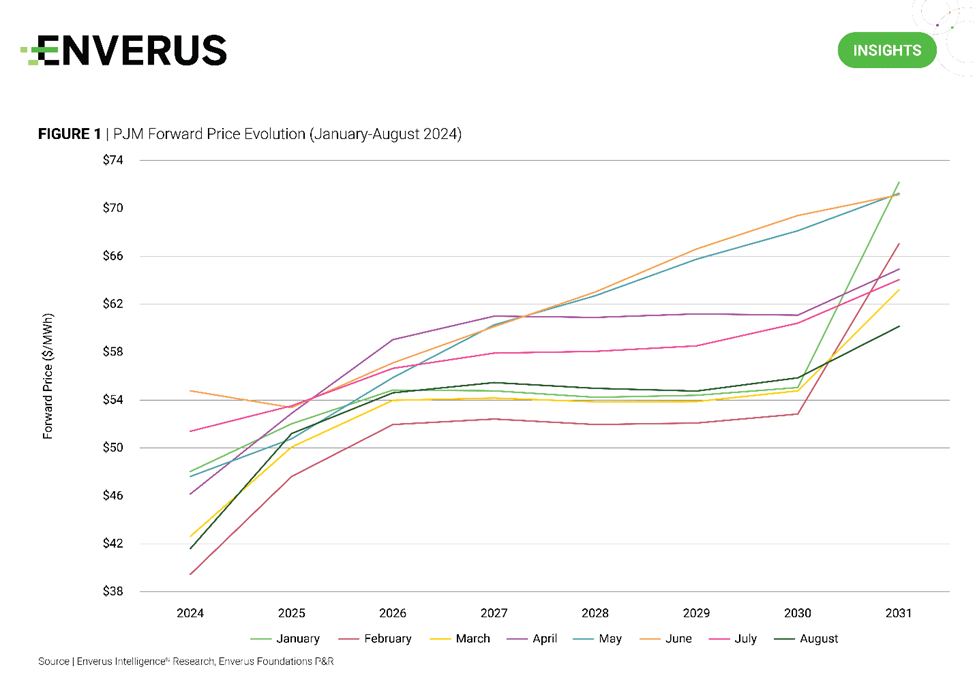

Earlier this year, PJM’s forward price curve saw considerable volatility, primarily driven by increased speculation and optimism around the rapid growth of data centers. In January, prices spiked as market participants anticipated a sharp rise in electricity demand due to the expansion of data centers in Virginia and other parts of the PJM region, fueled by announcements of new projects and the growing shift towards cloud computing and AI.

A significant correction has occurred since then, with prices now lower than those seen in January for the back years. This aligns with Enverus Intelligence Research’s differentiated view on data center load growth, where we find meaningful power demand growth will take much longer to materialize. Our models bake in data center efficiencies through time, as well as an optimal generation mix required to supply the announced projects.

Research Highlights:

- Calpine Generation Portfolio – Sneak Peek Valuation –Calpine Corporation is poised to benefit from rising power prices and demand in its key markets as new large loads like data centers look to connect to the grid. What is the potential market value of Calpine’s power generation portfolio, which is reportedly for sale, and what key factors will impact its valuation?

- Subpart W Revision – Modeling a New Baseline and the Super-Emitter Wild Card – This report analyzes the operator-level impact of the EPA’s finalized Subpart W reporting rule change under multiple scenarios and examines the risk that super-emitter events could add going forward.

- Constellation Emerges as PJM Capacity Winner – PJM’s latest capacity auction results were released this week, showing an average price increase of over 800%. The IPP public equity space is outperforming after this news was released, but we believe CEG is best positioned to benefit from rising capacity prices in PJM because of its relative exposure compared to its peers.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. Click here to learn more.