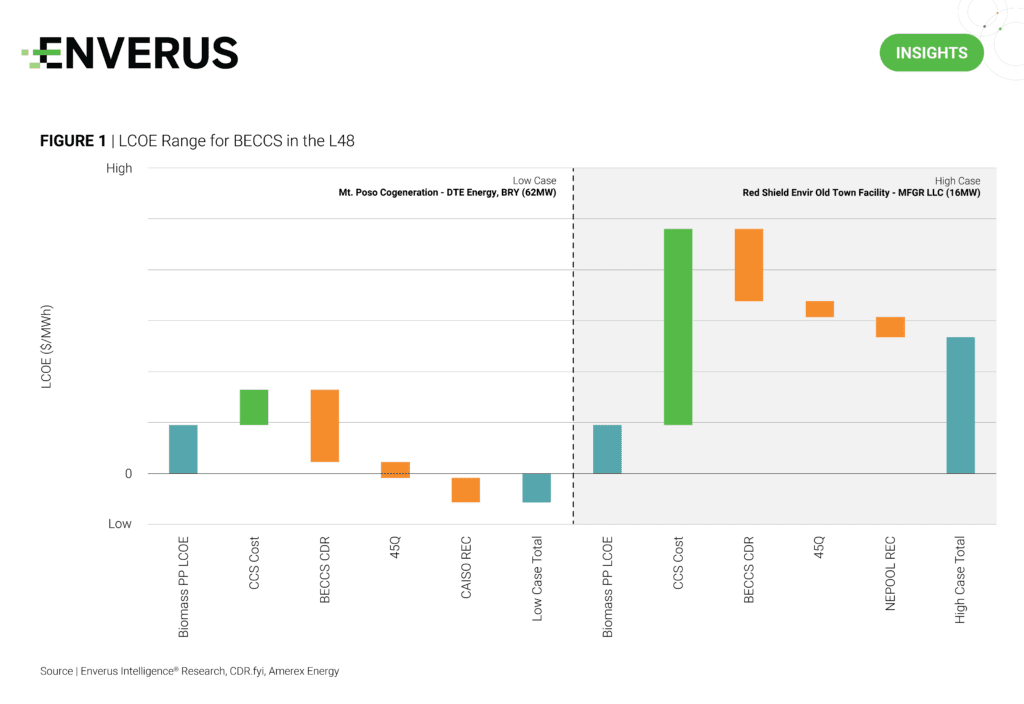

Biomass energy with carbon capture and storage (BECCS) is emerging as a leading pathway for CCUS commercialization. With the ability to stack incentives such as the $85/tonne 45Q tax credit, renewable energy credits (RECs) ranging from $2.08/MWh in the national voluntary market to $48.50/MWh in CAISO, and the $387/tonne carbon dioxide removal (CDR) credit, BECCS can achieve negative levelized costs of electricity (LCOE). At the lower end, LCOEs can reach as low as -$57.82/MWh, driven by high CO₂ capture volumes that benefit from economies of scale, proximity to sequestration sites, and access to premium REC markets depending on the ISO. In contrast, smaller-capacity facilities situated farther from Class VI injection wells can see LCOEs rise substantially, up to ~$267/MWh. This cost disparity indicates the importance of location and scale when considering BECCS opportunities.

The CDR market saw rapid growth last year, with BECCS at the forefront, accounting for 55% of total volumes transacted at an average disclosed price of $387 per tonne. BECCS also stands out as the only carbon removal technology with single transactions surpassing 1 million tonnes, with an average deal size of 535,760 tonnes. This reflects its current advantages in scalability and technological readiness compared to other CDR pathways.

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts, and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.