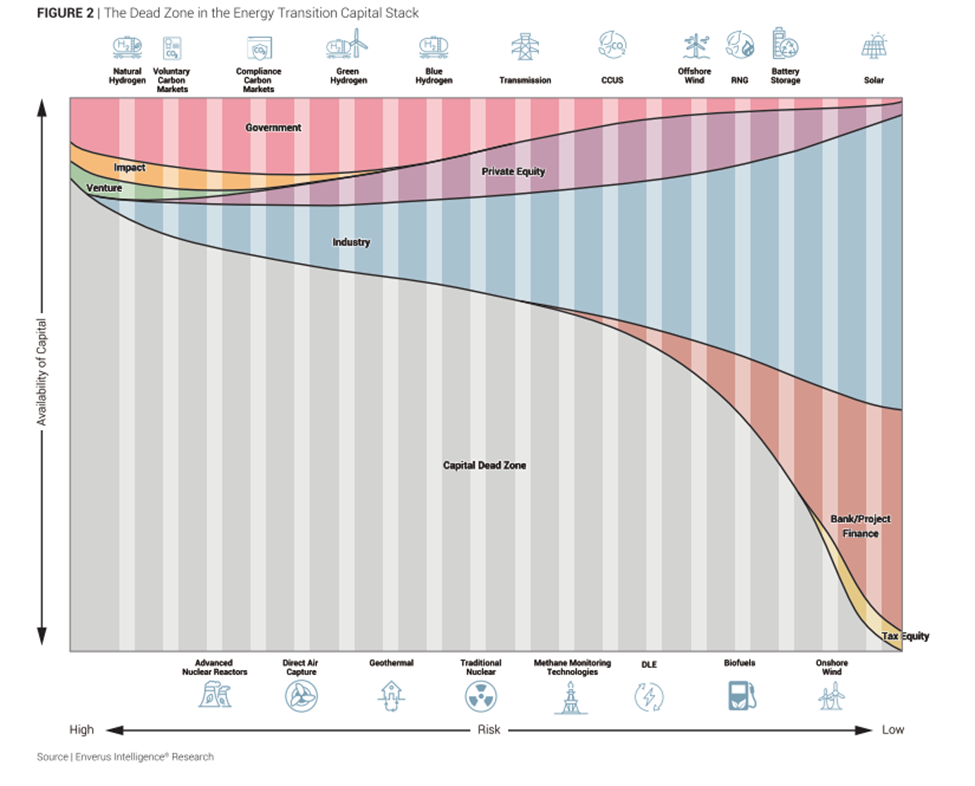

Enverus Intelligence® Research’s (EIR) recent The Ways to Play | Energy Transition Opportunities for Financial Participants report offers an in-depth analysis of the current landscape for financial stakeholders in the energy transition. The report provides strategic guidance for both advising and directly investing in this evolving sector. It delineates the essential investment criteria specific to each type of capital pool and aligns these with appropriate energy transition technologies. The report delves into the primary investment drivers for hedge funds, asset managers, investment banks, private equity, private credit and tax equity investors, aligning them with the most suitable energy transition technologies. This framework helps firms determine where to focus their efforts when considering capital allocation and coverage.

Research Highlights

(You must be an Enverus Intelligence® Research subscriber to access links below.)

- The Ways to Play – Energy Transition Opportunities for Financial Participants – This report continues the framework established in our “The Ways to Play” series. Financial services are the keystone of connecting capital for nascent energy transition technologies; however, the plethora of opportunities is staggering and makes deploying smart capital challenging. Deciphering the risk profiles of these technologies is critical for firms that seek to invest in and advise on the ongoing energy transition.

- Summertime Sizzle –EIR’s update to oil and gas balances through 2030. The team compares and contrasts our oil view to the IEA’s most recent 2024 Oil Market Report.

- Global Energy Transition | Infrastructure Dominates 2Q24 Themes – This presentation, shown at the Enverus EVOLVE 2024 Conference, delves into how emissions are being captured today and the global emissions monitoring landscape. We examine what technologies we believe will enhance emission visibility and how to expect those technologies to be deployed.

Global private equity dry powder soared to a record high $2.6 trillion at the end of 2023. Data assessed by EIR confirms that this amount has risen throughout the first two quarters of the year.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. Click here to learn more.