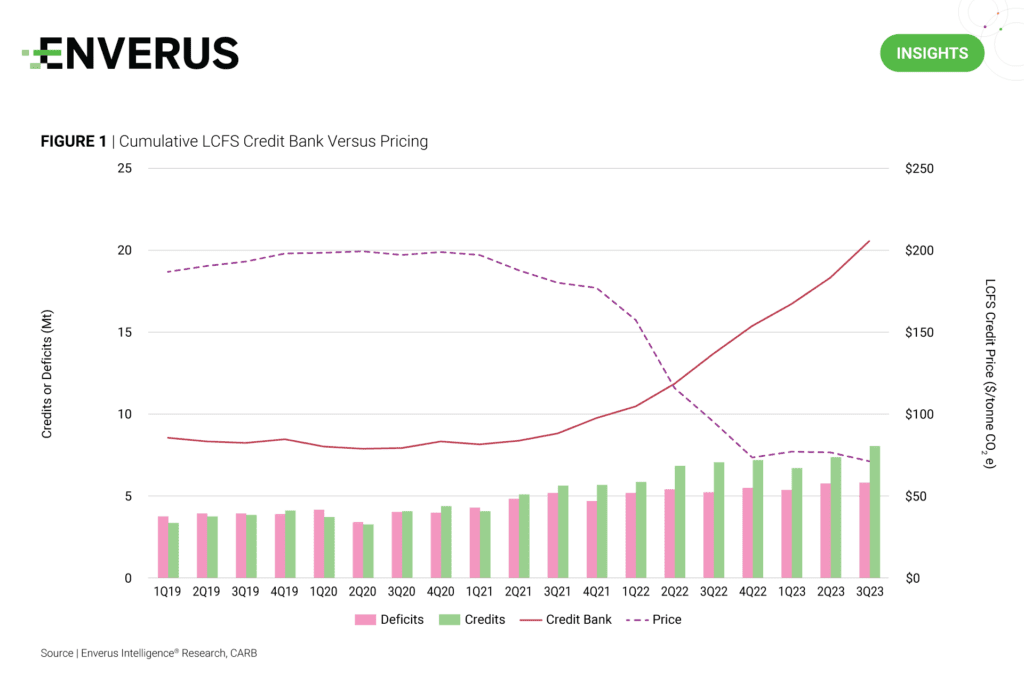

Renewable fuel uptake has surged in California in recent years, contributing to a 141% increase in the California Low Carbon Fuel Standard (LCFS) credit bank surplus and resulting in a drop in credit prices from ~$185/tonne to $75/tonne from 2019 through 2023. A tsunami of renewable diesel (the largest credit-generating fuel type), renewable natural gas/biomethane and electric vehicles have flooded into the state, accounting for 81% of the credits generated in 3Q23. Fuel volumes grew by 233%, 62% and 130% since 1Q19, respectively, while the corresponding credits generated increased by 166%, 674% and 206%. The program might be on the brink of working too well, desensitizing investments in nascent clean fuel technologies and ultimately failing to achieve California’s stated emission reduction targets in the long term.

In our first LCFS Price Forecast, available to Energy Transition Research clients only, Enverus Intelligence Research (EIR) explores the relationship between credit bank volumes and the historical prices of LCFS credits, finding an R2 value of 0.98. EIR’s forecast includes our long-term price curve assumptions for LCFS under the California Air Resource Board’s latest scoping plan, which will be critical to navigating the volatile market dynamics of low-carbon fuels.

Research Highlights

(You must be an Enverus Intelligence® Research subscriber to access links below.)

- Demystifying Data Centers – Energy and Tech Collide – Energy Transition Research’s primer for understanding the data center landscape highlights three of the key considerations when forecasting load from data centers and artificial intelligence, and how we think about those levers.

- Electrifying the Permian – Decarbonize or Destabilize? – This report quantifies the potential electrification of oil and gas assets in the Permian Basin based on operators’ emissions reduction targets and its impact on grid demand, transmission flows and the generation required to serve this growing load.

- Solar Market Screening – Benchmarking Prime Development Regions – What are the most attractive markets for solar developers looking to enter or expand in the U.S. market?

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Click here to learn more.