Late last month, the DOE awarded its first tranches of funding for Phase 1 of the H2Hubs initiative, designed to reduce project planning costs. ARCHES, ARCH2 and PNWH2 received up to $90 million collectively, cutting their Phase 1 costs by 20%.

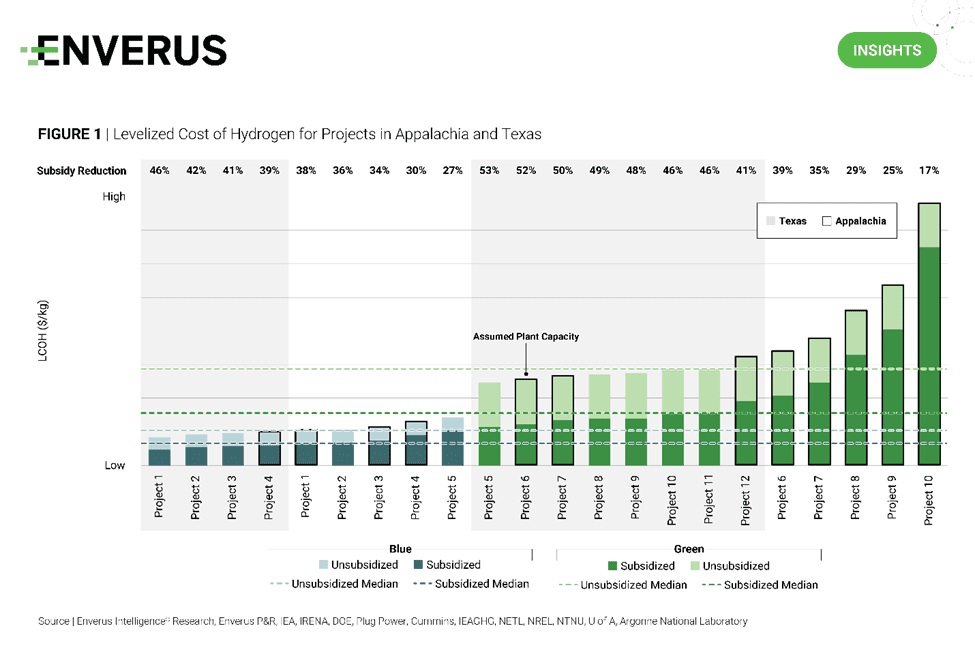

However, the financial viability of some of these hubs remains uncertain. In Enverus Intelligence® Research’s inaugural Hydrogen Fundamentals released earlier this year, we model subsidized costs for green and blue projects in the ARCH2 hub ranging between $4.20/kg and $13/kg, and $1.30/kg and $23/kg respectively. Even after incorporating the 45V and 45Q PTC tax credits, Appalachian projects struggle to compete with gray hydrogen ($1.50/kg) and would require material incremental funding to make a dent in the clean hydrogen market. Rather than investing in Appalachia, funding should be funneled to regions in proximity to abundant, low-cost resources first, such as the Gulf Coast, which offers subsidized green and blue hydrogen in the ranges of $2.30/kg to $3.00/kg, and $0.90 to $1.20/kg respectively.

Research Highlights:

- Subpart W Revision – Modeling a New Baseline and the Super-Emitter Wild Card – This report analyzes the operator-level impact of the EPA’s finalized Subpart W reporting rule change under multiple scenarios and examines the risk that super-emitter events could add going forward.

- Onshore Wind Screening – Benchmarking Prime Development Regions – We build on the Enverus Intelligence Research solar and battery storage market screening analyses to identify top locations for onshore wind projects in the U.S. This market screening considers factors like economic viability, power prices, demand growth, interconnection queues, planned transmission expansion and relative cost of entry via acquisition.

- ERCOT Fundamentals – Lighting the Lone Star – Gain valuable insights into the future of the ERCOT power market with Enverus Intelligence Research’s comprehensive report, covering generation mix projections, load forecasts, power price impacts, market restructuring, interconnection queues, asset benchmarking and project siting analysis.

About Enverus Intelligence® | Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. Click here to learn more.