Following a year of unexpected volatility with oil and gas prices, anticipating what revenue streams will look like in 2023 is top of mind for mineral owners. 2022 started with expectations of a return to a typical, flatter price curve after the economic and demand disruption of COVID-19. However, Russia-Ukraine war and OPEC+ production cuts saw a return to $100 oil and natural gas that doubled its new year start. With barrels from the second largest producer off the market, urgent attention was suddenly focused on Europe’s energy security and a sustainable supply of natural gas.

Despite prices that have settled below their 2022 highs, the outlook for 2023 sees a return to higher oil prices and a bright, long-term future for natural gas. With operators shedding their pandemic-era hedges, leading indicators point to the same conclusion.

Commodity price outlook

U.S. mineral owners are part of a global energy market where geopolitics, regional conflicts and the standard of living in emerging economies all influence commodity prices and the size of revenue checks. The Russia-Ukraine war has brought this into sharp focus, though the impact on energy markets will take time to play out. Contrary to the attention-grabbing headlines, Europe’s energy supply has been preserved with 90% of energy contracts covered through the winter and sanctions on Russian oil exports only taking effect from December 2022 through February 2023.

Primary drivers of higher commodity prices include:

- Russian sanctions on oil and refined products.

- Slow build out of U.S. LNG export facilities influenced by ESG.

- Evolving COVID-19 restrictions in China.

- Potential for a colder winter signaled by once-in-a-generation “arctic invasion” in December.

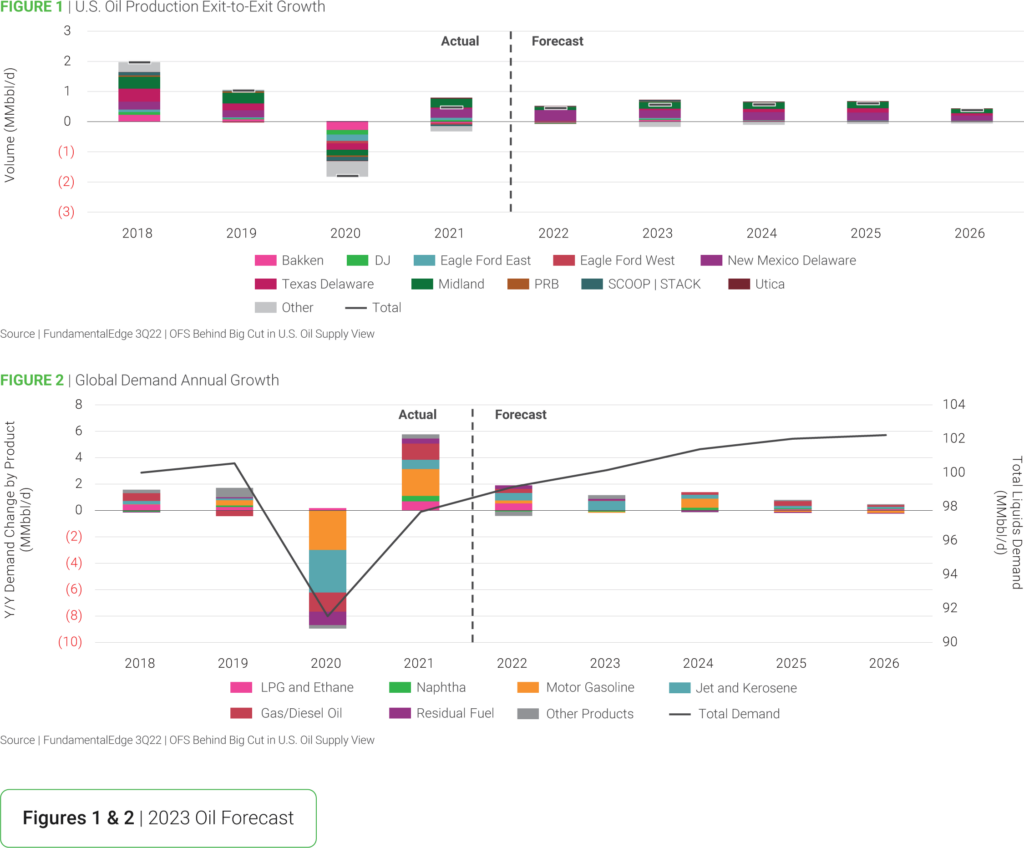

Oil forecast

Look for oil prices between $80 to $120 in 2023, with prices settling around $90 for the year. Check stubs may start to look different though as operators continue to focus on completion of an entire drilling spacing unit on multi-well pads, capital discipline and returning value to shareholders. A low rig count and declining production mean that mineral revenue streams will only get a boost from the anticipated favorable oil pricing.

The downside for 2023 is that declining production could intersect with declining prices and drilling to create a revenue crater for mineral owners. Upside drivers include increasing demand for jet fuel and motor oil driven by business-related travel, India and China remaining open for business, and expanding vehicle purchases.

To make informed decisions and build the right mineral investment and management strategies with trusted insights, download the full version of the 2023 Mineral and Royalty Outlook Report.