Battery storage is becoming increasingly vital for balancing intermittent renewable generation and maintaining grid stability. Its economics are particularly attractive due to rising power prices, increased price volatility from renewables and additional revenue streams from ancillary services and capacity markets.

To navigate these complexities effectively, this guide is designed to provide insights into the various stages of the battery siting process. It offers strategies for establishing initial screening criteria, identifying favorable markets for development, understanding key economic considerations and addressing pricing and grid infrastructure concerns. By equipping developers with this knowledge, we aim to empower them to navigate the battery siting process successfully and contribute to the ongoing evolution of the energy landscape.

Batteries are an essential component in the global energy framework, enabling the integration of renewable sources such as solar and wind into the grid. Batteries play a pivotal role in ensuring grid stability and resilience by effectively balancing supply and demand. Batteries also provide critical backup power during emergencies and aid utilities in managing peak demand by storing surplus energy during off-peak hours. The significance of batteries in our energy landscape has been underscored by the exponential growth witnessed in global installed battery storage capacity over the past decade. According to the International Energy Agency (IEA), this capacity surged from 1 gigawatt (GW) in 2013 to more than 85 GW in 2023. Notably, 40 GW were added in 2023 alone, doubling the amount added in 2022.

The investment in battery energy storage systems (BESS) reached nearly $40 billion in 2023 across three key markets: China, the United States and Europe. This surge in investment correlates with:

Although storage has grown significantly, battery demand continues to escalate. Projections indicate that by 2030, the United States alone will require six times more batteries than are currently available in the grid. Siting a battery project, however, presents some challenges, spanning market, economic and grid infrastructure factors. These challenges include:

Siting BESS projects involves careful consideration of various factors, rather than relying on a one-size-fits-all approach. Developers must weigh multiple considerations to determine the optimal location for a battery storage site. Below are several screening criteria that developers might establish before selecting a project site.

In the early stages of development, developers determine the intended purpose of their battery site. This involves careful consideration to determine what type of service or services the BESS will be used for. Battery projects can maximize their value to the grid by providing multiple system services. There are multiple applications for energy storage and determining which service is best requires a strategic plan that looks at several key factors mentioned throughout the e-book.

As some services are rarely called for or used infrequently, designing a battery site to provide multiple services enables a higher overall battery utilization. Typically, having multiple system services, known as value stacking, can provide the most return for the BESS.

Understanding these services and aligning them with your strategy, market dynamics and other economic considerations is crucial for achieving a return on investment. This decision significantly influences the design, size and operational strategy of the battery storage project. For instance, a project aiming to provide regulation service will prioritize quick response times and frequent cycling, while a project focused on arbitrage opportunities services will emphasize sustained energy delivery and larger capacity.

Optimal battery size, in megawatts (MW), and duration, in hours, depend on the type of services the battery will provide. It’s easy to assume that batteries with higher energy storage capacity would capture higher income, but Enverus Intelligence Research (EIR) found when looking at ERCOT’s 2023 revenue and profitability index, that assets with lower energy storage capacity rank higher in overall profitability standings than those with 200MWh or higher.

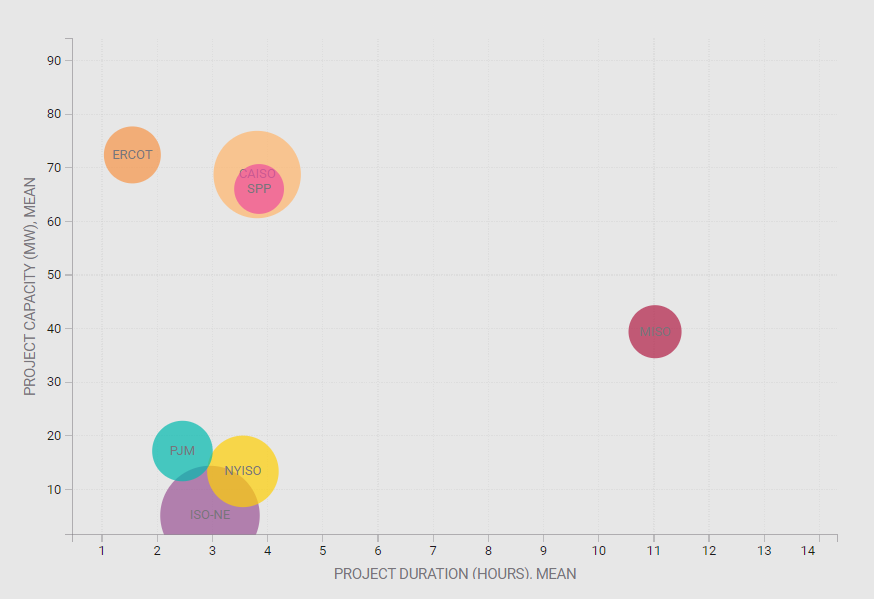

Batteries that provide regulation services tend to be smaller in size and duration, while batteries providing energy tend to have longer durations. As an example, note the average size in PJM and CAISO where batteries mainly offer regulation and energy services respectively.

From a developer’s perspective, the choice between regulation and energy services significantly impacts battery lifespan. Regulation services, with their frequent and rapid charge/discharge cycles, can accelerate battery degradation. To optimize performance and extend battery life, it’s crucial to align the battery type and operational strategy with the intended service. By carefully selecting the appropriate battery technology and tailoring your operational approach, you can maximize both the efficiency and longevity of your battery storage systems, ensuring a higher return on investment and more reliable performance over time.

Developers will assess the current market landscape, identifying regions where energy storage development is actively underway and evaluating the price volatility of the grid. This involves assessing the historical fluctuations in energy prices within the target market or region. By understanding the degree of price volatility, developers can gauge the potential revenue opportunities and risks associated with energy market participation. Sites located in regions with higher price volatility may offer greater revenue potential for battery storage projects, as they can capitalize on opportunities to buy low and sell high in energy markets. However, higher price volatility also introduces increased market uncertainty and risk, which developers must carefully manage through strategic planning and risk mitigation measures.

Understanding the proximity of potential sites to existing electrical infrastructure, such as substations, transmission lines and distribution networks, is crucial in assessing suitable locations for battery projects. Sites with convenient access to the grid can significantly reduce interconnection costs and streamline project development processes.

When paired with a renewable energy plant, batteries can also help mitigate curtailment issues.

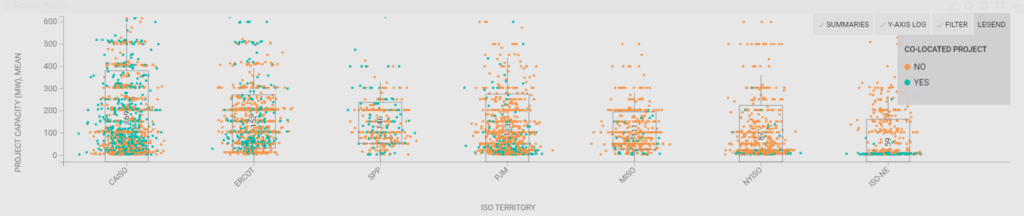

As noted in the graph, in regions like CAISO and ERCOT, more batteries are co-located with renewable energy projects compared to NYISO. This co-location not only enhances the efficiency of renewable energy utilization but also leverages existing infrastructure, further reducing costs and improving project feasibility.

Efficient project optimization requires the right tools and strategies to maximize value and profitability. By leveraging software solutions and optimization techniques, developers can:

Having access to the appropriate tools and insights allows developers to make informed decisions, optimize project configurations and achieve the best possible outcomes for their projects.

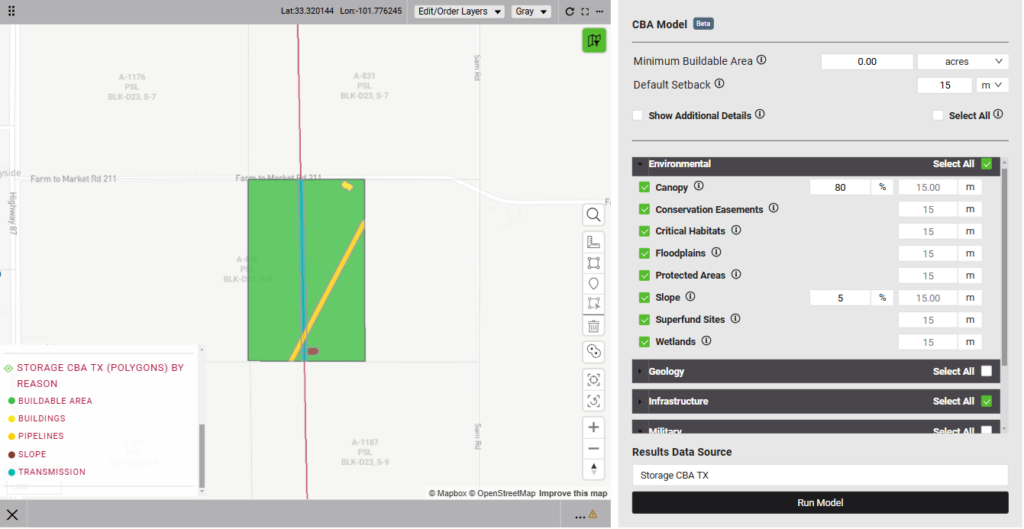

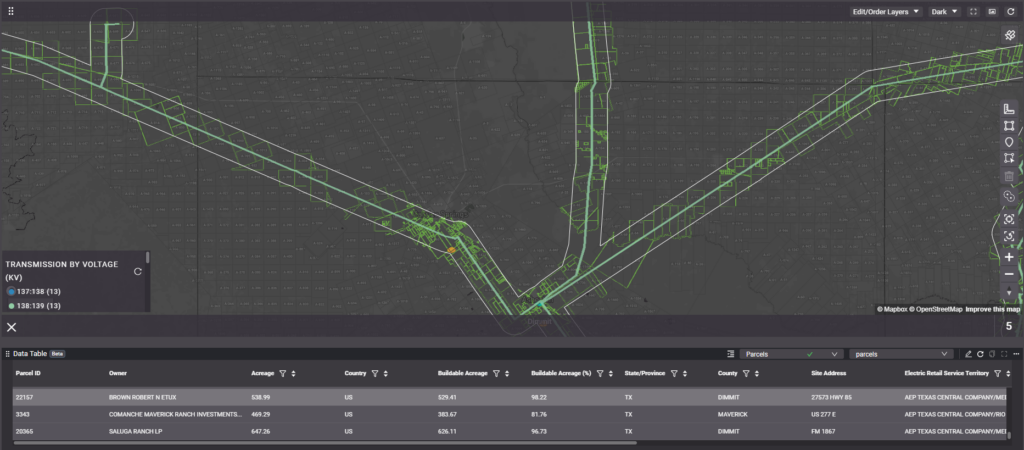

To successfully site a battery project, developers need to consider the availability of suitable land, which can be a complex and challenging process.

This involves assessing factors such as land ownership, terrain and zoning regulations.

Interestingly, energy storage systems can be found in urban, suburban and rural areas alike. However, identifying the rightful owner of the potential site remains a critical step. Developers often need to visit local courthouses to manually retrieve this information or alternatively, partner with tools or services that streamline this process, saving time and effort.

Siting battery storage projects involves considerations beyond just technical and economic factors. Environmental impacts play a crucial role, including habitat disturbance, air and water quality, and noise pollution. Additionally, selecting sites resilient to natural disasters such as flooding is essential for long-term reliability. Regulatory and permitting requirements are also critical, with developers carefully examining economic viability alongside compliance obligations. This entails assessing a range of permits, including those for land use, environmental impacts, zoning and grid interconnection agreements. Preference is given to sites with clear and streamlined regulatory processes to minimize delays and uncertainties in project development.

Once a battery developer has established their screening criteria, outlining important criteria for a successful project, the next crucial step is to identify and focus on favorable markets. Selecting the right market can significantly impact the success and profitability of a battery project, as different regions offer varying regulatory environments, demand profiles and incentive structures.

Choosing the right market for battery siting goes beyond mere geographical considerations. It requires a deep understanding of regulatory frameworks, market dynamics and emerging trends in the energy landscape. By strategically targeting markets that align with their project goals and operational requirements, developers can maximize their chances of success and mitigate potential risks.

An integrated resource plan (IRP) is a comprehensive long-term planning document used by utilities, energy regulators and policymakers to outline strategies for meeting future energy demand while considering factors like reliability, affordability and environmental sustainability.

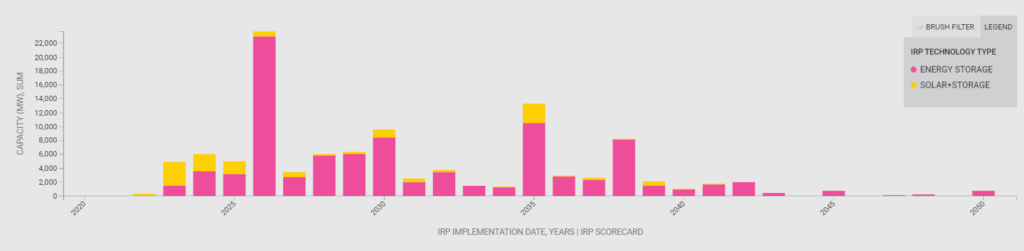

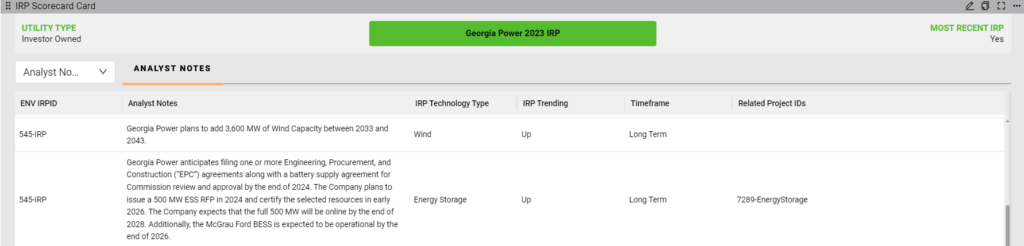

As a developer, it’s crucial to understand which utilities are planning to incorporate storage solutions and the timeline for implementation. Begin by examining the most recent IRPs to understand the projected storage capacity additions and the number of MW utilities intend to incorporate.

Reviewing the most recent IRPs for each utility provides valuable insight into their respective plans for adding storage capacity.

Diving into each utility plan allows developers to gain insight into how future opportunities for energy storage might materialize.

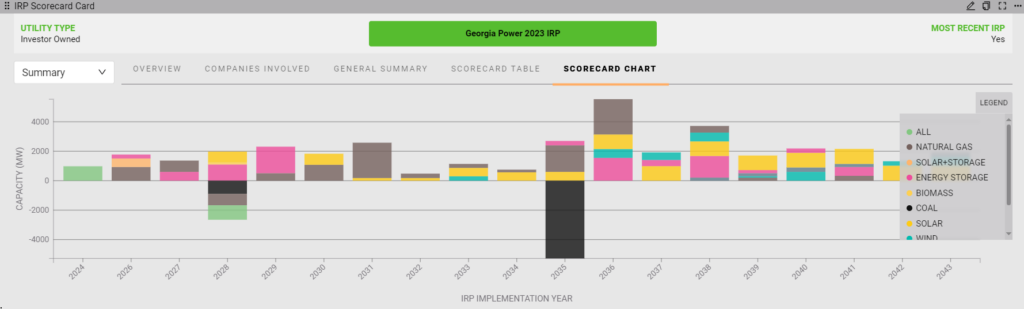

Here, we’re examining Georgia Power’s latest IRP from 2023, highlighting their plans for adding or decommissioning renewable and traditional capacity. Energy storage additions are represented in pink.

Key aspects of an IRP include the purpose of the project, forecasting, resource planning, risk and uncertainty management, stakeholder engagement and regulatory approval. IRPs play a crucial role in guiding long-term decision-making in the energy sector, providing a framework for balancing competing priorities and achieving sustainable energy systems that meet the needs of both current and future generations.

The regulatory landscape can have a profound impact on the economics and feasibility of battery projects. Markets with supportive policies, such as renewable energy mandates, energy storage incentives and streamlined permitting processes, can be more attractive to developers.

By providing answers to these questions, an IRP guides decision-making and planning processes, enabling stakeholders to effectively deploy battery storage projects and optimize their contributions to the energy system.

In many regions, battery developers must navigate interconnection queues, which not only determine the order in which projects are connected to the grid but also the number of projects planned in an area. Understanding the status and dynamics of the interconnection queue is essential for assessing the timeline and feasibility of battery projects in each market.

Battery developers should carefully consider the interconnection queue dynamics, including long durations, low success rates and key factors that influence a project’s probability of completion. Targeting strategic locations and understanding the M&A landscape can also help developers navigate the challenges of the interconnection process.

Queue durations range from 3-6 years on average across different ISO regions. Having information on projects coming online can help developers understand the quantity of projects in a given area and can be a key indicator of potential competition. If a significant number of projects are already planned or underway, it’s likely that competition for resources and favorable pricing may intensify, potentially affecting the profitability of new ventures.

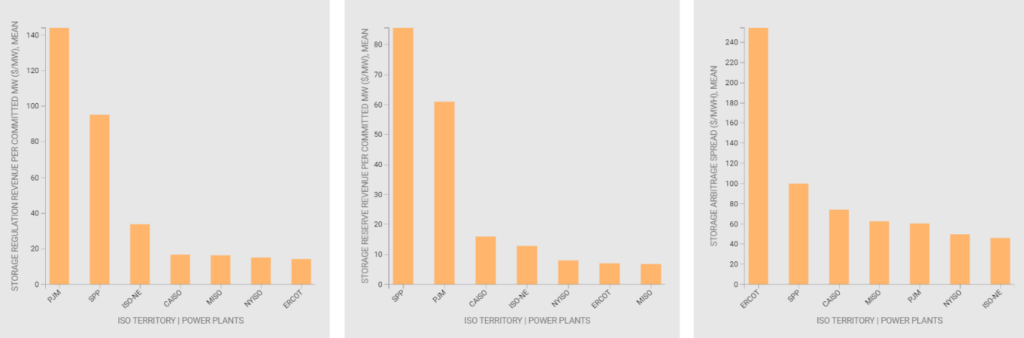

Stacking ancillary services revenues is crucial for evaluating the economic viability and value proposition of battery projects. Other factors to consider with the interconnection queue is the ancillary services pricing within a particular ISO. Additional storage capacity will disrupt ancillary services markets, forcing storage asset owners to change their bidding strategy from a price-taker approach to a price-makers. Battery storage assets can generate revenue through energy arbitrage or by participating in ancillary services and capacity markets. However, according to EIR, the importance of energy arbitrage has grown with the increasing number of batteries entering the market, which in turn reduces ancillary services prices.

As ancillary services markets become saturated with low marginal cost storage assets, EIR expects the clearing prices for these services to decline. Consequently, with lower ancillary services pricing, the expectation is that location will gain importance in achieving high profitability indexes.

Developers must meticulously evaluate the regulatory frameworks, market structures and technical requirements associated with arbitrage and ancillary services to effectively integrate batteries into the energy market and maximize their financial returns.

Different ISO markets have different market structures, pricing mechanisms and regulatory frameworks, all of which can affect the financial performance of a battery project providing regulation services. If a battery operates solely to provide regulation services, the internal rate of return (IRR) and net present value (NPV) of that battery project will vary depending on the ISO market in which it operates.

It’s important to understand the correlation between operating strategies a battery could take and different returns available.

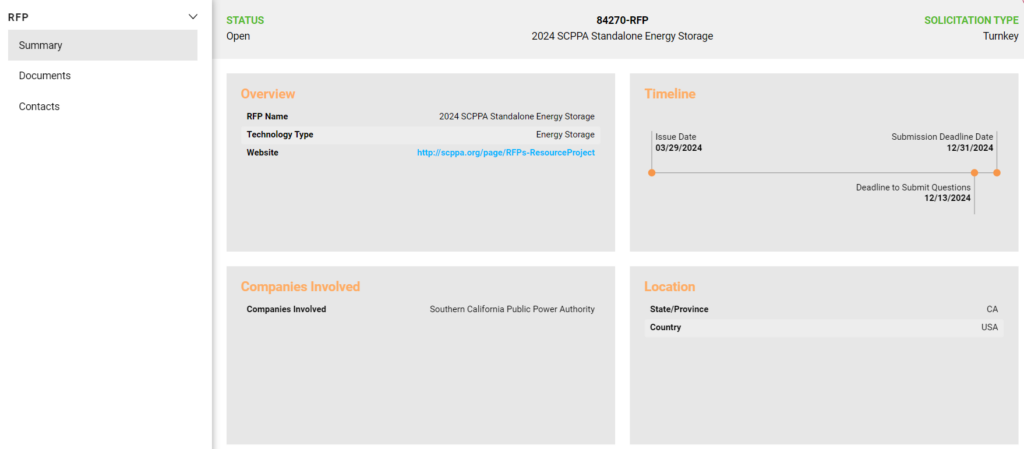

Some markets offer opportunities for battery siting through competitive procurement processes, such as a request for proposals (RFP). These solicitations invite developers to submit proposals for energy storage projects, providing a structured mechanism for project selection and contracting.

The structure of the local electricity market, including wholesale electricity prices, capacity markets and grid services opportunities, can influence the revenue potential for battery projects. Markets with high demand charges, volatile pricing or capacity constraints may present compelling opportunities for battery deployment.

As the penetration of renewable energy sources like solar and wind continues to grow, there is an increasing need for flexible and dispatchable resources to support grid stability. Markets with high levels of renewable energy deployment or ambitious clean energy goals may offer favorable conditions for battery storage projects.

As discussed earlier, a highly effective strategy for optimizing the return on investment in a BESS project is value stacking, which involves leveraging multiple services simultaneously. However, determining which services and strategies to employ at a site can be complex. While a BESS may possess the technical capability to provide multiple services, each additional service may increase the cycling of the battery—charging and discharging—which could potentially degrade its performance and shorten its lifespan, affecting its economic viability and making a thorough understanding of economic considerations crucial.

Comparing battery storage economics entails analyzing numerous factors, including capital costs, operational efficiency, revenue streams, market dynamics and optimization strategies. This comprehensive assessment enables developers to identify operational strategies that offer superior returns. By conducting meticulous economic analyses, developers can make well-informed decisions that maximize the financial performance of battery storage projects.

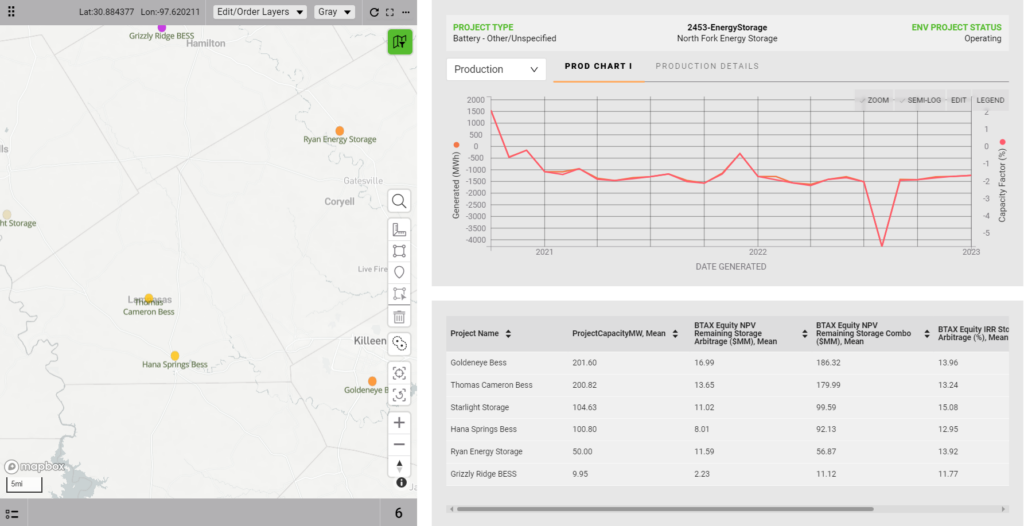

Understanding the production data, IRR and NPV of battery storage projects is essential for assessing their economic viability and potential returns.

Production data provides insights into the expected energy output of the system, allowing developers to estimate revenue generation and operational performance accurately. IRR and NPV serve as key financial metrics for evaluating the profitability of battery storage projects over their lifecycle.

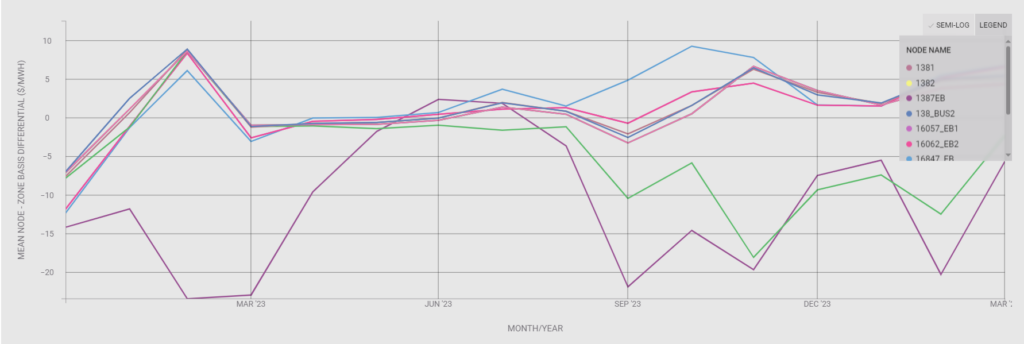

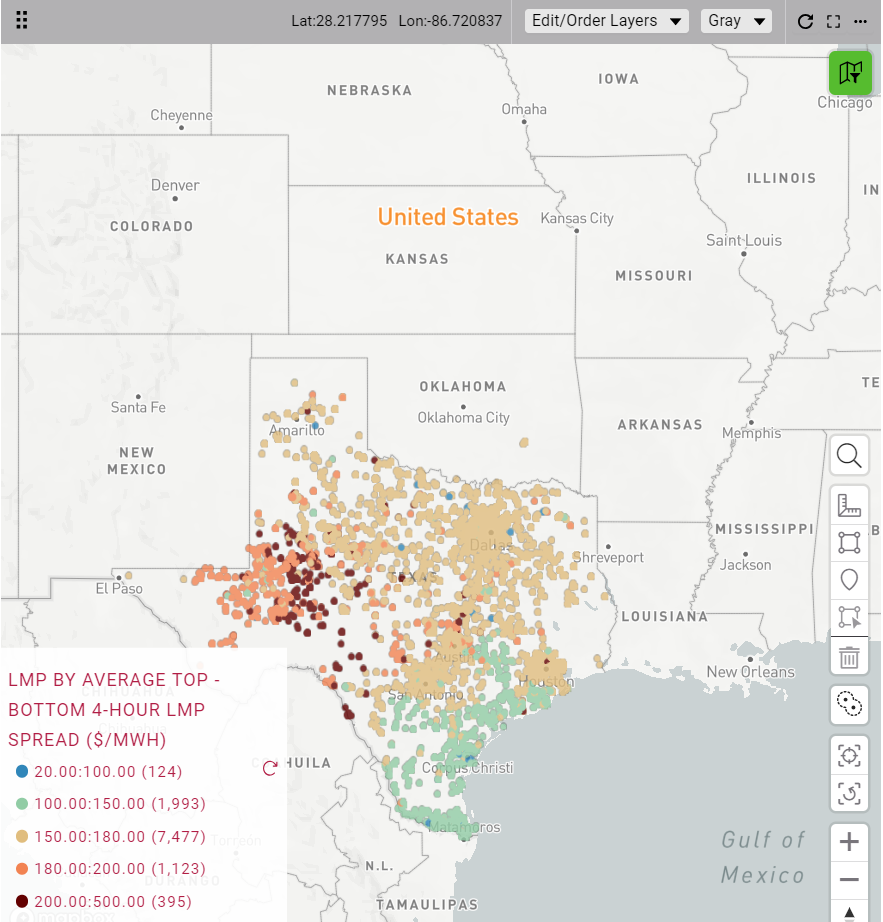

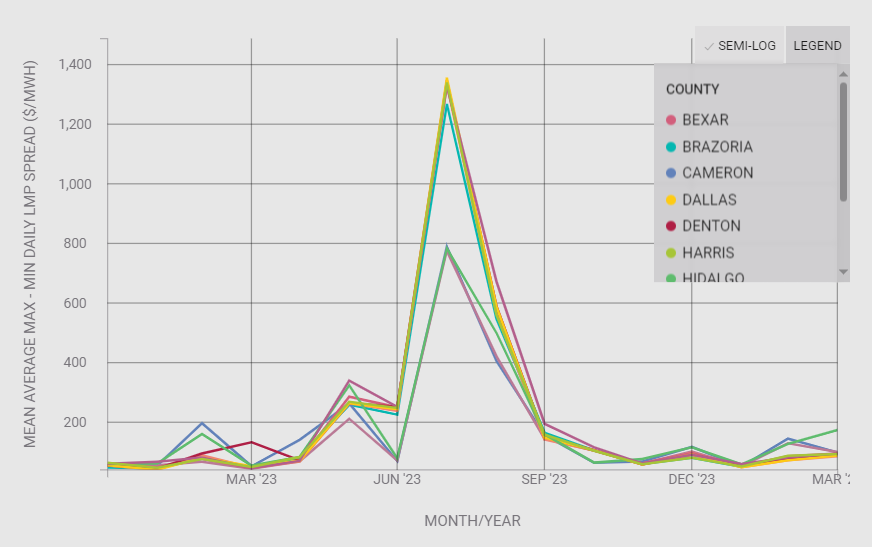

Analyzing the price of power is crucial for optimizing the revenue potential of battery storage projects. By selling or discharging stored energy when prices are high and buying or storing energy when prices are low, batteries can capitalize on market fluctuations to maximize profitability. There are a few factors to look at in terms of pricing. There’s value in monitoring the hourly or daily price spreads to help identify areas or nodes within the grid that exhibit volatile prices.

Understanding the timing and seasonality of these price spreads enables developers to refine the operating strategies of a battery. For example, by analyzing historical data, developers can determine if price spreads occur consistently during specific seasons or times of the day.

Armed with this knowledge, developers can tailor the charging and discharging schedules of the battery to align with periods of peak price differentials, thereby enhancing revenue generation.

Emerging trends in energy markets, such as the increasing penetration of renewable energy sources or the implementation of time-of-use pricing schemes, can significantly impact price dynamics. By staying ahead of pricing, developers can adapt their operating strategies accordingly and position their battery storage projects for long-term success in a dynamic energy landscape.

The availability and adequacy of grid infrastructure, as well as the ease of interconnecting battery systems to the grid, are critical considerations for project development. Access to robust transmission and distribution networks, along with efficient interconnection processes, can streamline project deployment and minimize costs.

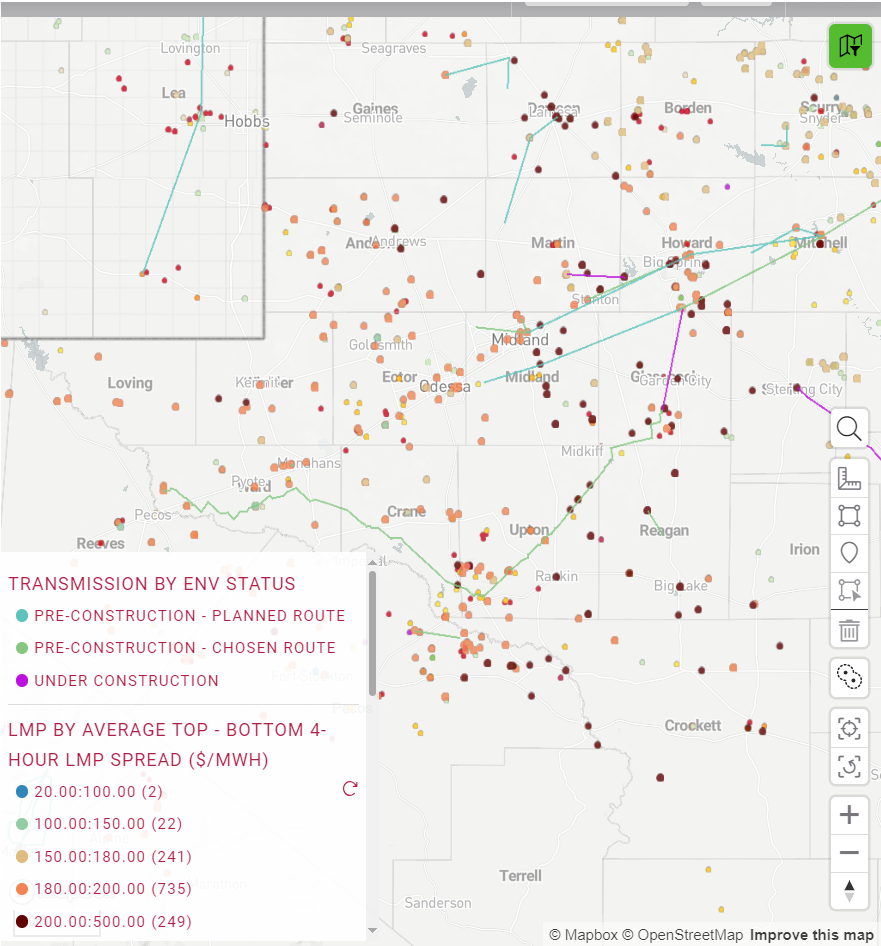

Another infrastructure consideration is monitoring the deployment of planned transmission lines because while they can alleviate congestion, they may also pose risks to the economics of battery projects. If a battery’s financial model relies on capitalizing on volatility induced by congestion, the introduction of new transmission capacity could undermine this model. This is particularly relevant for nodes located near future transmission lines, as their pricing dynamics are likely to be affected.

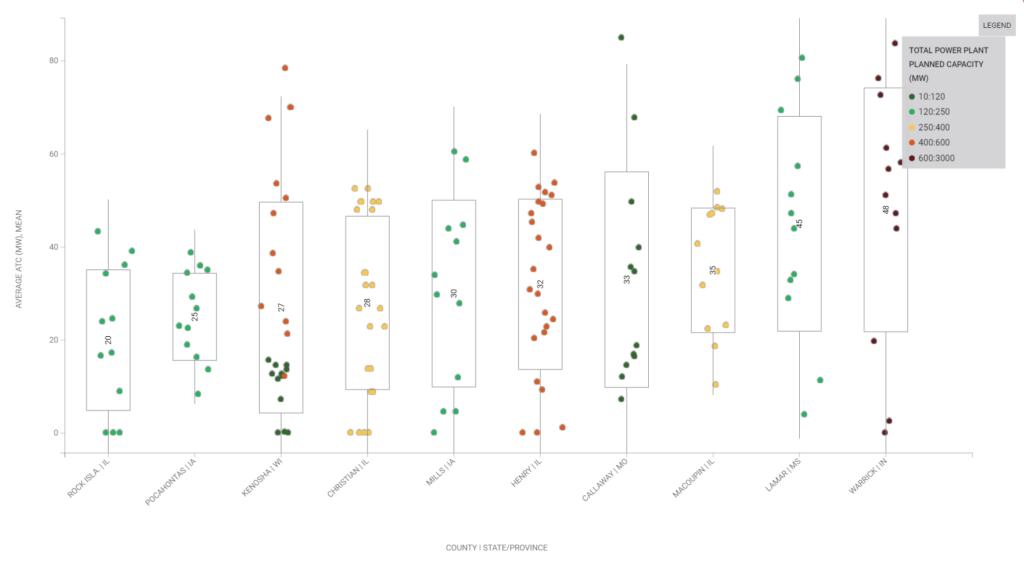

In the quest to optimize grid operations and enhance grid reliability, developers are increasingly exploring innovative solutions to address congestion challenges within the electricity transmission network. One such solution involves strategically siting battery storage projects in areas with the lowest available transfer capability (ATC) and available withdrawal capacity (AWC) to alleviate congestion and improve grid performance.

Start by identifying areas within the grid where congestion frequently occurs due to limited ATC. These congestion hotspots typically experience high demand or transmission bottlenecks, leading to constraints on power transfers.

Conduct a thorough assessment of grid constraints in these areas, considering factors such as transmission line capacities, voltage stability and load-serving capabilities. Understanding the root causes of congestion helps pinpoint where battery storage can effectively alleviate grid constraints.

Using such data like this graph aids in optimizing BESS project strategy by displaying planned, chosen and under-construction routes to nodes in ERCOT.

Batteries are an essential component in the global energy framework, enabling the integration of renewable sources such as solar and wind into the grid. They play a pivotal role in ensuring grid stability and resilience by effectively balancing supply and demand. Additionally, batteries provide critical backup power during emergencies and assist utilities in managing peak demand by storing surplus energy during off-peak hours. The significance of batteries in our energy landscape has been underscored by the exponential growth witnessed in global installed battery storage capacity over the past decade. As we look to the future, the continued advancement and deployment of battery technologies will be instrumental in driving the transition to a more sustainable and resilient energy system.

This e-book is brought to you by Enverus, the world’s largest energy-focused software company, providing insights from a trusted leader in power and renewables. More than 6,000 businesses, including 1,000+ in electric power markets, rely on our solutions daily, with 7,500+ users using Enverus to develop projects, manage the grid, trade power, and facilitate asset transactions.

Enverus customers, on average, spend 500 days less in the interconnection queue thanks to our industry-leading software and analytics. With a 15-year head start in renewables and grid intelligence, real-time grid optimization to the node and unparalleled expertise in load forecasting, we’re uniquely positioned to support your needs across the power market.

Our 1,700-strong team includes more than 300 power and renewables experts, including industry veterans and PhDs, ensuring our data and intelligence address the evolving challenges in today’s power industry.

Discover

About Enverus

Resources

Follow Us

© Copyright 2025 All data and information are provided “as is”.