Your guide to navigating the key themes reshaping energy dynamics. Join Enverus Intelligence® Research as they dig into the nuances of power demand forecasting for data centers and unravel the economic intricacies of carbon capture and storage deployment that will be required for increased gas-fired power generation.

Enverus Intelligence® Research, Inc., a subsidiary of Enverus, provides the Enverus Intelligence® | Research (EIR) products. See additional disclosures.

Select “Get Started” below if you would like to unlock Energy Transition Research’s in-depth reports on the power/supply demands of data centers and other energy transition topics, available exclusively for EIR members.

Research Written by:

Riley Prescott, Analyst, Enverus Intelligence® Research

Jeffery Jen, Analyst, Enverus Intelligence® Research

In this e-book, you will explore the rising power demand driven by the rapid expansion of data centers, cryptocurrency mining and sophisticated oilfield technologies. As our energy consumption soars to ever-higher levels, the industry faces significant challenges in power generation, with a focus on maintaining reliability and security, and minimizing environmental impact. Amid these changes, natural gas plays a vital role, with its future heavily dependent on the successful implementation of carbon capture and storage (CCS) to achieve sustainable operations. Dive into the analysis with Energy Transition Research (ETR), a branch of Enverus Intelligence® Research (EIR), as they unravel the complexities of power demand, challenge exaggerated predictions and examine the economics of CCS, an essential element for the future of gas-fired power generation.

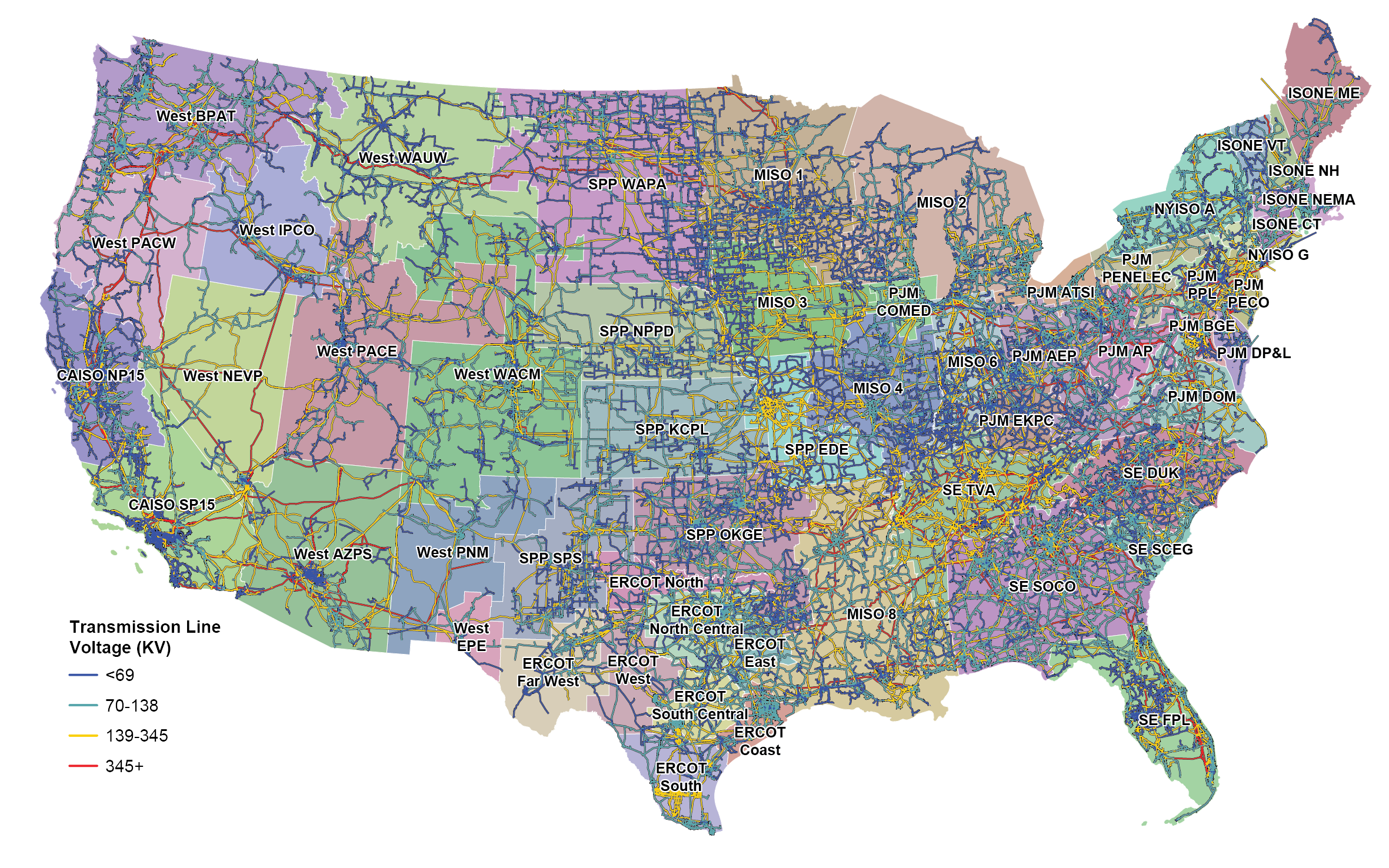

Source | Enverus Intelligence® Research, Enverus Foundations P&R

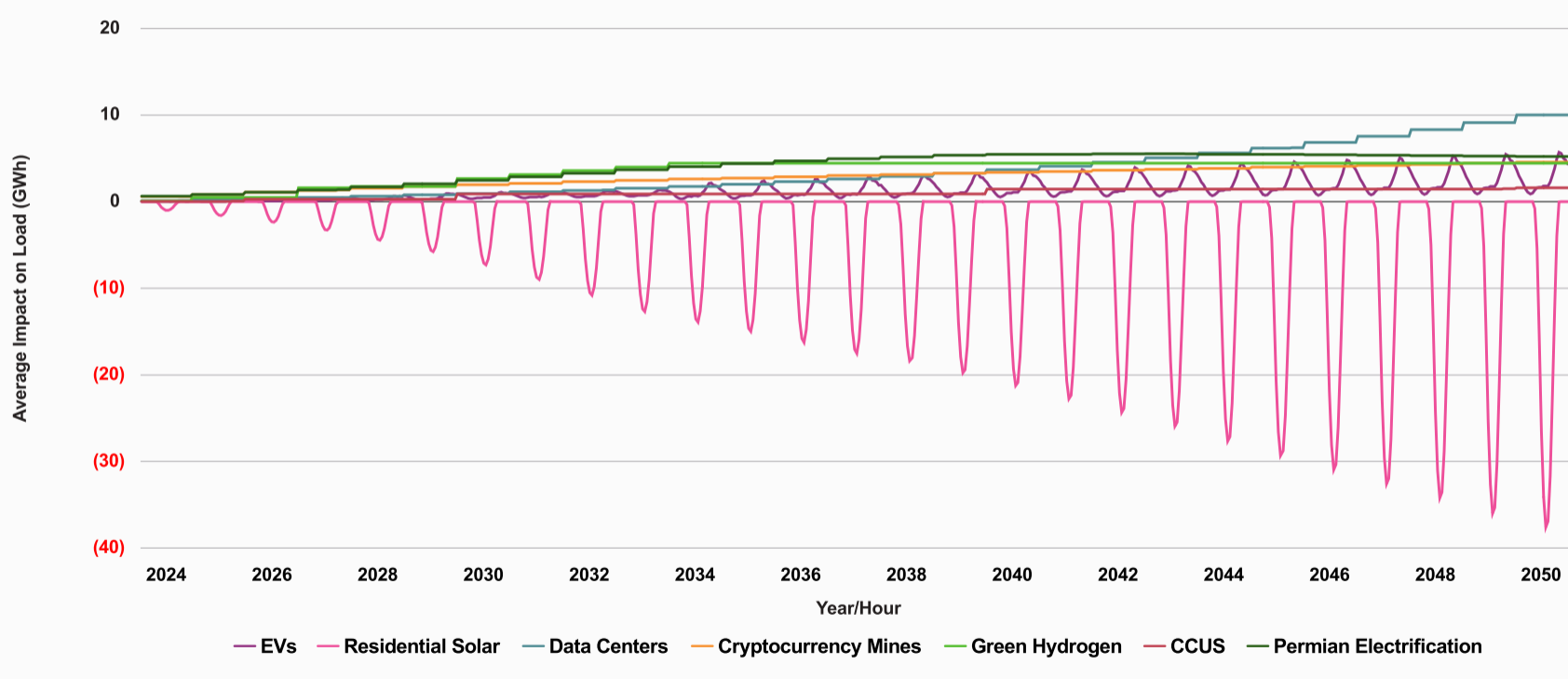

All aspects of ETR’s analysis on baseload growth are developed internally, based on their own proprietary models and sophisticated forecasting methods, of which all is made available to clients. They integrate traditional regression analyses, which account for key variables including population growth, temperature changes and seasonal trends, with contemporary factors that influence energy demands, such as advancements in technology and industry shifts. This ensures they stay ahead of emerging trends, not just relying on past data. Critical sectors including data centers, cryptocurrency and innovations in green hydrogen and carbon capture are reshaping energy demands. ETR pays close attention to developments, including the electrification of oil and gas operations in the Permian Basin and the balancing role of residential solar energy, providing depth to their strategic analysis necessary for maneuvering through the evolving energy landscape.

Source | Enverus Intelligence® Research, Enverus Foundations P&R

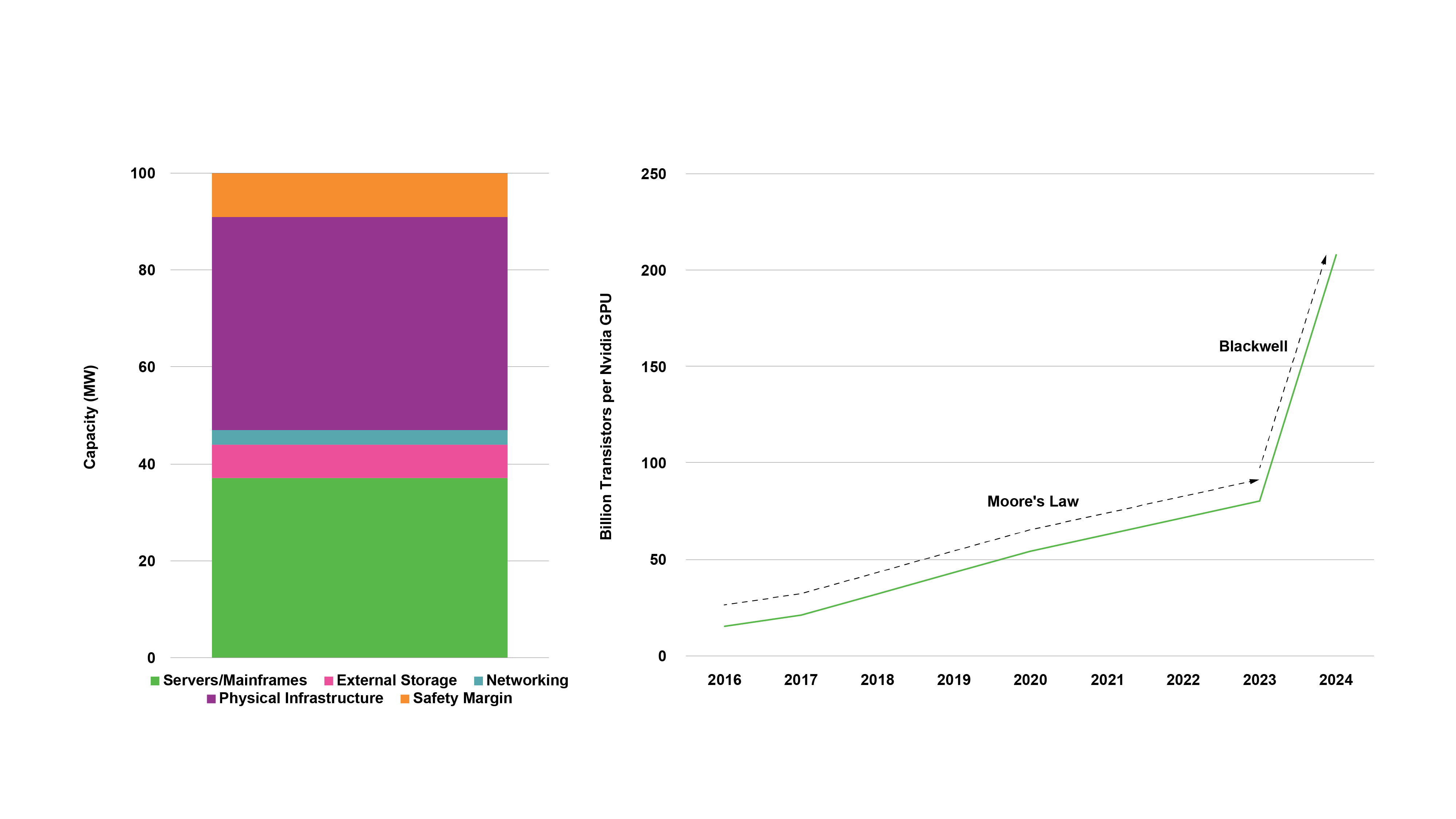

The top priority for those developing data centers is making sure they have a steady supply of energy because these facilities can have zero downtime. To ensure they can keep operating without interruption, they’ve been built with redundancy, using backup generators and batteries. It’s not only important to ensure a steady supply of power; environmental impact matters, too. Data center developers are mandated to ensure a certain component of their energy supply is from zero and low carbon sources, like wind, solar or nuclear.

Up until 2023, new technology was advancing at a predictable pace, but Nvidia’s release of the Blackwell chips has really changed the game. These chips have more transistors, which means they can do things like training AI models twice as fast and running them five times faster, making them super efficient. This big improvement doesn’t just mean better performance; it also helps the environment by using less energy, matching up with the data center industry’s goal to be environmentally responsible.

Source | Enverus Intelligence® Research, Nvidia

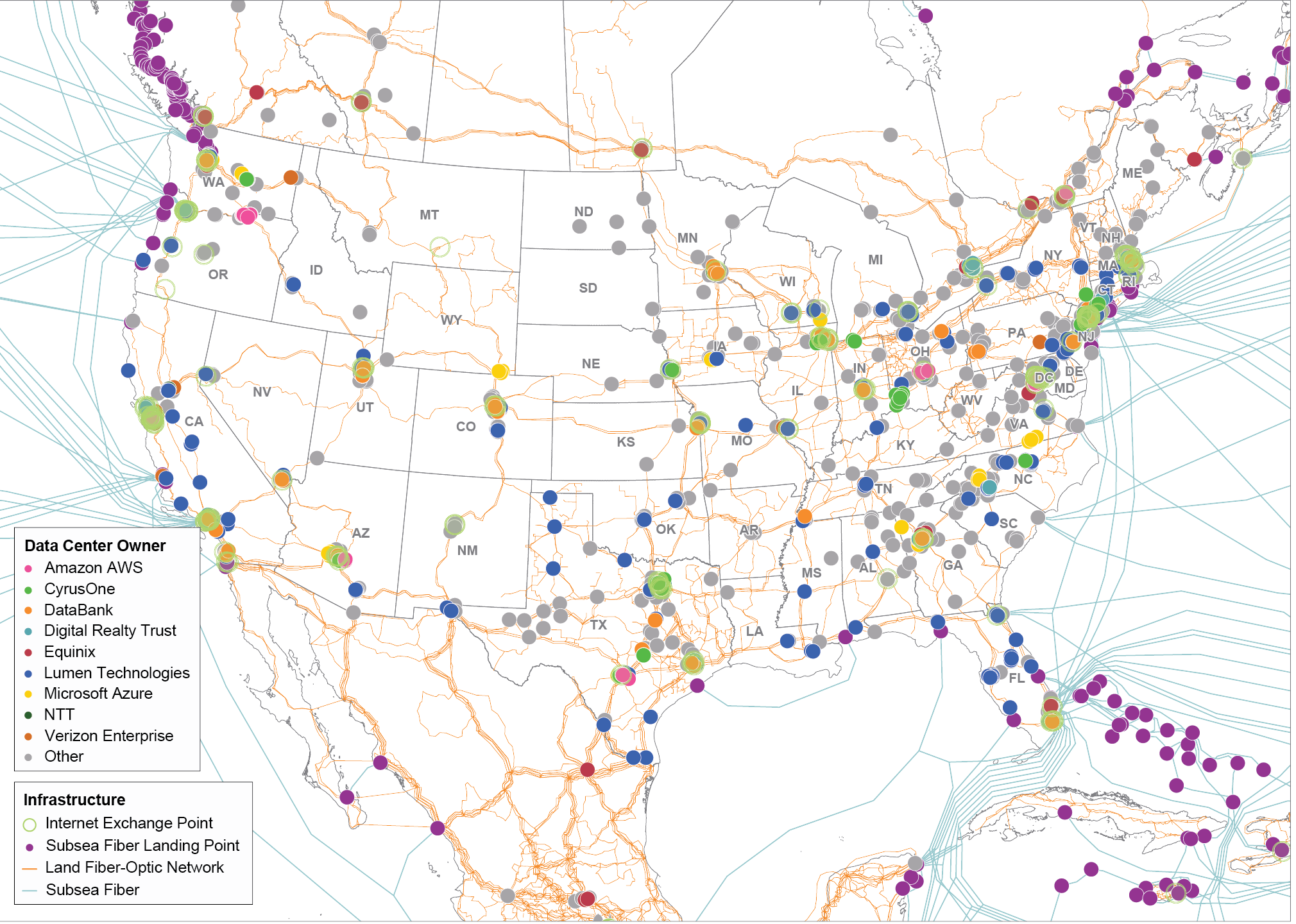

Data centers need to be within proximity to fiber-optic cables, both on land and offshore, to cut down on costs. It’s predicted that these centers will need five times the current fiber bandwidth to really use all their tech power. But it’s not just about more bandwidth; there are other points to consider, like making sure the computer chips are efficient, connecting different systems effectively, moving through data lines without delays and dealing with the availability of important electrical components like transformers and breakers.

Looking at the data center needs across the contiguous United States, the base forecast expects a 43% jump in the need for processing power. On the more cautious side, the slowest steady increase we might see could be at a 5% yearly rate that’s below this base prediction. On the other hand, the most optimistic scenario suggests a growth rate that’s 5% higher than the base forecast. What’s important to these estimates are two big tasks data centers have: training, which needs a lot of bandwidth to move data around, and inference, which requires fast networks, like those provided by fiber-optic cables, to quickly process data. This shows just how much data centers must balance their operational demands with the fast pace of tech developments.

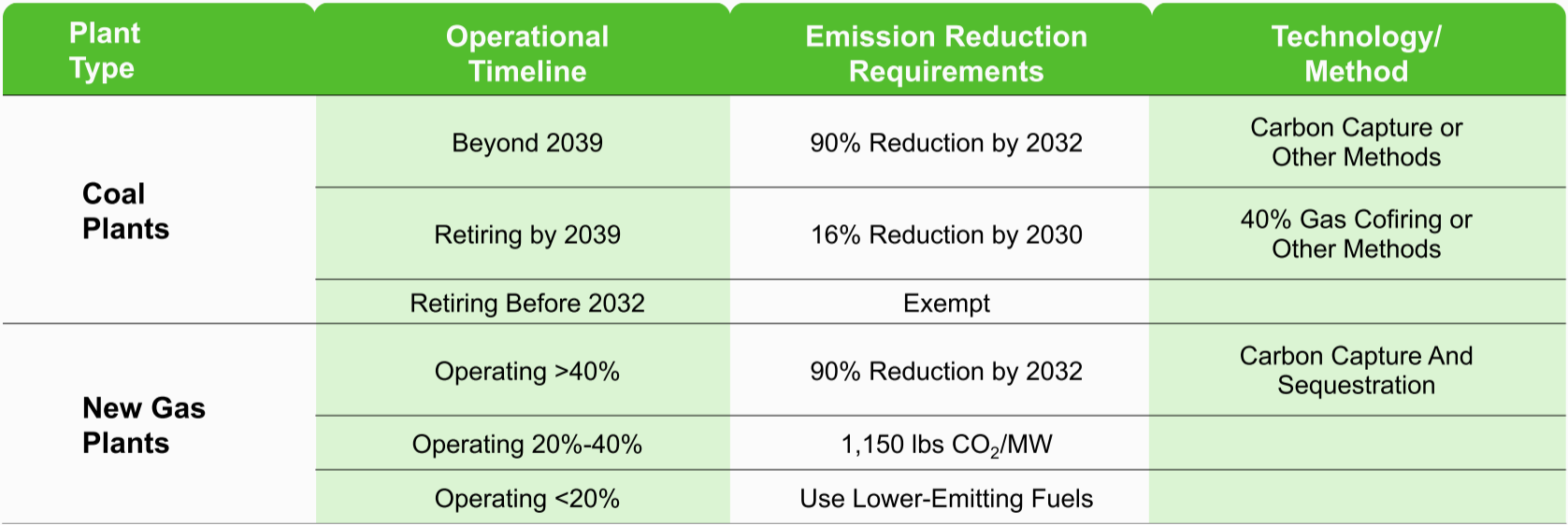

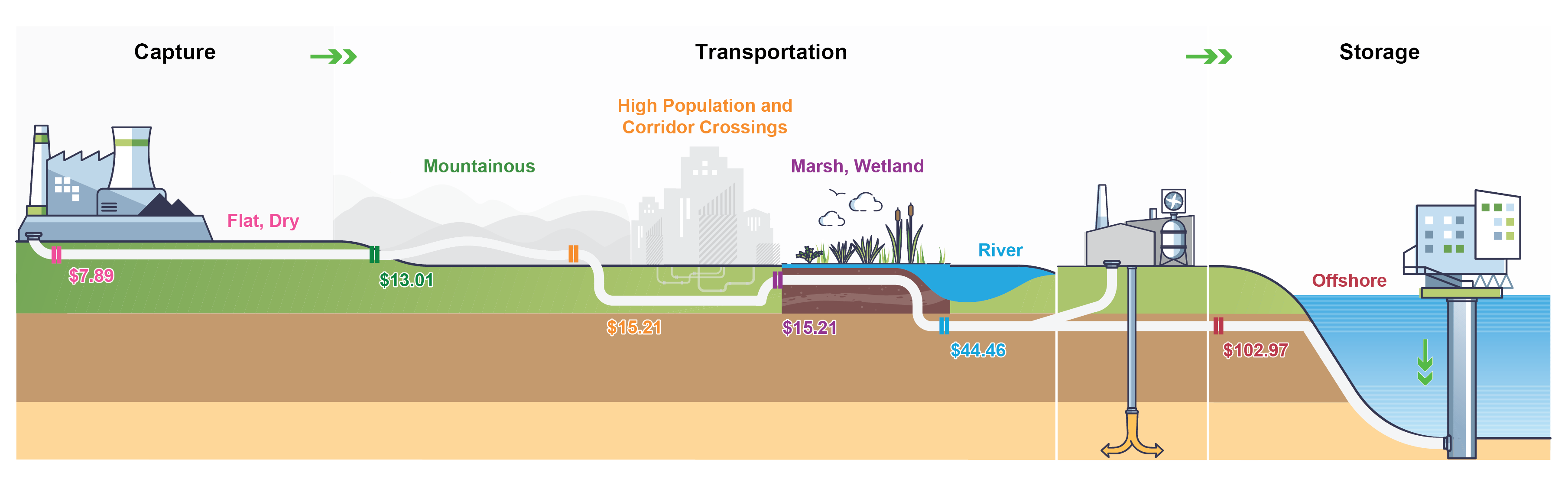

The growing need for more electricity, driven by the expansion of data centers, means that we’ll continue to use gas-fired power plants to meet this demand. In an effort to reduce emissions, the EPA has proposed a set of regulations on new gas-fired power plants that could require them to start using CCS technology by 2032. To effectively manage this significant transition and ensure we can meet the growing demands for energy while also protecting the environment, it’s crucial to fully grasp the workings of the CCS system.

Interest in tax credits for carbon capture (Section 45Q Production Tax Credit) has jumped since the Inflation Reduction Act was put into action which increased the value of the credit. This boost in value has made investors more confident about getting into this technology. As a result, the United States is moving to promote the use of such technology through regulations such as the one the EPA has implemented on gas-fired power generation.

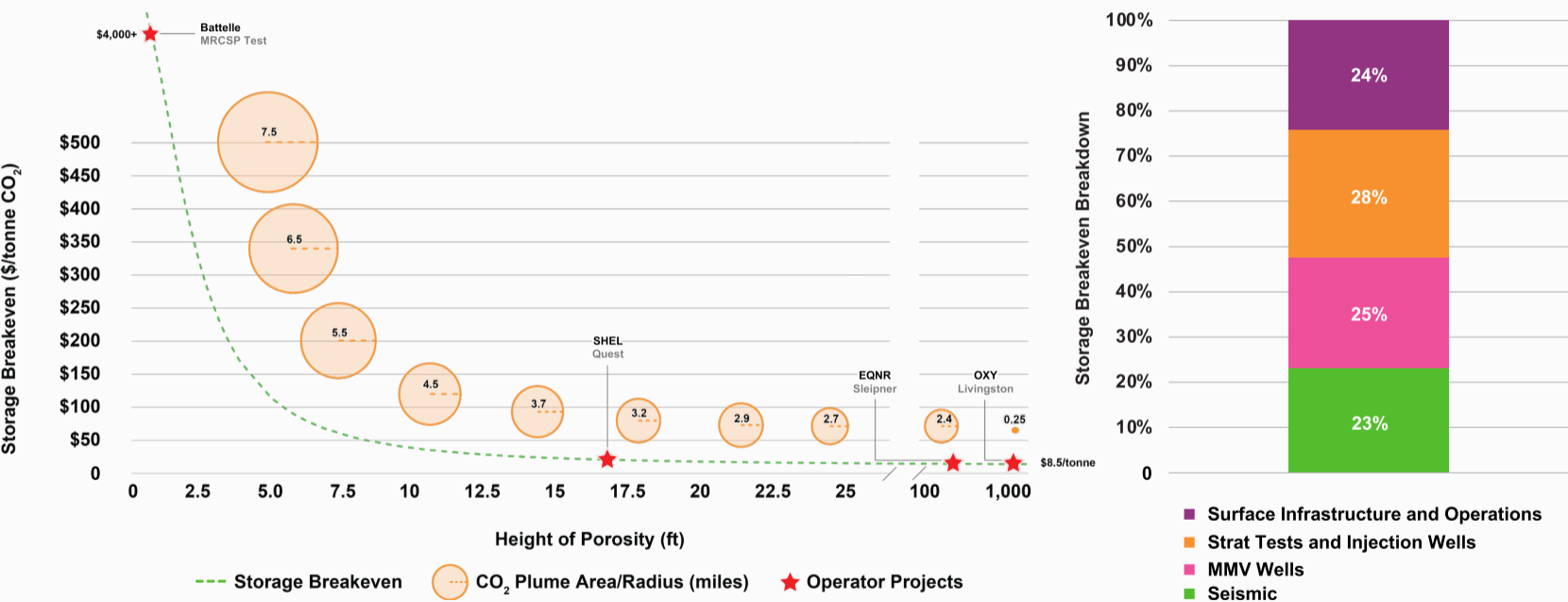

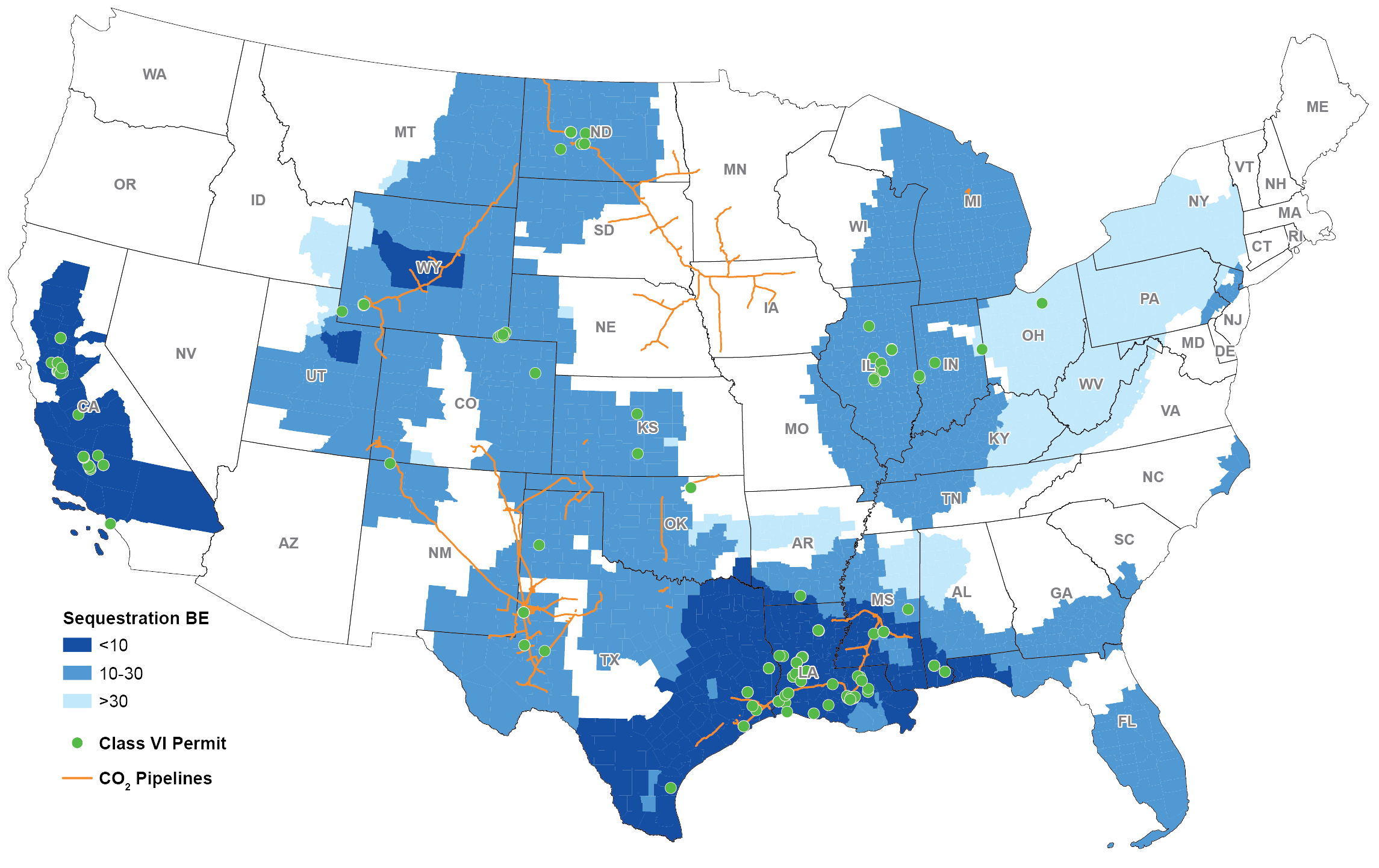

Note | carbon storage break evens are reported in $/tonne CO2 for 1 mtpa injection at a 7,000-foot depth over a 25-year injection life using a 10% discount rate. Height of porosity is defined by reservoir thickness multiplied by porosity.

Source | Enverus Intelligence® Research, FE/NETL CO2 Saline Storage Cost Model, U.S. DOE

Source | Enverus Intelligence® Research, USGS, EPA

Here are your key takeaways:

Access research that addresses your biggest challenges using fundamental asset valuations, forecasts and operations analysis. You’ll get clear, actionable insights to capitalize on market opportunity, optimize your portfolio and realize shorter time-to-value.

Comprehensive coverage of power markets and insights into emerging energy technologies and project economics.

Get fast, accurate global energy intelligence covering: E&P licensing, seismic, drilling, renewables, and much more…

Filter out the noise and stay ahead of the energy industry with timely, concise summaries.

Discover

About Enverus

Resources

Follow Us

© Copyright 2025 All data and information are provided “as is”.