One of the key problems in truly understanding a well’s production profile and predicted estimated ultimate recovery (EUR) is that the producing lifecycle of a given well is often impacted by nearby operations, when an operator will need to shut in the well to avoid damage. A well may be shut in due to offset development, intentional re-working, infill development or any other operational scenario.

The challenge: The shut-in event, though necessary at the time, can lead to decreased productivity, or it can provide a boost to well production, depending on the scenario. However, most type curve analyses treat the well as a single event from first spud through to plug, which does not accurately capture the impact of the shut ins.

The solution: Create distinct production segments, quantify the impact of the event on production and classify the type of event. Seems simple, right? Turns out, Enverus is the only one who has solved for this in the market today. Segmenting production data enables accurate identification and quantification of the impact these events have on company production and therefore cashflow.

The Proof: Bakken Case Study

To see production segmentation in action and how it can impact your business, follow through this single well example from the Bakken.

Example API: 33-025-00757

Historic approach to PDP calculation would attempt to fit a curve through the entirety of the well’s production (Figure 1).

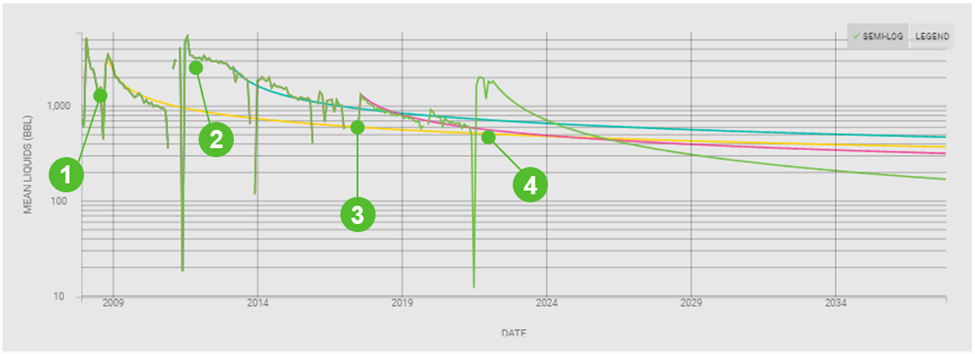

We can identify four distinct periods of production for this well, using Enverus Production Event Analytics (Figure 2).

- Initial production

- 2012 refrac

- 2018 shut in (no detectable cause)

- 2022 shut in (offset-infill operation)

Each of these periods can be fitted with a unique decline curve (Curve ID 1-4), which enables true quantification of the impact to production from each event through time and, therefore, the most accurate PDP numbers.

Results:

Comparing the two approaches to production forecasting shows that the first approach, with no segmentation, yields a First 360 EUR of 326 MBBL, while the enhanced approach with production segmentation by event (Curve ID = 4) yields a First 360 EUR of 333 MBBL. Only ‘Event Two’ required an additional capital investment, and that additional expenditure was negated by a later shut in.

This segmentation also enables more accurate type curves. We have found that Curve ID = 1 is a more useful analog for how future new drills will perform than Curve ID 4 or compared to the overall fit attempted in Figure 1.

Takeaway

Understanding the periods of production is crucial for assessing how operations impact the overall productivity and return on investment of an asset. Production forecasting best practices depends on what you’re trying to achieve, whether that is a quick screen of production profiles, establishing an informed type curve or running a decline curve analysis. Event detection improves your insights in the latter two use cases. Enverus has a range of production forecasting solutions, from current production data, predicted EUR and NPV values pre-generated on every well to detailed customizable type curves with your own production data. We know there’s more than one way to analyze well productivity; explore our other forecasting solutions here.

To learn more about Production Event Analytics, watch our webinar to learn how we identify and classify production events.