CALGARY, Alberta (Nov. 28, 2023) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS platform, has released a new report analyzing data from its updated Class VI permit tracker, which includes new entries such as CO2 source location, facility details, approval dates and disclosed injection volumes. Class VI wells are used to permanently inject CO2 into deep rock formations.

The report explores the following questions:

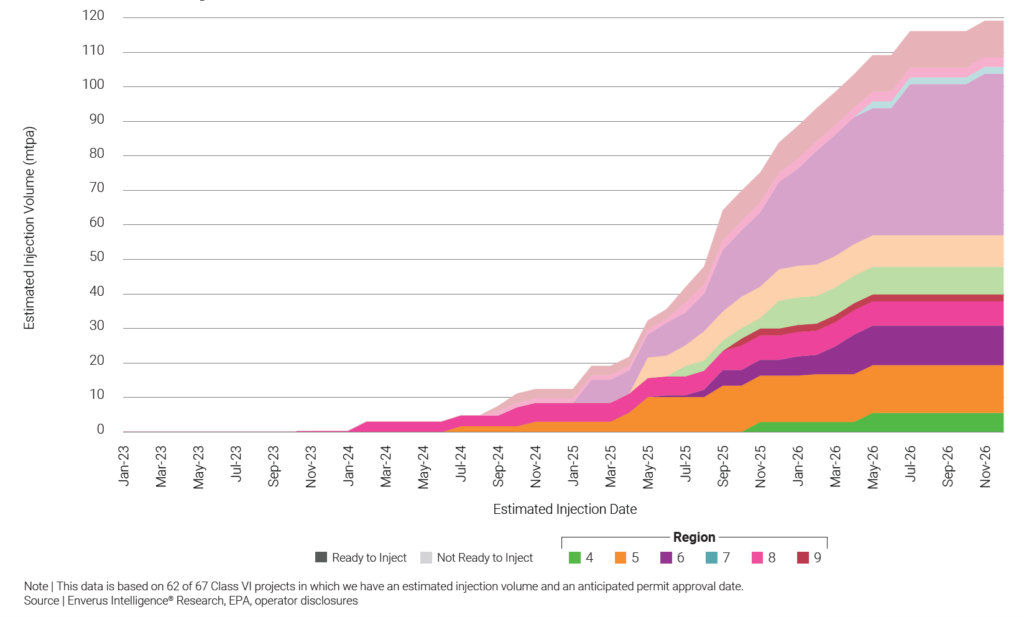

- What do current permit timelines look like today, and how do they impact anticipated regional injection volumes across the L48?

- How do the projects and permits stack up in terms of pipeline transport availability and point source emission quality?

- Are there any permitting trends that will help project anticipated timelines for future permit applications?

- Which region, state and counties are seeing the most permit activity?

“Class VI permits are a key component to the carbon capture and sequestration (CCS) project lifecycle, and while both the generation and evaluation of these applications are lengthy processes, much can be gained by evaluating the population of permits in the queue,” said Evan MacDonald, senior geology associate at EIR.

“By appending ancillary data points to the existing statistics pulled from the U.S. Environmental Protection Agency and other state regulator websites, we can generate several inferences. These diagnostic insights are derived by tying permits to CO2 pipeline data, emission quality, anticipated injection volumes and geographical locations. Analyzing the accumulation of this data provides CCS stakeholders and investors with an essential activity tracking tool to understand which regions are expected to see the most sequestration activity, where CO2 volumes are expected to be flowing and where there may be opportunity for both future partnerships and new developments,” MacDonald said.

Key takeaways from the report:

- EIR estimates CO2 injection in Class VI wells will ramp up 100x to 40 million tonnes per annum (MTPA) by mid-2026, based on disclosed injection volumes, Class VI permit timelines and projects with operational capture and transportation at time of permit approval.

- Class VI permit applications are up 500% since 2021, averaging four per month in 2023.

- 36% of projects are located within a 10-mile radius of an existing or proposed CO2. pipeline, allowing easy access to CO2. Notably, Orchard Storage and River Parish Sequestration’s RPN 1 and RPS are located less than 1.5 miles from transportation infrastructure.

- Hackberry, River Parish Sequestration’s RPN 1, 4 and 5 permits and TALO’s White Castle project have access to the highest volume of point source emissions with 40, 39 and 38 MTPA within a 30-mile radius of their respective project locations.

- CRC leads the permit queue with 31 wells across six projects, followed by XOM with 15 wells across three projects and CapturePoint with 14 wells across three projects.

You must be an Enverus Intelligence® subscriber to access this report.

EIR’s analysis pulls from a variety of Enverus products, including CCUS Analytics and Enverus FOUNDATIONS®.

Members of the media should contact Jon Haubert to schedule an interview with one of Enverus’ expert analysts.

Did someone forward this email to you? Sign up for Enverus’ press list or update your email preferences.

View all Enverus news releases at Enverus.com/newsroom.

About Enverus Intelligence Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. EIR is registered with the U.S. Securities and Exchange Commission as a foreign investment adviser. Enverus is the most trusted, energy-dedicated SaaS platform, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 98% of U.S. energy producers, and more than 35,000 suppliers. Learn more at Enverus.com.