The Northeastern U.S. has some of the most ambitious decarbonization goals in the nation, and some of the most vocal detractors to new infrastructure. This is notable when any project advances, let alone begins construction, as in the case of the Champlain Hudson Power Express (CHPE) HVDC line. Meanwhile, a project in Maine is in the early stages, but its advancement starts to hint at costs and challenges coming down the pike.

Of course, these are just two projects of note. Look for continuing research from Enverus’ experts as more milestones are reached. The first quarter of 2023 will be exciting with the launch of 90-day forecasts for both NYISO and ISO-NE. These projects are well beyond 90 days out, but what we study today will help us understand what happens in the future.

Now, let’s take a further look at these two transmission projects.

New York

The CHPE is a planned 339-mile HVDC transmission project designed to move clean, hydro power from Quebec to New York. The project’s capacity is listed as 1,250 megawatts and it will blend submarine and terrestrial elements, snaking under Lake Champlain and through the Hudson River Valley.

The project announced financial close Nov. 1 and has since ceremonially broken ground and started the construction phase. The project will run from an existing HVAC converter at the Hertel substation outside Montreal, to the Canada-U.S. border at Riviere Richelieu. Hydro Quebec will be responsible for all construction on the Canadian side of the border. The terminus of the project is in Astoria, Queens in New York. While the project is scheduled to finish construction in 2026, it’s not too early to begin evaluating the impact.

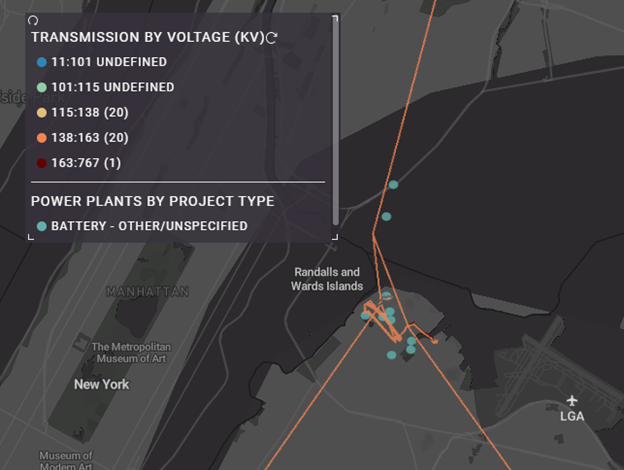

What happens when you inject 1,250 megawatts of power into the existing 345 kilovolt system in Astoria? Astoria is a complex area, and many projects in the interconnection queue plan on connecting in the Astoria area or within Queens County, New York. Enverus data show more than 1,200 megawatts of energy storage projects are at some phase of development in the immediate vicinity of the Astoria Annex 345 kilovolt substation, where CHPE will connect.

There are also some large wind projects slated to connect in the vicinity, and Clean Path New York is planning to connect to the grid just south of Astoria, at the Rainey substation.

Injecting what amounts to gigawatts in the Astoria area will create and exacerbate local congestion. Two constraints jump to immediate attention: ASTANNEX 138 ASTORIAE 138 1 and ASTANNEX 345 E13THSTA 345 1, with the Astoria-Hellgate basket of constraints also showing higher flows. The energy storage projects, to the extent they are completed, will provide some balancing support for congestion and energy cost during peak hours, but with short discharge durations, they aren’t expected to overshadow the influx of power.

The increase in congestion will start to drive more basis between Zone J and update regions with the J/K spread also taking a jump, all else being equal. But all else is not equal, given the projects in the works. Offshore wind coming online in New York, New Jersey and New England, will play an important role in the market landscape by the time CHPE is energized.

New England

There are two projects taking a step forward in Maine. State regulators granted initial approval for a transmission line and wind farm located in Aroostook County in Northeast Maine. Both projects have some hurdles to clear, including how much ratepayers will contribute to each project.

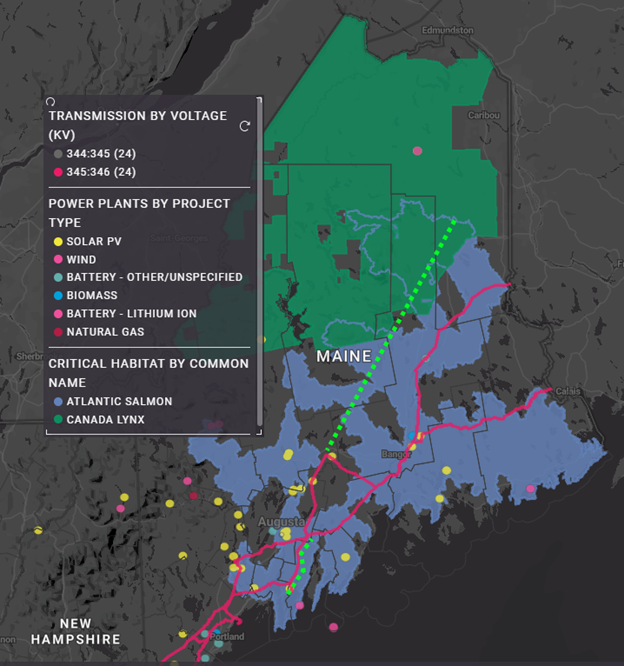

LS Power’s bid won approval for a 345 kilovolt transmission line that would connect a portion of wind-rich, rural Maine to the rest of the New England system. Currently, there is a small pocket of Maine that lies outside of ISO-NE, connected to New Brunswick. The proposed line would allow for delivery of the planned wind farm’s energy directly into New England instead of flowing into Canada, where it may or may not flow back into the states via existing interfaces.

The following image shows existing 345 kilovolt infrastructure and proposed transmission additions in green. Note, the path has not been finalized for the northern branch. In this case, crossing critical habitat (Canadian lynx and Atlantic salmon) is not viewed as insurmountable. Proposed projects are also shown in the image. Other planned projects are in western and southern areas where existing infrastructure makes connection more attractive.

The wind farm, a 1,000-megawatt plant named King Pine, has been awarded to Longroad Energy. It stands to reason that the fate of the wind farm is dependent on the completion of the transmission project, although that is not explicitly stated based on research.

Putting aside any doubt that these projects will be completed, how will these projects change the landscape? Congestion is already common when there is strong wind in Maine. The transmission and wind projects are sized in relation to the other to an extent. A 1,000 megawatt wind farm connected to a 345 kilovolt line around 100 miles long would almost fully utilize the line’s capacity. The doubling of a circuit between Cooper’s Mill and Maine Yankee substations hints at the underlying engineering and subsequent impact. While power will move somewhat unimpeded to the area south of Augusta, it will eventually reach a bottleneck flowing further south into New Hampshire and Massachusetts. The further downstate the congestion occurs, the more impactful it will be on the Maine Zonal price. While current wind driven constraints are moderately bearish on Maine, the new additions are viewed as being high impact. Zonal basis between Maine and Massachusetts will increase upon completion of these projects.

The projects in New York and Maine are quite different but do underscore the need and willingness to pay to improve system reliability while marching toward a lower carbon future. New York and New England have little to no dispatchable generation in their planning queues — it’s predominantly wind, solar and short duration batteries. Maine, New Hampshire and Vermont all have a history of being unfriendly to transmission projects. Will the LS Power project fare different?

Transmission is an effective way to tap existing hydro power in Quebec and allow for the build out of wind in rural areas. With another winter in full swing and ever-increasing competition for natural gas, will the public open their mind to transmission? Hopefully it won’t take a catastrophe to turn public opinion, but time will tell.