Calgary, Alberta (May 3, 2022) — Enverus Intelligence Research, a subsidiary of Enverus, the leading global energy data analytics and SaaS technology company, has introduced a new geopolitical risk index built to gauge market sentiment and better understand oil price movements beyond fundamental price forecasting.

“By quantifying the geopolitical premium, we estimate how much of a risk differential is warranted versus the fundamental price forecast,” said Bill Farren-Price, lead report author and director of Enverus Intelligence Research. “The current geopolitical premium has eroded materially as Brent appears to have settled around the $100/bbl mark — a value that we feel is fundamentally justified. The geopolitical premium reached its peak when Russia invaded Ukraine and Brent touched $139/bbl.”

Key takeaways from the report:

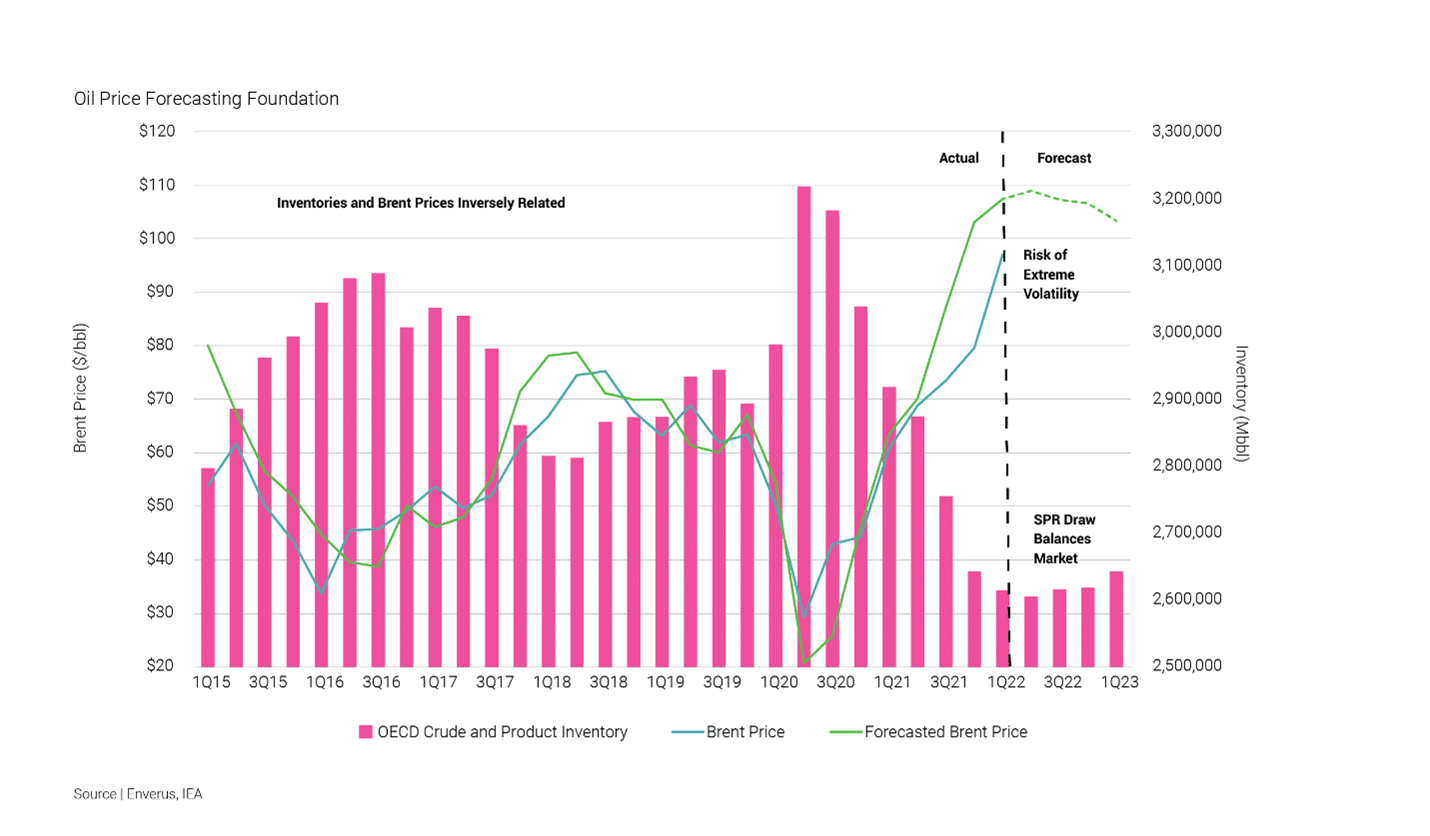

- EIR can now project not just global oil supply, demand and stocks, but also explain the spread in forecast oil prices from our fundamental outlook based on a sentiment score generated by a proprietary algorithm fed by open-source keywords.

- The new index enables us to estimate geopolitical premium or discount in oil prices. The index our geopolitical index can be useful for market participants such as oil option traders, oil price hedgers and geopolitical observers.

- Looking back through history, we can see those events, such as the Arab Spring tensions, resulted in $10-$15/bbl price premium in 2012-2013, drone attacks at Saudi’s Abqaiq-Khurais facility led to a premium of about $10/bbl in 2019, and an anticipated demand rebound from COVID-19 equated to nearly $20/bbl.

Members of the media should contact Jon Haubert to schedule an interview with one of Enverus Intelligence Research’s expert analysts.

About Enverus

Enverus is the leading energy SaaS company delivering highly-technical insights and predictive/prescriptive analytics that empower customers to make decisions that increase profit. Enverus’ innovative technologies drive production and investment strategies, enable best practices for energy and commodity trading and risk management, and reduce costs through automated processes across critical business functions. Enverus is a strategic partner to more than 6,000 customers in 50 countries. Learn more at Enverus.com.

About Enverus Intelligence Research

Enverus Intelligence Research, Inc. is a subsidiary of Enverus and publishes energy-sector research that focuses on the oil and natural gas industries and broader energy topics including publicly traded and privately held oil, gas, midstream and other energy industry companies, basin studies (including characteristics, activity, infrastructure, etc.), commodity pricing forecasts, global macroeconomics and geopolitical matters. Enverus Intelligence Research, Inc. is registered with the U.S. Securities and Exchange Commission as an investment adviser.