No one drills a natural gas well just to burn their investment. On the other hand, an oil well is drilled for the more profitable liquid hydrocarbon while the associated natural gas is often flared to prevent a financial loss, especially in areas that lack the necessary infrastructure to move, store, process, and market natural gas. Natural gas flaring is a complex and evolving practice governed by economics, regulation, and safety.

Read on to learn more about natural gas flaring, key statistics, environmental impact, and alternatives.

What is Gas Flaring?

In the US, gas flaring falls into two main categories: processing plant flaring and associated gas flaring. While the news flow tends to focus on the latter, processing plant flaring accounts for the bulk of all flaring in the US where dangerous acid gas streams are burned off to prevent release into the environment.

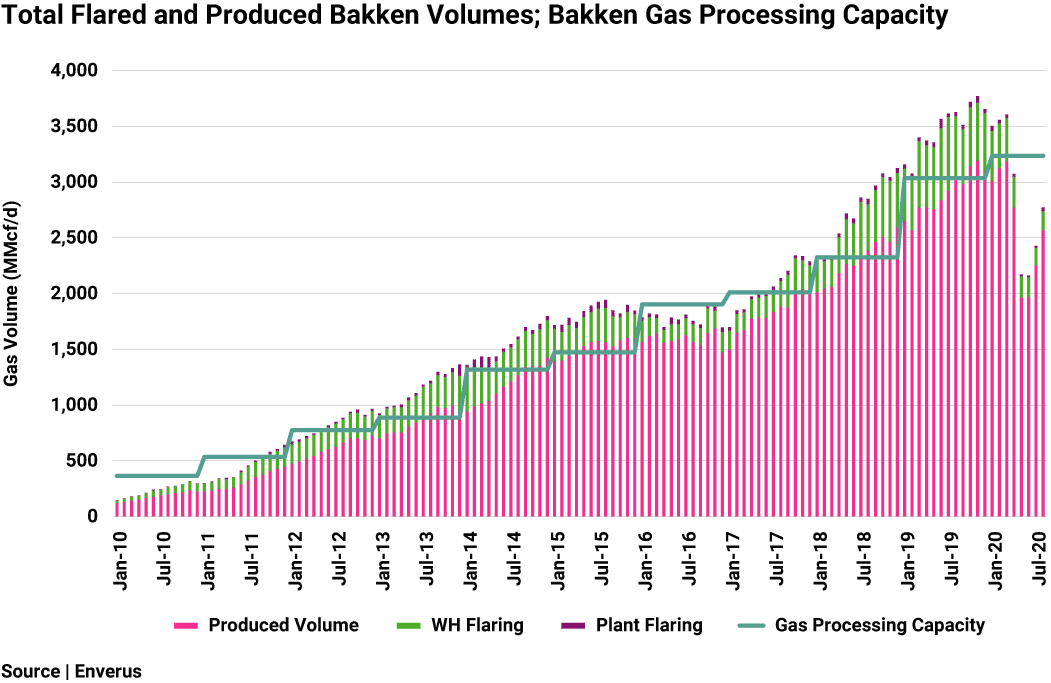

Associated gas flaring occurs in areas like the Permian Basin and Bakken Shale of North Dakota, where infrastructure is first built out to accommodate oil gathering and transportation. The associated gas that is produced is “stranded” or stranded gas because it lacks the specialized infrastructure needed to economically transport and process it. As a result, stranded gas is flared.

What is the Procedure of Gas Flaring?

Gas flaring occurs in multiple stages of the oil & gas value chain, starting with exploration and field development. While drilling, pressure in the circulating mud system can build up and create flowback, or kicks. This buildup of gas must be contained to avoid dangerous well control events, which is why the gas is routed to specialized gas busting equipment then fed into a nearby flare stack. Flare stacks are used during drilling, completions, production operations, and midstream processing. The tall tower ignites natural gas in a safe and controlled combustion process that directs flames and fumes upward into the sky.

Why is Flaring Necessary?

Flaring is necessary for economic and safety reasons. Moving stranded gas in most basins is simply not profitable to bring to market resulting in it being flared. Flaring is also standard operating procedure during well tests, flowback following hydraulic fracturing, certain maintenance operations, and workovers.

Gas Flaring and Venting / What is the Difference Between Flaring and Venting?

Flaring is the controlled combustion of uneconomic or waste natural gases and is typically performed in a flare stack or combustor. Venting is the release of methane and other gases directly into the environment, typically through loss and leaking at multiple points in the value chain.

Gas Flaring Environmental Impact

Natural gas flaring and venting have significant impact on the environment and in some cases safety of field staff and nearby ecosystems.

What are the Byproducts of Natural Gas Flaring?

When combusted, natural gas (typically methane) releases a variety of by products and greenhouse gases (GHG), such as carbon dioxide. It also produces black carbon/soot adding to the global warming process. In comparison, venting methane directly would be far more detrimental to the environment.

Effect of Gas Flaring into the Ecosystem

While flaring remains a preferred solution in lieu of venting, it nonetheless carries its own risks to the ecosystem. Hydrogen sulfide is one byproduct that anyone working around oilfield facilities should be aware of as this gas can be deadly with just a few breaths.

Alternatives to Gas Flaring

Much of the natural gas that is flared occurs at gas processing facilities where it is safer to flare acid gas containing hydrogen sulfide and other deadly gases. While flaring remains a preferred solution for many oil-producing basins lacking the infrastructure to transport large volumes of associated gas, alternatives solutions to gas flaring are becoming more widely available.

Natural Gas Combustor vs. Flare Stack

while flaring generally refers to igniting unwanted or waste gas, there are different methods to accomplish this. Most well-known is the flare stack located on wellsites, offshore platforms, and midstream facilities. Flare stacks direct flames up and away from nearby equipment and personnel. In contrast, combustors are designed to fully enclose the combustion process and are shorter and wider in size. Flare stacks are typically a short term solution to burn off gas produced from oil storage tanks, during well tests and maintenance. Combustors are typically designed to burn natural gas for extended periods.

Wellsite Gas Processing

Ironically, many types of oilfield equipment, such as compressors and separators, run on natural gas fueled power generation, however, these systems require purer forms of methane then is typically produced from wet gas wells. In the Bakken for example, only about 50% of the gas stream is methane with the remainder comprised of natural gas liquids. Emerging wellsite gas processing technology is enabling producers to separate the gas stream into pure methane, ethane, and NGLs that can be monetized or used for oilfield power generation instead of being flared.

Flare Gas Capture and Reinjection

Where the infrastructure exists, producers can also capture and store gas that would otherwise be flared. In some cases, flare gas can be transported to injection wells and stored in subsurface reservoir rock.

Global Gas Flaring Reduction

Reduction of gas flaring GHG emissions is embodied in the spirit of the Paris Agreement, however, government agencies and international organizations are taking lead on specific efforts to minimize and eliminate flaring. Notably are the World Bank’s Global Gas Flaring Reduction (GGFR) Partnership and Zero Routine Flaring by 2030 initiatives.

Global Gas Flaring Statistics

Annually, 140 billion cubic meters (BCM) of natural gas is flared worldwide. That’s enough to generate 750 billion kilowatt hours (KWH) of electricity and power the entire African continent each year. Flaring also introduces more than 300 million tons of carbon dioxide into the atmosphere annually, contributing to global warming and climate change.

Natural Gas Flaring in the Permian

Spanning vast areas of west Texas and southeast New Mexico, the Permian Basin represents a premier oil and natural gas producing region in the world, largely thanks to unconventional shale extraction technology like hydraulic fracturing. Supermajors, majors, and hundreds of smaller independents came for the oil, which can be more readily transported by truck in the absence of gathering and pipelines. Natural gas processing facilities continue to be built in both the Midland and Delaware ends of the basin, enabling producers to process and sell more of their associated gas and reduce flaring.

Gas Flaring in Texas

Given the immense impact of the oil & gas industry on its economy, Texas has historically taken a more liberal/accommodating view of flaring. However, amidst growing concern of the environmental cost, evolving legislation, and improving takeaway capacity for natural gas, flaring in Texas is expected to steadily decline.

Gas Flaring Data

The following chart summarizes the top 10 sources of flaring in the oilfield.

Gas Venting Data

The following chart summarizes the top 10 sources of venting in the oilfield.

Greenhouse Gas Inventory Distribution of Methane Emissions

Source | US Department of Energy

Gas Flaring by Country

Natural gas flaring is heavily weighted towards countries with limited regulations and transparency into oilfield operations as well as producers like the US who are continuing to build out the required midstream infrastructure to economically transport and market associated gas.

Top Gas Flaring Countries

Together, the top 7 countries account for 40% of global oil production but over two thirds of flaring. These include Russia, Iraq, Iran, the United States, Algeria, Venezuela, and Nigeria.

Gas Flaring in Nigeria

Nigeria is one of the first big flaring countries to implement aggressive plans to eliminate flaring by 2030 and meet its GHG emissions reduction target of 20%. As part of its strategy, it is accepting third party bids to capture flare gas and export it as liquefied natural gas (LNG), however, amidst the COVID-19 pandemic the plan has stalled.

Current Government Regulations

Government regulations for natural gas flaring and venting vary widely from country to country. Even within the US, state regulations vary from flaring friendly to bans on many types of flaring.

Natural Gas Flaring Regulations

Most natural gas flaring regulations focus on limiting flaring to a few hours per day, set guidelines on extended flaring, or completely eliminate flaring of stranded natural gas. In Texas for example, flaring is allowed for both continuous combustion of stranded gas while Colorado limits flaring to only short term oilfield operations, such as well tests and maintenance.

Natural Gas Venting Regulations

Natural gas venting regulations are uniformly restrictive due to the hazards of allowing methane to be released into the environment, including hazard of explosive events and atmospheric damage.

Gas Flaring and ESG

The oil & gas industry finds itself in a ‘catch 22″ situation with Wall Street. The Climate Action 100+ group of investors has taken the initiative to ensure that publicly traded energy companies take action to reduce GHG emissions through environmental, social, and governance (ESG), including disclosure of natural gas flaring and venting. To achieve the ESG targets that investors are increasingly demanding, the oil & gas industry needs the capital infusion traditionally provided by Wall Street to build out gas gathering and transportation systems, among other infrastructure. Absent that investment, flaring and venting will remain part and parcel of oilfield operations.

Methane Emissions Monitoring

While natural gas flaring has a significant environmental impact, keep in mind it is the lesser of two evils, so to speak. Methane contributes 82 times more to global warming over a 20 year period compared to carbon dioxide emissions. Therefore, if quickly curtailing GHG and climate change is the goal, the logical first place to start is vending and, perhaps more importantly, natural gas leaking along the energy value chain.

Methane Regulatory Reporting

Propelled by ESG focused investors and market participants, the oil & gas industry is under increasing pressure to disclose more about its carbon dioxide emissions from flaring as well as methane emissions from venting. This movement intersects with evolving federal and state regulations around reporting GHG intensity, ultimately leading major and smaller independents alike to take a more proactive approach to gathering and disclosing emissions data.

MethaneSAT / Cutting GHG Emissions in Years vs. Decades

The Paris Agreement has set out to achieve a carbon neutral planet by mid-century. This long term vision is match by an equally ambitious short term methane reduction initiative through the launch of MethaneSAT, a joint project between the US and New Zealand. Following its expected launch in October of 2022, MethaneSAT will stream high resolution methane intensity data for every natural gas producing region on Earth, enabling unprecedented visibility into actual methane emissions and leaks at oil & gas facilities, gathering, and pipelines. Armed with this knowledge, the global oil & gas industry gains unprecedented opportunity to reduce methane emissions in a matter of years instead of decades.

The Future of Gas Flaring and Venting

Producers are under intensifying pressure not just from Wall Street to end the practice of flaring, but from governments and sovereign wealth funds as well, including the European Investment Bank, Norway’s Government Pension Fund, and the United Kingdom’s Export Finance. In addition to its commitment to reducing investment in fossil fuels, The World Bank has launched a Zero Routine Flaring by 2030 initiative to incentivize governments to invest into the infrastructure needed for flare gas capture and other repurposing.

Innovation is also playing a major role in the future of flaring and venting. Advancement in wellsite gas processing will ultimately render flaring moot as the natural gas stream is broken out into pure methane, ethane, and natural gas liquids that can be readily used for powering oilfield facilities while more valuable NGLs are transported to points of sale. Methane monitoring innovations, like MethaneSAT, will also be invaluable in detecting venting and oilfield leaks for rapid remediation.

Natural Gas Flaring FAQ

Below are answers to some frequently asked questions.

What is the Purpose of Gas Flaring?

Flaring is purely an economic consequence of oil production. Associated natural gas that cannot be efficiently transported and sold for a profit is flared at the wellsite.

Is Gas Flaring Illegal?

For the short term, flaring is an essential operation in the oilfield, however, federal and state regulations limit the practice. Venting, on the other hand, is strictly limited to certain operations, such as maintenance on tanks, and venting from flare stacks is illegal as natural gas streams contain deadly or carcinogenic gases like benzene.

What are the Effects of Gas Flaring?

Depending on the efficiency of the flare, controlled combustion of natural gas releases a broad range of by products, including carbon monoxide, carbon dioxide, nitrogen oxide, sulfur dioxide, and other gases. Many of these gases are not visible but can be seen with specialized cameras. Flaring also creates black carbon (soot).