COVID-19 Focused Investments: Publicly Traded Companies

Investor demands for showing free cash flow and capital discipline have been met with oil and gas public equities tamping down their capex spend, hunkering down to wait for WTI to appreciate enough to start completing DUCs and bringing their supplies to market, and consolidating in mergers or buyouts.

Lost in all the analysis, however, is the fate of the small, privately held operators, that don’t have access to the public equity markets or indulgent lenders who will get them through hard times.

Well Production

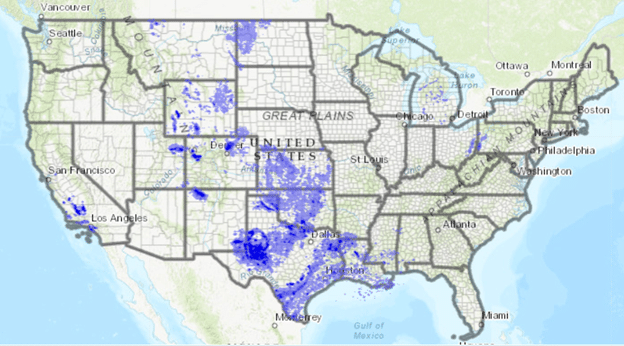

Consider this — of the 627,520 active wells in the U.S., about half of them are stripper wells that produce 15 barrels of oil per day or less. These wells are within about 13,000 distinct fields.

Constraining the wells to their most recent monthly production from Aug. 1, 2020 to Nov. 1, 2020, then summing their production, these wells account for approximately 27 million barrels (not including Indiana, Illinois or states that report on a year-behind basis). This represents just under 10% of the total production of active wells that produce above the stripper threshold of 15 BOPD.

No doubt a significant fraction of these wells is operated by large companies that have the financial wherewithal to attempt to ride out current conditions, but what about the rest? What can they do to keep themselves in business, both now and in the future? With prices where they are now and are projected to be through much of 2021, they’re not going to raise capital to go horizontal. They’re probably not going to be drilling any field expansion wells and may struggle to fund workovers. They may get some government stimulus relief to help short term, but that won’t address their long-term issues.

Banding Together

Although our industry has always valued and honored rugged individualism, there is merit in the idea of small operators in the same basin considering creating cooperatives — or at least banding together — to create some economies of scale that could allow them to reduce their costs by buying in bulk.

Consider that Gazprom Neft is dedicating gas supplies to power turbines to generate electricity for mobile crypto mining enterprises. A cooperative of small operators in a gas rich basin could theoretically pool their gas through trucked CNG to a central turbine location and generate electricity for either sales to the electric grid or for on-location use for crypto mining, or they could sell the gas to an efrac outfit completing wells on a pad currently lacking power or lease gas. They could even do a deal to truck their gas to well-positioned electric vehicle charging locales where their gas could be combusted in a gas turbine to charge on-site battery packs.

Supervisory control and data acquisition systems controls could reduce pumping and gauging costs for small oil operators, especially if they can be transacted through a bulk buying process.

A small operator cooperative could fund drone operations to conduct lease overflights to inspect lease conditions in remote locations to ensure equipment integrity.

Potential Benefits of Banding Together

Assuming ESG concerns become more prevalent, and carbon capture and sequestration needs more pronounced (especially under the new Biden administration), small operators should begin the process of determining the capacity of their reservoirs to store not only CO2 but hydrogen as well. Banding together will give small operators a chance to compete in the current and, more importantly, new energy economy. If they can see their asset base as a resource that has value beyond the straight sale of barrels or Mcf to gatherers, they might get through the current chaos in the business.

Please send any comments to me at [email protected].