Recent commissioning activity on the Kinder Morgan’s new Gulf Coast Express (GCX) project led to a small increase in natural gas deliveries from producers in the Permian Basin. What does that signal for these producers over the short- and long-term? To determine the answer, we used our ProdCast natural gas, crude, and NGL production forecasting software, part of our MarketView FundamentalsⓇ (MVF) solution suite, to compare various growth scenarios versus progress-to-date on GCX and other projects to forecast what producers can expect.

The result: the region likely faces difficult pricing through 2022. Producers will remain hamstrung by pipeline capacity constraints, and it will be at least three years until a number of proposed projects bring permanent relief.

GCX did bring some relief to producers last month. As my colleague Bert Gilbert explained in his recent post, Enverus’ analysis of infrared data collected from NOAA’s Visible Infrared Imaging Radiometer Suite (VIIRS) platform reveals that while August may have been a record month for flaring in the Permian Basin, it also indicates the GCX will have a direct impact in reducing in Permian flaring.

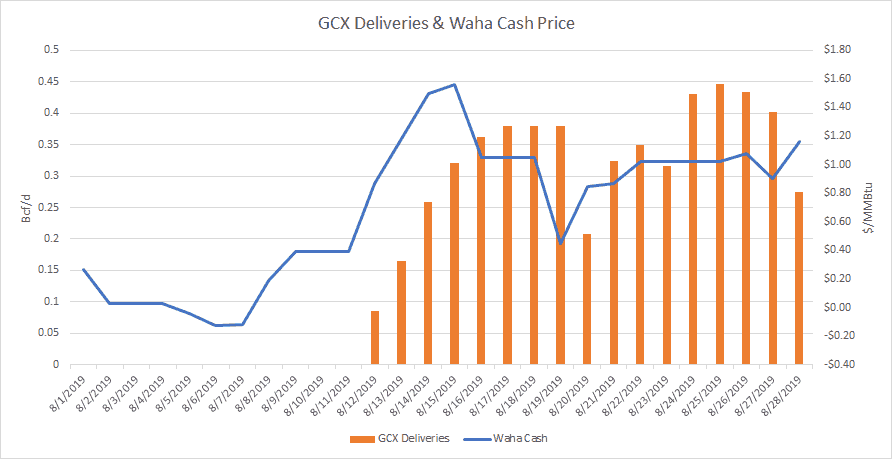

In terms of short-term deliveries, daily natural gas meter flow data from Enverus shows that El Paso Natural Gas began delivering to GCX around Aug. 12, and has averaged ~300 MMcf/d since.

Source: Enverus Trading & Risk

As a result, cash prices at Waha are now trading north of $1.00/MMBtu, an improvement from the negative settlements seen in the first week of August.

However, ProdCast shows that while this upward trend will continue, progress will be slow. Very slow.

Traders eyeing the forward markets at Waha in 2021 and 2022 are wise to have a skeptical bias due to the risks of returning to this negative price territory.

This chart shows the current ProdCast “base-case” forecast for natural gas production, as well as a “high-case” scenario driven by a 20%t improvement in IP rates.

Source: ProdCast

Three of the announced projects have reached Final Investment Decision (FID), which is a clear indication that the project has the financial backing secured to reach completion:

- Gulf Coast Express (1.98 Bcf/d)

- Permian Highway (1.9 Bcf/d)

- Whistler (2.0 Bcf/d)

In the high-case scenario, all three expansion projects are necessary to relieve bottlenecks, which would come in late 2021. However, even in the base case, although the Permian Highway project would provide temporary relief, Whistler must come online to prevent return of constraints in 2022. The fact that three planned projects – Pecos Trail, Bluebonnet, and Permian to Katy (P2K) – have been suspended or delayed due to inability to reach FID will only exacerbate the issue.

We will present our full analysis in the latest FundamentalEdge Market Outlook, our monthly proprietary market forecast report that delivers supply/demand analysis and forward-looking predictions five years out for crude, natural gas, and NGL market.

Follow this link to access the full report.